In a post-crisis financial environment, customers are demanding solutions to satisfy their unique needs for money management. Additionally, they are showing preference for simpler products where benefits and risks are easy to understand and the feeling of control over the product increases their loyalty. Therefore, banks and credit unions are facing a crossroads: acknowledge and embrace the demands of customers wanting more personalized and simplified services or try to push customers into a dated mass production model.

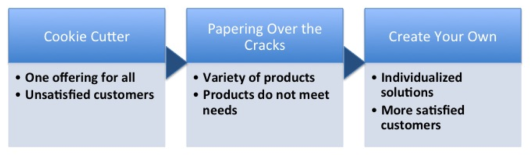

From Cookie Cutter to Papering Over the Cracks

Taking a look back in history, consumer products used to be built on a made-to-order basis, using expensive highly labor-intensive processes. To make things more affordable, companies began to adopt mass production technologies and techniques, creating a one-size-fits-all product line.

When Henry Ford moved automobile production to the assembly-line model, revolutionizing manufacturing, he divided labor into standardized tasks that were put together on a moving line. The individual creation processes and unique personalization of previous years moved towards a repetitive blueprint that was now centered on the product, not the customer. The result of this innovative change was standardized production that had lower costs per vehicle for both the manufacturer and customer.

Ford realized, very quickly, that mass production allowed him to achieve economies of scale, a key to keeping prices low and gaining an edge on competition. As a result of this success, all types of companies (including financial services) have been utilizing this model of mass production: focused on building the most popular products at the most economical cost, assuming that customers will choose the options they are presented with.

However, over time, competition has become more intense and companies have started to offer a more diverse selection. As a result of this variety, customers realized that they could find solutions in the market closer to addressing their specific needs if they shopped around and paid less attention to traditional concepts such as brand loyalty.

As a consequence of this customer attitude and shift, companies are being forced to abandon the take-it-or-leave-it approach of mass production, focusing instead on a more robust product offering that would aid in their efforts to meet customer demands.

In today’s age, consumers are provided — some may say overwhelmed — by an ever-expanding variety of goods and services in many industries. For example, since 1970:

- The number of new vehicle models has risen from 140 to 270.

- The number of TV channels has gone from 5 to over 200.

- The U.S. market makes available to consumers more than 145 over-the-counter pain relievers.

- There are more than 7,500 different prescription drugs.

- Consumers can find over 3,000 types of beers and 50 different brands of bottled water in the market place.

- There are more than 350 breakfast cereals.

A lot has changed since Henry Ford and the assembly line production of the Model T and I am comfortable in saying that the mass-production model will no longer satisfy the overall customer demand. While customization is a recognized strategy in many business-to-business models, today’s retail consumer markets are also motivating companies to increasingly offer personalized solutions.

It’s important to note that personalization is not jargon for variety. Variety represents a producer’s best guess about what consumers will buy and offering quantity. Companies that personalize wait until they know precisely what the customer wants to create quality.

“Brand Keys, a research firm that studies customer loyalty, found that personalization is 30% of what draws a person to a brand today, as opposed to only six percent in 1997.”

A paradigm shift is taking place, from a product centric approach (off-the-rack) to a customer centric approach (made-to-order), where customer involvement shifts from just purchase to the development as well. It’s become more important than ever for companies, especially those in financial services, to be nimble and respond quickly to this market demand.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Banking is Far From Personalized

As customers have grown accustomed to personalized solutions in other industries, the demand has begun to receive the same attention from their financial services providers. With all the innovation in other sectors, the financial world, still has a long way to catch up.

Traditional mass production techniques and commoditized products may result in getting new customers in the door, but research has shown that a key to retain customers, especially profitable ones, is through personalized solutions that drive loyalty to the brand. Furthermore, high levels of customer satisfaction result in a powerful competitive advantage and less likelihood to stray to rival banks.

In market research conducted by GfK which obtained results from consumers with over $10,000 in deposits, over 40% surveyed said they would be more inclined to continue their relationship with their primary bank if they offered products where the economics of the product could be personalized.

