The number of free checking accounts continues to decline, following another sharp drop last year. An annual checking study conducted by Bankrate shows that just 45% of basic checking accounts are free of any monthly maintenance charges, down from 65% in 2010. That number peaked at 76% two years ago. Overall, 60% more noninterest accounts carry fees and balance requirements than they did last year.

“Free checking is going away because the economic model that free checking survived on is no longer viable,” says Ajay Nagarkatte, managing director of BAI Research.

Even so, Greg McBride, CFA, senior financial analyst for Bankrate, says free checking isn’t likely to go away entirely for those consumers willing to jump through a few hoops.

Last year, 88% of noninterest accounts were either free or could become free if the customer signed up for direct deposit. This year, the number is 92%, which shows banks are still willing to offer free checking in exchange for a deeper relationship with customers.

The average account maintenance fee rose from $2.49 last year to $4.37 this year — that’s $52.44 annually — an increase of 85%.

The average minimum balance required to avoid monthly fees rose from $249 in 2010 to $585 this year, an increase of nearly 135%.

“The big increases in balance requirements and fees aren’t just from banks that already have those raising them, it’s also from those that didn’t use to have a balance requirement or a fee now instituting one,” McBride says.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

At this point, only 4% of accounts charge a point-of-sale fee when using a debit card, and less than 2% charge a monthly or annual fee for carrying a debit card.

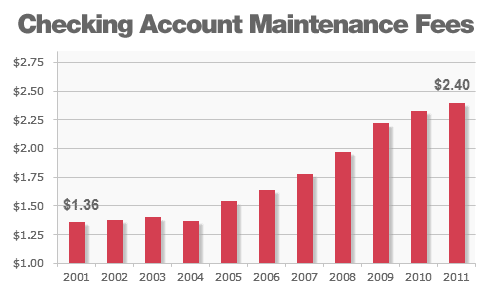

ATM surcharges hit an all-time high for the seventh consecutive year. in 2010, the average charge was $2.33, climbing to $2.40 in 2011. That’s an increase of 7¢, or about 3%. The most common ATM fee was $3.

“A few years ago, Bank of America moved to the $3 surcharge, which at the time was uncharted territory. Now, it’s the most common surcharge that we find in the survey,” McBride says. “There was a lot of negative reaction at the time, but it didn’t take long before the industry embraced it.”

The fee a bank charges its own customers for drawing money out of another bank’s ATM stayed flat at $1.41. That brings the average total customers have to pay for using an out-of-network ATM up to $3.81. If a customer only withdraws $20 from an ATM, they are paying a fee that equates to a 19% surcharge.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

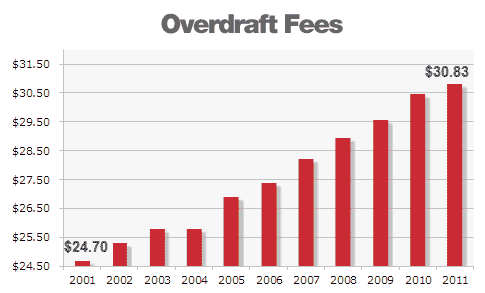

The average overdraft/NSF fee rose 1%, from $30.47 last year to a record $30.83 this year. Bankrate says these fees typically rise at or near the rate of inflation.

Interest checking continues to become less attractive for accountholders. Yields were down for the fifth consecutive year, falling 2 basis points to an all-time low of 0.08%. Even as yields fell, fees rose. The average monthly maintenance fee for an interest-bearing checking account jumped 8.5%, from $13.05 to $14.05. Meanwhile, the minimum balance on these accounts increased sharply, rising 43% from $3,883 to $5,587.

Bankrate’s data come from surveying the five largest banks and five largest thrifts in 25 of the nation’s biggest markets from August 1-12, 2011. Bankrate asked institutions about terms on one generic noninterest account and one interest-bearing account for the general consumer.