The proliferation of digital channels has prompted banks and credit unions to focus on being digital-first. This, after all, is the philosophy that has propelled the best-performing companies of the century — Facebook, Amazon, Netflix and Google (FANG). But now with digital-first evolving into mobile-first, technology is enabling newer and easier ways of banking and paying digitally. The money is once again back in the pocket — not in wallets but on phones.

The immense possibilities in finance unlocked by mobile-first have attracted the technology giants to this sector. And this is happening while successful fintech start-ups like Nubank, Revolut and Chime continue to invade what was once the exclusive domain of banks and credit unions. Currently, over 100 challenger banks with primarily digital operations are spread across the world. It is high time the traditional institutions take note and hasten their move towards the digital future. If they delay, they might not have a future to move towards.

“Time to Start Again: The State of Financial Services 2019,” a report published by Oliver Wyman, recommends that today’s financial institutions start with a blank canvas. The report talks about how financial institutions can incorporate new technology in their existing system to evolve into a new, more customer-centric organization. The ultimate aim is to provide a frictionless digital experience to patrons and stakeholders, something that the FANG have managed to do by leveraging technology. To do the same and cater to changing customer preferences and usage patterns, banking institutions must embrace the mobile-first philosophy and invest in changing how they deliver products and services to both consumers and businesses.

There is no shortage of examples of the power of digital. While Netflix has disrupted the way home entertainment is perceived, Amazon has replaced the big retailers and empowered small vendors. For banks and credit unions, digital disruption is now happening closer to home. Apple has moved beyond selling iPhones and iPads to launch a payment card. Google has been aggressively marketing Google Pay, their digital wallet. Uber announced a new division called Uber Money. It would start with a digital wallet and soon add debit and credit cards. The company aims to offer bank account to consumers on its platform in future. Uber’s move is only the latest sign that tech giants are looking to make inroads into finance. It is imperative that banks act fast to protect their home advantage.

What a Digital-First Approach Entails for Financial Institutions

Going digital does not mean launching an application or rectifying ones website. Instead, digitization of banks means enabling them to offer end-to-end digital products and services, including banking and payments. There are three primary approaches toward making core banking operations digital-first:

1. Overhaul of the core: This involves monolithic system upgrades every few years, guided by an architecture roadmap. This approach demands time and carries significant risk. The investment is also higher than in the other approaches, and can run into a few hundreds of millions, depending on the size of the bank.

2. Progressive modernization: For this, the top customer journeys are re-invented end-to-end, starting with a clean slate and casting aside all existing notions. Modular micro services with shared utilities are introduced iteratively creating the new business logic. To take this approach, the current core must be robust enough to last five to ten years. The risk profile is the lowest among the three approaches with product complexities and legacy systems proving the biggest hurdles.

3. Greenfield tech stack: This takes advantage of cloud-native architecture. The new customers are on-boarded on the new platform and existing ones are migrated. This approach is the passport to the quickest possible transformation and can potentially be implemented with the lowest investment but carries greater risk than progressive modernization.

No matter the approach, the endgame is simplified P2P (person-to-person or peer-to-peer) as well as P2M (person-to-merchant) payment. To reach that goal, challenger banks are using a multitude of digital distribution channels. These typically include artificial intelligence powered inbuilt budgeting tools allowing customers to buy, hold and sell cryptocurrencies, mobile-based deposits, and P2P mobile payments.

Challenger banks are gearing up to scale new heights by launching new products and services through API integrations with other fintechs and exploring new markets. Traditional players need to rethink strategies to keep pace with them.

Considering the Future of Digital Banking

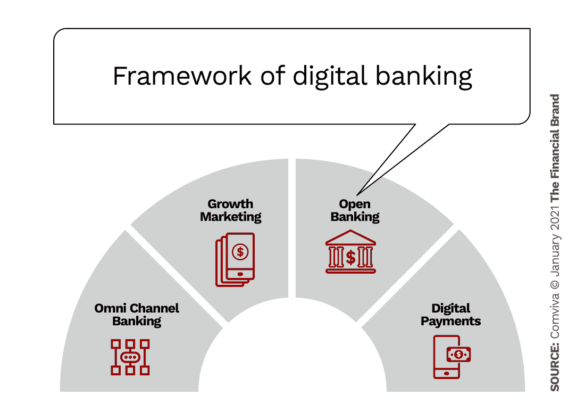

1. Omni-channel Banking. The focus on enhanced customer experience has led to a paradigm shift in this space. Traditional channels, such as brick-and-mortar branches and, websites, have given way to omni-channel banking. Omni-channel banking creates a central hub for all channels, ensuring a consistent customer experience across touch-points.

