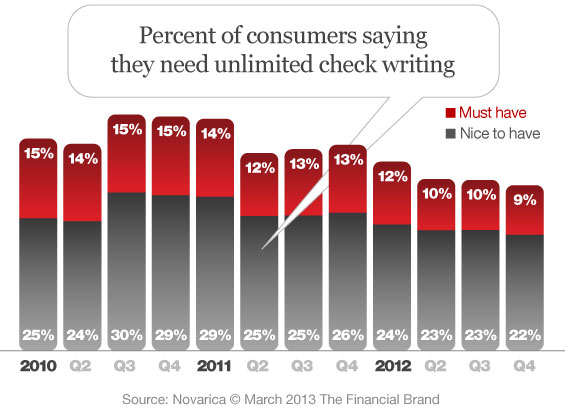

Interest in the unlimited check writing feature among consumers shopping for new checking accounts has been slowly declining. This correlates with industry data showing that as electronic payment methods like debit cards and online bill pay increase, the number of checks written decreases. Fewer consumers need to write a lot of checks, so demand for unlimited check writing has declined.

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Yet most banks and credit unions still offer unlimited check writing on all of their checking account products. In fact, of the 137 institutions listed on FindABetterBank, only 12% of institutions offer a checking account product that limits how many checks can be written per month. Most limit usage by charging fees per check over an amount per month (e.g., 3 checks per month free) and a few allow checks to be written only from specific accounts.

In most cases, the cost of processing payments by paper check is higher than the cost of processing electronic payments. Therefore, if all other things are equal, customers who write fewer checks cost less to service. At the same time, charging for check writing generates incremental revenue and encourage customers to use less expensive payments. Should banks continue to offer this service for free, or should they charge customers in order to push them towards more cost-efficient payment methods and generate incremental revenue?