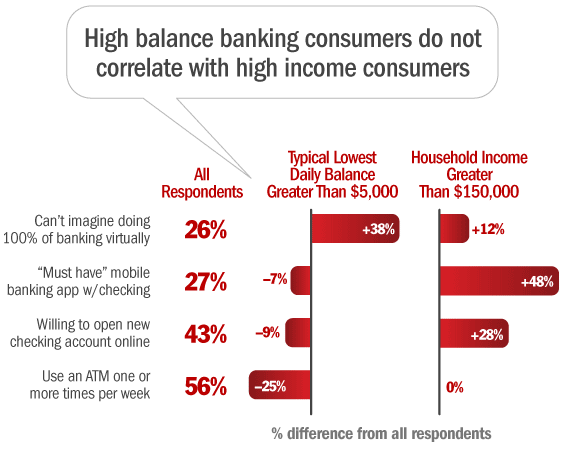

Many banks target their “top shelf” checking account products at high income consumers. Most of these fancy checking accounts with bells and whistles — like ATM fee rebates — require high minimum balances to avoid monthly service fees.

Instead of marketing checking products to specific income segments, marketers should focus on age. In a recent survey on FindABetterBank, 63% of respondents over 40 years old reported daily checking account balances of more than $5000, but only 37% of those with income of $150,000 or more carry such high checking account balances.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Shoppers with high balances have different banking requirements and attitudes about branches than high income shoppers. Here’s three fundamental differences:

1. High balance consumers are more tied to branch banking. Both high balance and high income consumers segments have stronger affinities towards bank branches than the overall market. This tendency correlates with age and both segments skew towards older consumers compared to lower balance and income segments.

2. High income consumers are more digital. The starkest difference between high balance and high income segments is their demand for mobile banking – 40% of high income respondents said they must have mobile banking compared to only 25% of high balance shoppers. High income shoppers are also much more willing open accounts online compared to the high balance segment.

3. High balance consumers use ATMs less. Maybe high balance consumers have so much money in their accounts because they don’t use ATMs as frequently as lower-balance consumers? Regardless, their ATM use is lower than other consumer segments based on balances or income.