“Speak to a representative..” Pause. “No, speak to a representative.”

“I’m sorry, I couldn’t hear you. Can you repeat that?”

“SPEAK. TO. A. REPRESENTATIVE.”

Getting in touch with customer service should never be a painful experience — but it is. And the cost of a poor customer experience is high. More than nine out of ten (91%) people will not “willingly do business with your company again” if they’ve had an ordeal during the customer experience, according to research from Glance.

The call center is the bane of many peoples’ existence. One report, from the U.S. State of Multichannel Customer Service, found two thirds of people are frustrated with a company before they even get on the phone with an agent, often thanks to anger-inducing voice response systems still widely used.

The overall experience is frustrating to customers, but it’s also a reliable way to frustrate employees. There are Reddit forums chock full of bank staff, excoriating the traditional call-center strategy.

One employee said she “had no patience for the policies and systems that make it that much harder to do our jobs. We field calls we don’t have the answers to, only to have to have the people with the info do callbacks.”

It’s not all negative of course. During the pandemic, the banking industry had to jump to its feet, offering customer service options for people who couldn’t make it to the branch. Call center employees were among the essential workers who helped banking function. And the industry did pretty well, given the rush.

And there are institutions that rightfully take pride in their call center operation. Some banks and credit unions by policy require every incoming call to be answered by a human, avoiding voice-response hell. Still, for most, the “modern call center” isn’t actually very modern.

Read More: The Complex Relationship Between Chatbots and Bank Call Centers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Big Problem: ‘Channel Disconnect’

Three quarters of customers (76%) say they expect a truly omnichannel banking experience but just over half (58%) of financial institutions say they prioritize it right now, according to a Capgemini and Efma report. Nearly a third (31%) of customers say they would like to see stronger customer support services in the retail banking world, but just a little over one out of ten banks say it’s a top priority for their team.

The customer service process — as it operates now at many financial institutions — is fragmented. Most banks and credit unions have phone-operated contact centers, many have true “contact centers” incorporating responses by phone, text or email. A growing number also use chatbots. And of course most institutions still have branch employees.

The problem is: they rarely all connect.

Most consumers with a banking need or question begin online — 84% of customers are already online and have already accomplished nearly three quarters (72%) of their journey when they decide to call a customer service rep, according to Forrester research.

That’s where the disconnect happens, and it can be rather disconcerting for customers, says Steve Kaish, Senior Vice President of Product Marketing and Alliances, at Glia, a contact center technology provider.

Keep in Mind:

The percentage of customers who are already online when they call a customer service representative:84%

“When you call in, the rep on the other side has no context,” Kaish explains. “They don’t know you have been online for 15 minutes, and you’re starting all over.” This kind of channel disconnect has been a weak spot in banking (and elsewhere) for decades. The means to solve it is available now.

Dig Deeper: Beyond Omnichannel: Banks Must Rethink How Branches and Digital Sync

Call Centers: Omnichannel or Channelless?

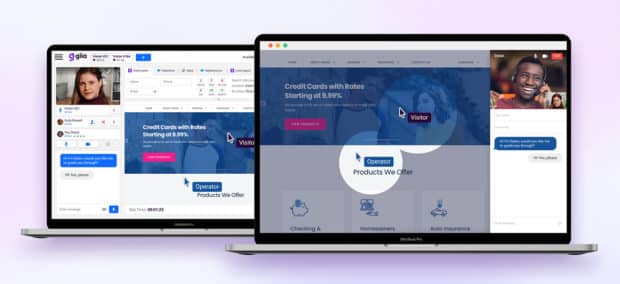

Kaish gave The Financial Brand a short demo of Glia’s product to highlight where banking call centers go wrong. The way they see it, the solution should be a digital-first — not phone-first — experience. That’s because digital is how most people tend to interact with their bank or credit unions first.

“It’s an evolution from the call center, which was a phone concept, to the contact center — which is an omnichannel experience — to what we call ‘channelless’,” he says.

Financial marketers may wonder if this isn’t just semantics. But, as Kaish points out, there is a key difference in between omnichannel — when your financial institution has instituted different customer-to-employee touchpoints — to channelless, when it doesn’t matter on the backend where customers are finding service.