2. Growth Marketing Growth Marketing. involves drawing insights from massive volumes of data spread over divergent systems to deliver hyper-personalization at scale for all stakeholders. In fact, a hyper-personalized-centric approach has a cascading impact on multiple other aspects as well.

For example, to cross-sell effectively, organizations need to be prepared to refine and customize the offer with the consumer. To do this, banks and credit unions need access to crucial data on consumer behaviors, understanding when to engage with the consumer, and how to make offers aligned with both the consumer and the financial institutions goals.

At the backend, big data drives all growth marketing initiatives and is the key to gleaning actionable information. Each customer gets a product or service customized to their need through channel or channels chosen specifically for them.

A relevant example in this context is Russia’s Sberbank offering customers an AI-based tool called Tips that analyzes their banking behavior to suggest ways of saving time and money. In other words, the idea is two-fold. Deep-dive into the data available, while utilizing advanced analytical tools. This is aimed at building rich customer profiles and making effective targeting and offer decisions.

3. Open Banking. Conventional bank accounts bundling together a range of services are becoming a thing of the past with open banking structures enabling the unbundling of many services. To do this, financial institutions are opening their APIs and tapping into third-party capabilities of fintech ventures. While it has unlocked unexplored options, open banking has also made it imperative to put in place robust fraud-prevention measures. Regulatory measures such as the Second Payment Services Directive (PSD2) can protect consumers from identity theft and asset takeovers. An example is large banks like BBVA and Nordea developing APIs that provide other companies access to banking data for creation of new services.

4. Digital Payments. One of the clearest manifestations of digitization of banks has been the proliferation of options for digital payment, which have managed to bring new customers on board and remove friction in monetary transactions. Among the various modes of digital payment, mobile wallets have seen early success. While some wallets, such as Alipay and PayTM, emerged primarily to ensure ease of payment, financial inclusion was the main goal of the others, such as Ecocash. Both sets of wallets have evolved to offer a more comprehensive bouquet of financial services, including cover loans, insurance and investment that cater to the differential needs of consumers.

Several traditional banks had launched wallets after perceiving a threat from the challengers but the most digitally enabled of them are now competing with new-age financial service providers for supremacy in this space. The competition includes not only neo-banks, challenger banks and fintech companies, but even mobile phone operators. Safaricom’s M-Pesa is Africa’s leading mobile money service. Joining the crowded field are giants like Google, Amazon and Uber with their proven expertise in deploying technological solutions.

The era of digital payment has thrown up interesting patterns and lessons. For example, Starbucks emerged as a mobile payment leader in the U.S. by combining its loyalty program with payments and in-store experience with a broader digital effort. In only about a year, the adoption of Walmart Pay in the U.S. nearly surpassed that of device-centric wallets.

A Likely Future Roadmap for Digital Banks

With the banking business shifting to the digital space, Gartner’s 2018 CEO Survey showed that most financial services firms, including banking institutions (88%) are focused on digital optimization. To achieve this, it becomes critical for these players to adopt a digital banking experience platform, enabling:

- Digital Experience: The ability to dynamically control omni-channel configuration, coupled with personalized content.

- Digital Transactions: This entails orchestrating new journeys by interaction with multiple-host systems/micro services. Equally critical is transforming the existing banks/host API to conform to the open banking API standards.

- Foster Agile Innovation: On-board and launch new services in a streamlined manner, while ensuring integration of legacy investments with greenfield initiatives.

If fintechs, open banking and challenger banks are giving financial institutions a headache now, the tech-savvy legacy banks have a chance not only to catch up on the digital race but to surge ahead!

Banking-as-a-Service (BaaS) platform is an end-to-end process that allows a fintech or a third-party provider (TPP) to access the BaaS platform by paying a fee. The institutions open their APIs to the TPP through BaaS platform. This can allow legacy banks to offer white label banking services through TPP.

Adopting the BaaS solution will not only allow legacy banks to get a new stream of revenue generation but will also help them to work closely with fintechs and utilize the experience for future upgrades. According to KPMG Australia’s 2019 report on The Future of Digital Banking, technology will make banking more personalized and ubiquitous across devices.