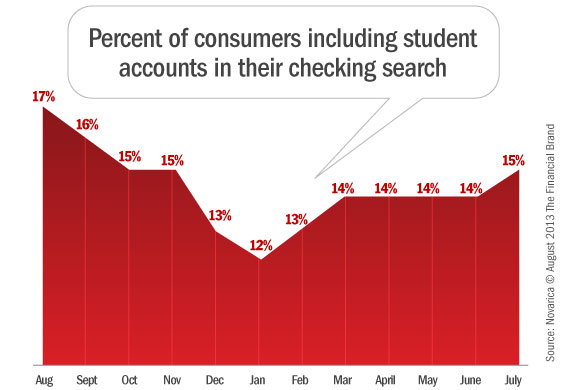

High season for students shopping for checking accounts peaks in August and starts winding down in Septembers as kids find their way to college campuses for fall classes. Over the last 12 months, 14% of shoppers on FindABetterBank have requested student accounts be included in their search results. The percentages are higher from July through October/November and lower during the winter months.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Larger institutions are more likely to have checking accounts designed specifically for students. On FindABetterBank, 64% of banks with more than 1,000 branches offer student accounts, but only 16% of institutions with fewer than 100 branches have student accounts. Yet in most cases, despite requesting student accounts be included in their search results, these student shoppers choose non-student accounts 73% of the time. The fact that they’re more likely to choose another account indicates that banks have not done a good job developing checking accounts specifically for students.

In most cases, it’s difficult to differentiate student accounts from banks’ low-end checking accounts. The differences are usually related to fees associated with withdrawing cash from ATMs — like no ATM fees when cash is withdrawn from non-affiliated ATMs, and some offer ATM fee rebates.

But these “features” don’t appeal to students any more than they do for other consumers. Student shoppers are more interested in features to help them manage their balances to avoid other fees — like overdraft protection, mobile banking and email alerts. What special features would appeal to student shoppers? A limited number of free NSF’s per year and free overdraft protection transfers from a savings account would be a good place to start.