You have to say this about the folks at Fifth Third Bank: They’re willing to roll the dice on a gutsy move that may or may not pay off. Not many traditional banking providers have the chops to do that.

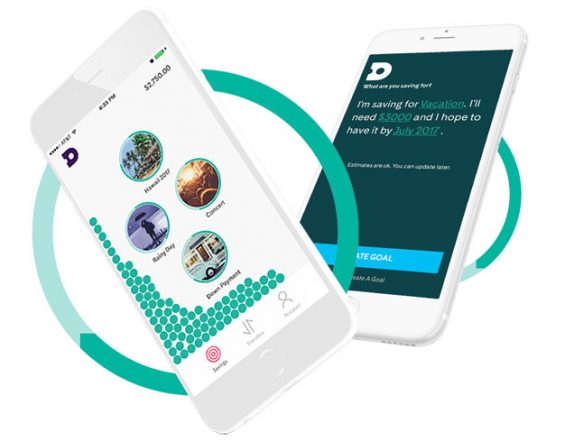

Fifth Third’s most recent digital banking foray is a bit unorthodox, even by fintech standards. Dobot is a cool financial app that helps people save. Dobot (the name is short for “the robot for your dough”) is part of the bank’s wider, and on-going transformation.

Dobot was actually spawned by a fintech startup. The app had some early success and strong reviews, but the company had to shutter its doors in the fall of 2017 after burning up all their capital. At the time the app had about 24,000 savers using it, with deposits being held by Wells Fargo.

“We ended up returning all the funds and essentially closing down the app,” says Andy Zurcher, who led the original Dobot’s product development team.

In early 2018, Fifth Third bought Dobot and brought it back to life, bringing Zurcher along too.

Fifth Third, had been toying with offering a similar savings sweep app for Millennials. Such a product would complement a “round-it-up” savings app the bank already offered to young adults, specifically those with student loan debt.

Dobot’s inventors met the team from Fifth Third at conference in late 2017, laying the groundwork for Fifth Third to acquire the app, the name and the team of developers behind it. The $145 billion bank believed in the product and that it could pull off a successful relaunch.

Now Vice President and Senior Product and Channel Manager at Fifth Third, Zurcher also says the bank reworked Dobot’s branding while building internal understanding of the app among retail employees.

Dobot officially relaunched in early December 2018. In less than three months, the app has already yielded roughly 20,000 users — without any marketing muscle outside Fifth Third’s own customer base.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Bot Moves Money Behind the Scenes

Dobot is very similar to Digit, but has its own unique features. Both are automated savings tools designed to make it easy for people who don’t think they can save, or don’t take the trouble to save, to put money away toward specific goals.

After downloading the app, the setup (which takes about five minutes) includes identifying the financial institution where you have your primary checking account. The Dobot algorithm automatically begins to scan and analyze your checking account activity and determines how much you can afford to move into savings.

Every few days, the app automatically transfers small amounts of money — typically $5 to $20, although it can be as much as $100 — from a person’s checking account into their Dobot savings account — now at Fifth Third. This happens in the background unless consumers want to turn off the auto-save feature, which they can do easily at any time and for any length of time. They can also add additional funds to the account, and can return money to their checking account from within the app. Transfers in either direction are done by ACH, so they are not instantaneous.

Incoming dollars show up in the app as little green balls, each one representing $1. They move around the screen if you tip it, almost like they’re liquid. They accumulate there until the consumer allocates them to one (or more) self-determined goals. It’s more fun to do it yourself, however, because of the cool visualizations in Dobot. Once you allocate, say, $35 toward your spouse’s birthday present, that goal reappears as a circle displaying in its center the photo you selected to make it more personal and the little green balls move up and around it and then change into a circular progress bar, much as you see when downloading an app.

There is one small hitch… Sometimes users make large purchases, leaving insufficient funds in the account to cover the automatic savings transfer. This results in an occasional overdraft. But in such cases, Fifth Third covers any related fees.

Read More: The Banking Industry’s Critical Role In Saving Small Businesses

What Sets Dobot Apart Among Savings Apps

The big question for Dobot is whether its second incarnation can make a dent in a crowded market where Digit, Qapital and others have a significant head start. Zurcher points to two factors help it stand out: It’s free and it offers a better user experience.

“The green dots and the way users interact with the app are a real differentiator,” he states. “It’s fun, and engages people in a way that makes them feel empowered and confident.”

Digit, by contrast, charges $2.99 a month to use its service. Digit doesn’t pay any interest either, but does provide a 1% annualized savings bonus every three months that helps offset its monthly fee.

Doug Smith, SVP and Head of Consumer Banking at Fifth Third, adds another reason the bank is bullish on Dobot: The stability and security of having a large bank standing behind the app makes a difference to consumers.

Newer entrants into the savings app field such as Chime and SoFi Money are offering automated savings functions as part of broader financial offerings. Fifth Third envisions Dobot as part of its effort to approach customer relationships more from the viewpoint of financial wellness. The new app complements another one the bank launched in 2017: Fifth Third Momentum. That app allows consumers to round up debit card purchases to the next dollar and apply the proceeds to their student loan debt. Momentum has already helped to pay down more than $1 million, the bank states.

Zurcher notes that the data the bank can collect and leverage from Dobot will enable the bank to provide more useful insights to consumers, such as “Others in your peer group are saving this amount for such and such.

The whole user experience is built around setting and reaching specific goals. Because the account does not pay interest, these are almost all short-term goals. The most common ones are travel and vacation related, according to Zurcher, followed by emergency funds and/or a general savings stash. The third most popular category is home-related goals — e.g. a remodeling project or a downpayment for a new home. Other goals range from cars to weddings to birthdays, etc.

Dobot encourages users to engage by text at any time. It sends a “bite-sized” piece of money advice once a week by text and at the end of every week lets users know what they saved that week, “encouraging and congratulating them.”

Millennial consumers are Fifth Third’s primary target market for Dobot. It’s soon-to-be-launched promotional outreach for the app will concentrate in digital channels accordingly, says Zurcher. However, the banker admits that the uptake of the Dobot app by older generations has been a bit of a surprise — “but a pleasant surprise.” He says that while Millennials represent the biggest portion of users at roughly 35-40%, Baby Boomers come in at about a third.

“We all have needs to save,” he says, “including saving to go see the grandkids next summer.”