One of the most popular features that consumers look for when shopping for new banking relationships are savings accounts “linked” to their checking accounts. In Q2 2014, nearly 46% of active bank shoppers indicated that they prefer to have a free linked savings with their new checking account.

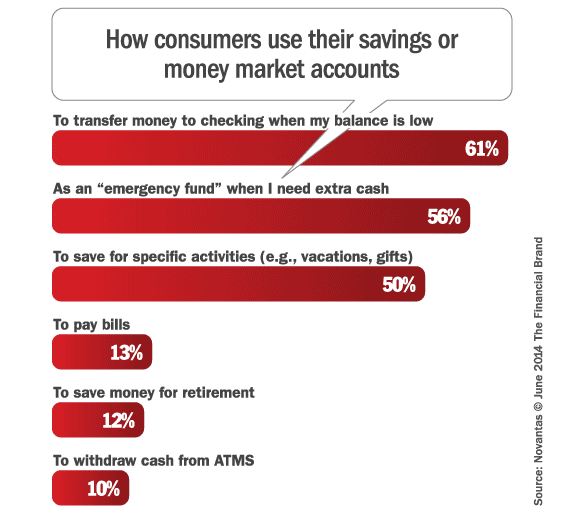

In June 2014, Novantas fielded a BankChoice Monitor survey to understand how consumers use these accounts. Based on how people really use them, it makes no sense calling them “savings accounts.” In fact, most people don’t use these accounts save money over the long-term. Only 12% of respondents said they use their linked savings or money market account to save for long term goals, like retirement.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

If product names conjured up functional use, these accounts would be called:

Cash-Flow Management Accounts. Nearly 61% of respondents said they use their linked savings account or money market account to transfer money to their checking account when their balance is low. Basically, they’re using these accounts to cover shortfalls. Forty percent of these respondents report having a balance under $100 at some point over the last 6 months.

Emergency Fund Accounts. Fifty-six percent of respondents indicated they use their linked account as an “emergency fund” when they need extra cash. Seventy-three percent of these respondents report keeping a balance of over $1000 in their savings accounts.

Gift and Vacation Accounts. Half of consumers say they use their linked account for things like saving for vacation or for things like gifts and other purchases that don’t require a long time to save up for. Forty percent of these respondents said their high balance over the last 6 months was more than $5,000, but many of these respondents also report significantly lower balances in these accounts over the same period.