Unfortunately for customers, only a few financial services companies have implemented true personalization for the broad retail segment. Banking products and services are usually categorized by one of two things; a high-degree of personal service with product personalization delivered to a small segment of wealthy individuals or standardized offerings to the broad consumer retail and mass affluent segments.

Many financial institutions have done a very nice job of drastically improving the customer experience by adding layers in the account opening flow for perceived personalization. However, a closer look at the underlying offerings uncovers no more than a “standard” product catalog behind the scenes.

A next and logical step is to allow customers the ability to actually build and develop their own products, and choose the economic conditions of the same, helping meet individual saving or investing needs. Now, we start to truly change from a product-centric to a customer-centric mindset.

An example of a degree of personalization is Spanish Novagalicia´s Personalized Deposit:It lets the depositor make a key decision such as the amount to invest, the interest to earn and the deposit term. The customer can decide the interest rate he wants to earn, how much to invest and for how long just by introducing the number. Once the numbers are introduced, the customer will be offered a variety of mixed deposits in which a part goes to a time saving and another part goes to an investment fund. A higher interest rate, leads to a larger allocation to investment funds and a lower portion in the fixed term interest deposit. This new combined deposit is a big step in the right direction towards personalization.

Today, customers are putting a high value on being treated and recognized as individuals, while demanding personalized solutions from the financial industry similar to the ones they are receiving from other retail offerings.

Customers are not asking for the traditional financial/banking products. What customers are asking for now are solutions that help them with their objective of saving for specific purchases (a new car, family vacations, etc.) or planning their personal finances to be able to meet future expenses (tuition fees, home projects, etc.).

FIs need to become the solution providers for the new generations and not just a product variety shop. Credit cards, loans, deposits, retirement plans, insurance plan…they all can be personalized and everything should be personalized to meet customers´ specific demands.

However, personalizing an offering to satisfy each customer´s specific needs can be a significant challenge with existing internal legacy systems.

Another good example of applying the ideas of personalization to the banking industry is Turkey’s Garanti Bank with its ‘Flexi Card’. It lets the cardholder make a few key decisions, allowing them to set over ten parameters. When applying for a card, customers can manipulate variables like reward rates and types, interest rate and card fee. The rewards system is especially flexible, not only letting customers determine reward ratio and type (cash or points), but also enabling them to choose which payments will earn them extra rewards: whether it’s broad categories like restaurants, or specific stores like Zara.

Interest rate, bonus rate and card fees are selected by sliding bars that render various combinations of rates and fees. Card fees, for example, can be pushed back to zero by committing to a monthly spending minimum. A lower interest rate leads to a lower bonus rate, etc. Lastly, after making serious decisions about financial terms, customers can design their own card, choosing from different colors and a gallery of images, or uploading their own image. There’s even the option of picking a vertical card, which is a world’s first for Visa.

With its flexi Card Garanti has been able to offer added value to their customers and adjust credit card to each customers´ lifestyle and needs.

New Generations

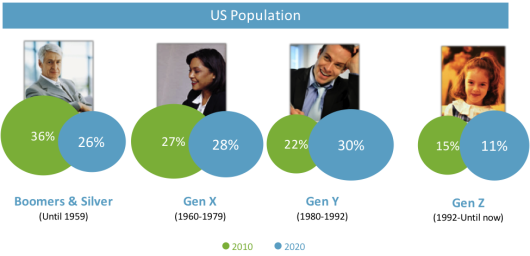

Baby Boomers are currently nearing the end of their wealth accumulation stage and banks are, in general, meeting their most basic needs. However, this generation is soon approaching retirement with a dramatic demographic shift and change in demand within the next decade worldwide. Banks should be, and are, aware that this new generation is knocking loudly at their doors and they cannot be ignored.

The Gen Y and Millenials express their individuality differently than previous generations. They do it through their clothes, their music and how they stream it, their smart-phone choice, their preferred social network, on what devices they watch TV and any other number of ways that previous generations were not able to. They like personalized products that express their own uniqueness.

