Consumers are keenly interested in seeing the fine print that comes with checking accounts simplified. 78% said it would be a positive change to require banks to provide a one-page summary of information about their checking accounts’ terms, conditions, and fees.

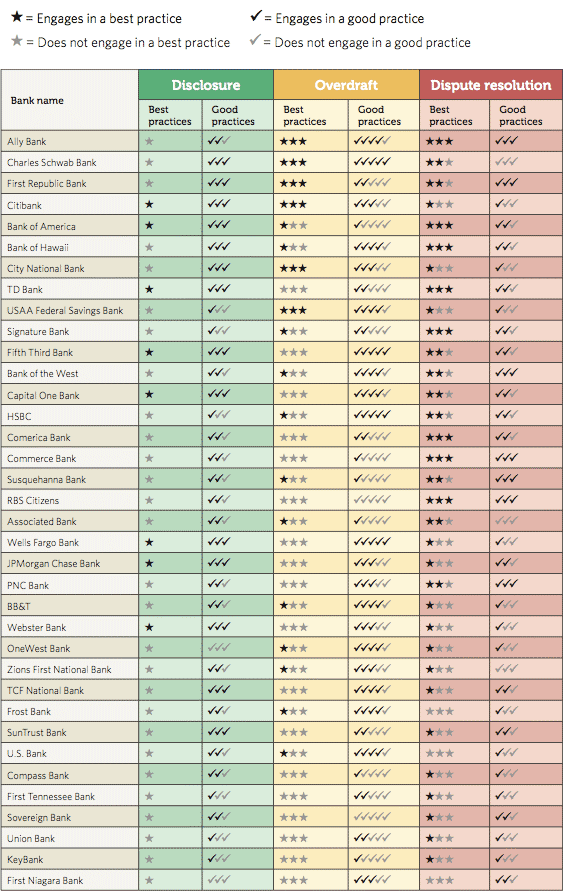

A study from The Pew Charitable Trusts rates largest U.S. banks on their policies regarding checking account disclosure terms and fees, overdraft, and dispute resolution practices. Analyzing the checking accounts of the nation’s top banks, Pew provides a comprehensive rating system in which banks’ checking accounts are assessed for “best” practices and “good” practices across three categories, believed to be the first of its kind.

Pew defines the “best” as those that are the most effective in:

- Providing checking accountholders with clear and concise disclosure about costs and terms.

- Reducing the incidence of overdrafts and eliminating practices that maximize overdraft fees.

- Offering consumers a meaningful choice to resolve a problem with their bank rather than including mandatory binding arbitration clauses in checking account agreements.

For the study, Pew started with the 50 largest banks based on domestic deposit volume. Full documentation was obtained for 36 of the top 50 banks in October and November 2012. Banks that did not provide all of their disclosures online or by mail were omitted from the study. At each bank, the most basic checking account offered was chosen for analysis. These 36 banks comprise almost 56% of domestic deposit volume.

No bank provided all best practices or even good practices in every category. 97% of the studied banks achieved at least one best practice. But even among the highest-performing banks, none performed very well in every category Pew evaluated.

Fourteen of the top 50 banks could not be included in the study because key terms and fees were not accessible online or by mail. These financial institutions failed to provide the opportunity for consumers to review all of the relevant disclosures for checking accounts without visiting a branch.

Read More: Marketing Clinic: Handling Lengthy Sweepstakes Disclosures

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Who Ranks Best? And Who is Struggling?

Read More: More Banks Adopting Simplified Disclosures For Checking Accounts

Two of the nation’s largest financial institutions — Citi and BofA — are among the five highest-performing banks in Pew’s analysis. The top five scores include those earned by Ally, Charles Schwab, First Republic, Citi and BofA.

While Ally Bank achieved the highest number of best practices, it still failed to provide optimal policies across all three studied categories.

Pew actively advocates that banks and credit unions simplify their checking account disclosures. They are now urging the nascent Consumer Financial Protection Bureau to require financial institutions to:

- Summarize key information about terms and fees in a concise, uniform format.

- Provide account holders with clear, comprehensive terms and pricing information for all available overdraft options.

- Make overdraft penalty fees reasonable and proportional to the financial institution’s costs in providing the overdraft loan.

- Post deposits and withdrawals in a fully disclosed, objective, and neutral manner that does not maximize overdraft fees.

- Prohibit predispute mandatory binding arbitration clauses in checking account agreements, which prevent account holders from accessing courts to challenge unfair and deceptive practices or other legal violations.

“Over three years, we have seen progress by some banks, specifically in their checking account disclosure documents,” said Susan Weinstock, Pew’s safe checking expert. “However, banks still have much room for improvement. Consumers should have strong protections, no matter where they bank. We urge the Consumer Financial Protection Bureau to develop new rules ensuring greater transparency and less risk in this fundamental product.”

Read More: Consumers Confused By Checking Disclosures Riddled With Landmines

Nine in 10 American households have a checking account,” Weinstock says. “The product’s near ubiquity increases the importance of ensuring that checking account terms are understandable and do not include hidden fees or practices that unnecessarily deplete the funds deposited in the account.”

You can download the complete 43-page report from Pew, “Checks & Balances: Measuring Checking Account Safety and Transparency,”.