Omnichannel is offering live chat and a phone number for customers to call and possibly a chatbot. A channelless strategy is blending all those together.

“Sometimes, the conversation can get too complicated for chat,” Kaish explains. “I’ve had it many times where [the online rep] responds ‘Sorry, I can’t help you on this chat anymore. Here’s the 800 number — why don’t you call them and start all over again.'”

Difference Between Omnichannel and Channelless:

If your bank has omnichannel options, it means you're offering customers multiple channels. Channelless means all the channels work as one.

In fact, the average Net Promoter Score drops 29% if a customer is “forced to call a phone number during a digital interaction and restart the process,” a Glia report found.

Other experts in the industry acknowledge this inherent flaw in banking customer service operations. Chris Adams, who leads the Dynamics 365 Customer Engagement portfolio at Microsoft in the U.K., says it is a key issue for banking. Omnichannel is important, but it’s useless if it’s uncoordinated.

“[The technologies] are often used in silos and operated by different vendors,” Adams says. “This leaves customer data confined. Additionally, it prevents agents from serving customers across multiple systems. Most importantly, it prevents organizations from leveraging customer insights and using them to better orchestrate the customer journey.”

Learn More: How Banks Can Meet SMB Demands for Omnichannel Payments

Call Center Technology Options Are Endless

There are numerous contact center technologies and platforms out there. PwC points out voice authentication technologies alone can vastly improve the likelihood of a customer staying on the line and/or solving their banking needs on their own ahead of a conversation with a representative.

“Financial institutions can start by mapping the customer path to identify where in the journey to include automation,” the PwC report says. “For example, implementing NLP-enabled interactive voice response software to capture caller intent can satisfy pre-approvals, prompt self-service or enable a specialist to step-in. Identifying caller intent can also improve the routing of calls to the right service channel, reducing overall transfer rates.” (NLP refers to natural language processing, a form of artificial intelligence that understands human communications.)

Capgemini — in a partnership with Amazon — built a solution for a bank client dealing with over 37 million customer calls every month. Instead of upkeeping and upgrading the bank’s legacy interactive voice response system, Capgemini designed a single desktop for the bank’s call agents — which also aided the financial institution’s segmented banking product set-up. The results, per Capgemini:

- Call volume misroutes down by 24%

- Average handle times reduced by 15%

- Overall supervisor efforts reduced by 20%

Where AI and Virtual Assistants Come Into the Mix

The contact center doesn’t need to be fully run manually, utilizing branch staff to man the chats and phone calls from customers. In fact, artificial intelligence can bridge the gap for customers who have simpler request.

Intelligent voice assistants (IVA) are one tool, according to AIAuthority, that can automate smaller issues customers are looking to solve.

“IVAs are one way that businesses can make consumers’ lives easier, reduce the burden on contact center agents, and demonstrate a tech-forward and innovative approach,” an AIAuthority article reads. “A contact center IVA uses artificial intelligence to enable self-service.”

An IVA is most helpful for financial institutions who want to cut down the verification process when a customer is connected with an agent.

Sorting out call center terms

The terminology in the call center tech space is abundant: IVAs and IVRs, virtual assistants and chatbots. IVAs and IVRs (interactive voice response) are frequently confused. The latter is an older phone response technology that reroutes a customer to an agent that can best help through pre-recorded messaging and pre-routed navigation menus.

An IVA — intelligent voice assistant — is AI-based technology that analyzes a customer’s needs and offers support ahead of connecting the customer with an agent. In essence, an IVA is an upgraded IVR.

Chatbots and virtual assistants, on the other hand, are used differently. Virtual assistants can help with a wide range of tasks (think ‘Hey Alexa’ commercials), whereas an AI chatbot is essentially an online version of an IVA.

Kaish recommends financial institutions use voice assistants the same way they would virtual assistants and chatbot services. In many instances, the backend AI technology can be synced. He says the AI that controls the automated voice conversations at Glia is the same engine used for the chatbots.

Over time, Kaish expects to see banks recognize that a chatbot on a website can be built on the same technologies that the call center relies on. The key is to bring in the same context so both website and call center provide better services to customers”