FIs will need to use a different approach than what was used in the past. As the economic power of this demographic grows, its members will change, and influence how business is conducted, together with patterns of spending, saving and investing.

Why Personalize?

By allowing consumers to tailor products to better fit their needs, FIs will have the opportunity to gain loyalty in several ways.

- Personalization will improve customer satisfaction, a primary driver of loyalty. Services that meet customers’ specific needs should naturally be more satisfactory than a one-size-fits-all offering.

- Personalized services will help the customer believe a firm is appreciative towards him or her, increasing trust, another loyalty driver. Additionally, trust is also impacted when the customer can create their own product with a more transparent risk/reward understanding.

- Personalization also increases stickiness as consumers will view these services as difficult to replace with another provider. Once a personalized product has been created at their existing FI, customers are less willing to try and replicate the solution at another institution.

“We need to create a positive interaction dialog with customers. Customers do not want to be sold to, customers want to buy” — Howard Putnam, ex-CEO of Southwest Airlines

Companies are using personalization to create a competitive advantage for themselves. By offering consumers personalized options, they can differentiate themselves from competitors as well as:

- Retain existing customers through added value perception and brand strength.

- Attract new customers as word of mouth marketing is a highly effective tool and satisfied customers will recommend a preferred FI.

- Better understand customer demands and needs by collecting and aggregating information from a segment of customers (Big Data). As a result, new products for the mass market segment can be planned more efficiently utilizing this non-biased research.

In market research conducted by GfK which obtained results from consumers with over $10,000 in savings products over 1 in 5 savers said they would switch their primary banking relationship in order to access personalized savings products.

Risks and Barriers

When properly implemented, personalization has the potential to add many benefits for a FI. However, there are critical factors which need to be considered when deciding to move to this exciting concept.

Personalization may lead to new complexities from a customer’s perspective. Financial services customers, and now regulators, look for simplicity and transparency in product offerings. Satisfaction may not only plateau after a certain degree of personalization, but also decrease because of the overwhelming feeling a customer may have due to excessive choice or variety. When facing so much choice, customers may tend to avoid making decisions, paralyzed by indecisiveness. Thus, setting the right degree of personalization and carefully selecting the way FIs offer personalization is crucial for success.

FIs must be aware that not all customers want personalized products or the same degree of personalization. An FI should be able to segment customers appropriately to allow more personalization capabilities to those that want it and offer less or zero to those who do not. FIs may also find other barriers that make personalization challenging:

- Production Cost: If an automated process is not available and utilized, personalization will be more expensive than mass production. This is why many FIs have limited personalization to only the highest value customer segment levels.

- Timely Delivery: It is necessary to have a flexible system that allows FIs to create new products quickly and without high upfront costs.

Despite the perceived barriers in producing and delivering personalized products, some leading FIs have found success by developing in-house technologies or implementing third party solutions, which is usually less time consuming and more cost effective.

Final Thoughts

We are witnessing nearly a full circle approach to how companies are now focusing on satisfying customers. Many years ago we started with a made-to-order approach with a result of higher costs to customers. Henry Ford used technology and innovation to divide labor into standardized tasks that were put together on the assembly line, resulting in a standardized product but lower costs for both companies and consumers.

Today we see another technology and innovation revolution. This time, pieces are being put together to create bespoke options coupled with low costs. As mentioned, some companies are trying to take advantage of this new opportunity, undertaking significant efforts to offer affordable tailor-made products.

When properly implemented, personalization will result in a greater sensation of comfort and higher satisfaction for customers. If customers are able to tailor-make solutions to their specific needs, product features and behavior are more easily understood than when explained by a sales representative.

Additionally, in today´s markets, where competition is fierce, offering added value to customers represents a significant and distinctive advantage for customers when selecting their FI. An effective personalization implementation hinges on a company’s ability to leverage new technology and innovation. FIs need to be able to develop or outsource flexible and automated systems that address this growing trend.

The choice at this crossroads seems clear but let us wait to see which road the financial institutions take.