According to a study by management consultancy cg42, the 10 largest retail banks in the U.S. are in trouble. Based on a survey encompassing more than 3,000 of their current customers, cg42 ranked banks based on projected customer attrition and potential revenue loss. The study, which is an update of research cg42 repeated in 2011 and 2013, found that up to 23% of current bank customers are ready to change banking providers. cg42 says 8% will actually follow through and make the switch.

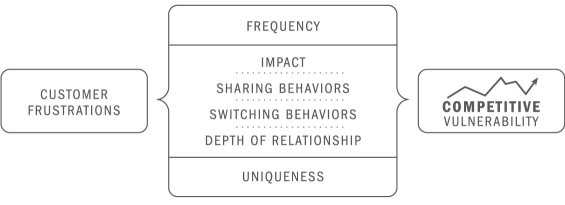

The firm uses data to calculate its own proprietary Brand Vulnerability Index (BVI), which measures consumer frustrations along four variables:

- The frequency with which customers experience frustrations

- How customers express their frustrations (such as sharing grievances in social media channels)

- The magnitude of impact that these frustrations have on customers’ likelihood to leave

- The uniqueness of a particular source of frustration to a specific bank

In their analysis, researchers identified the top frustrations among at-risk customers, then compared those findings against customers who actually switched. The results point a spotlight on the perennial irritations that plague banking consumers:

In their analysis, researchers identified the top frustrations among at-risk customers, then compared those findings against customers who actually switched. The results point a spotlight on the perennial irritations that plague banking consumers:

- Having to deal with staff who are not empowered to resolve issues

- Failing to keep promises

- Fees — getting “nickeled and dimed”

- Mistakes on statements

- Limited or inconvenient branch locations

The prominence of these frustrations jumps significantly among at-risk customers. Two in particular — “being hit with overdraft charges” and “being nickeled and dimed with incidental charges” — generate significant noise.

The most common frustrations cited as reasons for switching by customers who changed their primary bank in the last 12 months are high or predatory fees, overdraft charges, branch location, moving to an area where their old bank does not have a presence, and poor customer service.

Read More: Who Are You Really Competing Against?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Who’s In The Most Trouble?

After survey responses were collected, analyzed and modeled, cg42 produced a ranking of the top 10 retail banks by vulnerability, from most to least.

- Bank of America

- Chase

- Citibank

- Wells Fargo

- SunTrust

- BB&T

- TD Bank

- PNC

- Capital One

- US Bank

The most vulnerable bank, Bank of America, also ranked at the top of the list in 2011, and was the third most vulnerable bank in 2013. With 29% of customers at risk, cg42 projects that as many as 10.3% of Bank of America’s customers could move up to $57 billion in deposits to other institutions in the coming year.

But then again… maybe big banks have nothing to fear. For decades, they’ve relied on consumer apathy and inertia as a source of stability to maintain the status quo. Why should anything change now?

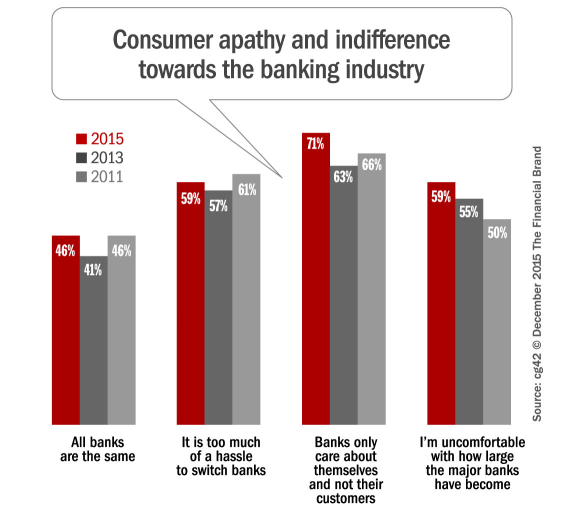

Indeed the cg42 study found that attitudes about financial institutions have remained fairly stable since 2011. Two out of every three consumers believe that “all banks really care about are their own interests, even though they may claim they have my interests at heart.”

Nearly half say “all banks are the same,” and 61% feel that it is too much of a hassle to switch. That would seem to make sense. After all, if every bank is the same, why endure the hassle of switching? And yet that is precisely what cg42 says many at-risk consumers will do — throw up their hands in disgust with one big bank only to move to another.

How Real Is The Peril Facing Big Banks?

Stephen Beck, founder and managing partner of cg42, says that if big banks don’t change their ways, their customer base — and profits — will shrink.

“With hundreds of billions of dollars on the line, banks need to reevaluate how they treat their customers,” he cautions. “They need to understand the substantial financial impact of failing to address customer frustrations.”

cg42 estimates that agitated customers put $649 billion in deposits and over $30 billion in revenues at risk. If banks don’t eliminate friction and pain points from their customer experience, the top 10 retail banks are projected to lose $229 billion in retail deposits and nearly $11 billion in retail revenues — that’s in the next 12 months alone.

Smaller, community-based banks and credit unions can only hope megabanks don’t heed cg42’s warnings; they’d love to scoop up as many big bank refugees as possible.

As for Beck, he doesn’t sound terribly optimistic that the titans of banking will pivot in ways that will thwart impending customer defections.

“Since we began studying the retail banking industry in 2011, we have seen consistently high levels of frustration among customers,” said Beck. “Despite an improvement in vulnerability levels from 2011 to today, a majority of consumers continue to believe that banks don’t act in their best interests.”

Read More: Why Do People Switch Banks?

Who Will Prevail In the Battle for Banking Consumers?

The results in cg42’s 2015 study show signs of improvement for many major retail banks, but certain challenges still loom large and the levels of customer frustration remain significant — pointing to an opportunity for innovative players to provide a real alternative that addresses the lingering frustrations of customers.

But which banks will step up and respond? That’s the question bothering Beck: “Who will move beyond empty advertising messages and truly put the customer at the center of the banking experience?”

Some observers say the answer is already before us. There seems to be an endless wave of fintech startups and neobanks poised to disrupt the banking industry. If traditional institutions continue to resist change and ignore their shortcomings, these scrappy outsiders will happily fill the void.

cg42 says the concept of “brand vulnerability” (or “customer vulnerability”) can be a useful tool, whether it is leveraged by a megabank or challenger brands — inside the financial industry and out. Indeed the firm’s full “2015 Retail Banking Vulnerability Study,” which runs a hefty 95 pages, breaks down the competitive weaknesses of 11 of the biggest — and most vulnerable — institutions in the U.S, detailing the key frustrations that are shaping customers’ attitudes and influencing their propensity to switch.

Smaller institutions, regional banks, credit unions and other alternative financial service providers might find this type of analysis particularly helpful when identifying the critical vulnerabilities of megabanks, so they can plan to specifically target areas of unmet need. Insight can be used to guide strategic planning and how institutions define their value proposition. With a better understanding of consumer sentiment, community banks and credit unions can refine their marketing communications to highlight areas where megabanks are most vulnerable.

In fact, cg42 says institutions of all sizes should consider implementing their own vulnerability assessment, adding relevant measurements to the standard set of metrics used to track business and brand performance over time.