Community banks and credit unions have a window of opportunity to fill a gap in small-business lending. To take advantage, they need to change gears, putting their traditional credit processes on a severe diet to match the requirements of this market.

The window will not stay open long, however. Already online lenders like Kabbage, Credibly and many others have grabbed market share ceded by the biggest U.S. banks after their post-crisis pullback.

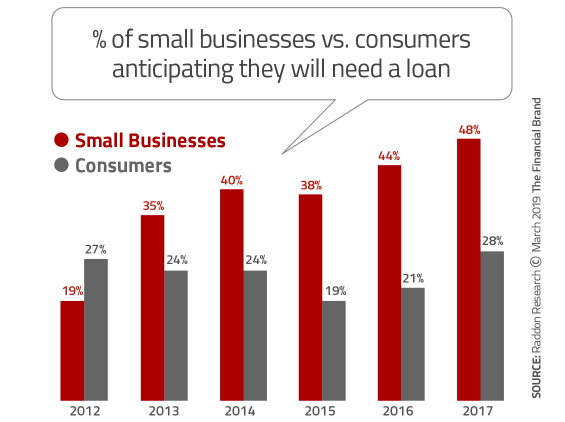

The small business market currently is thriving and the need for capital has risen steadily. In 2012 19% of small businesses needed a loan, whereas by 2017 48% needed one, according to Raddon Research Insights. Overall, small businesses comprise about half of the U.S. labor market and account for two-thirds of net job creation. Still, the sector has been credit-squeezed since the recession, which analysts believe has contributed to sluggish economic growth for several years.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Community Lenders Take a Pass on Small Business

In a detailed 44-page report, Raddon found that while community banks and credit unions are active in the small-business market, they have not as a general rule moved to fill the gap left open when the biggest banks did not return to pre-recession lending levels. The cost of booking and carrying these small-dollar loans is a big reason why community institutions remained on the sidelines.

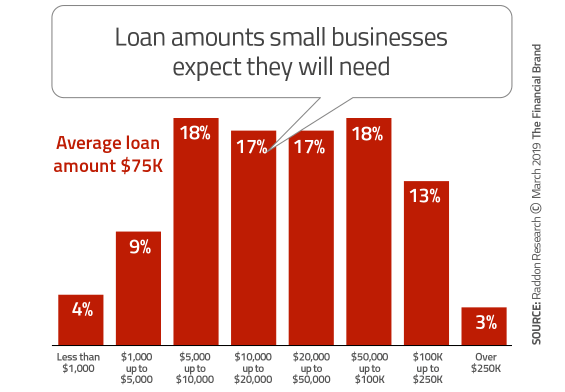

Nearly two-thirds (63%) of small businesses have annual sales of less than $500,000, Raddon notes. And while just 15% are currently in the seed/startup stage, over half (56%) are still run by the founder. The average loan size for a small-business loan, Raddon found, was just $75,000, with almost three quarters of small businesses seeking $100,000 or less, and 95% needing $250,000 or less.

Although some traditional financial institutions have converted to modern loan platforms, the majority continue to use conventional business loan processes and technology which makes it cost-prohibitive to handle small-dollar business loans. Some community institutions do make such loans as part of supporting the community, or in hopes that the small businesses will grow into profitable customers. But that practice is the exception, the research suggests.

The Raddon report — produced in cooperation with PayNet, a provider of small-business credit ratings and lending software — lays out in detail the financial mismatch most banks and business-lending credit unions face. For example, a PayNet analysis found that the manual underwriting process can consume up to 100 man hours.

“It is not uncommon,” the report says, “for the entire process, from application to adjudication, to take 30 days or longer. The typical financial institution can handle a volume of just ten loan applications per analyst per month. At an average booking rate of 50%, this means the underwriting cost per loan ascends to $10,000.”

It gets worse. Financial institutions conduct periodic reviews of loans in portfolio. These can take up to two days of work and cost over $1,000 for a single loan review, according to PayNet. That math may work for a $5 million loan, but for a $75,000 loan, it doesn’t come close. The report calculates that the breakeven balance for a 60-month term loan at 5% with a 50 basis-point loan-loss allocation, would be $861,505 to deliver a 15% return on equity with a 10% capital requirement — assuming an annual loan review. Looked at another way, the traditional lender would have to charge interest of 9.49% for a $75,000 loan.

Read More: 5 Ways Banks Fail When Serving Start-Up Businesses

Online Lenders Have Pros and Cons

Marketplace lenders typically charge considerably higher rates than traditional lenders because their model relies on high-cost investor funding in many cases. Why would a small business pay the higher rate?

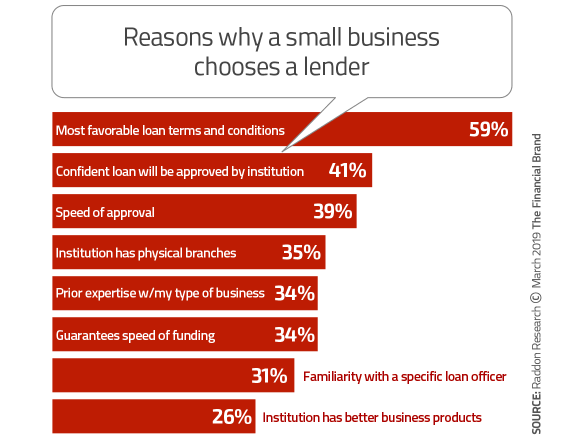

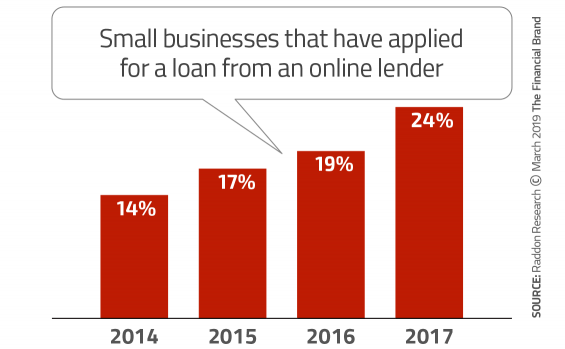

Raddon found that the three most important factors were: Favorable loan terms and conditions, confidence in getting a loan approved from that institution, and speed of approval. Almost one quarter (24%) of small businesses applied for a loan from an online lender in 2017, according to Raddon’s data, up significantly from the three previous years.

Further, the data show that in 2017 more than half of small businesses indicated they would be likely to use a nontraditional online lender — 32% of them indicating “Extremely/Very likely.”

A loan to a small business often is more than just a transaction, however. With their ability and willingness to provide personal engagement that small businesses often need, community banks and credit unions are ideally suited to serve this market. By contrast, large banks struggle with mass-market, high-touch service, and online lenders often are difficult to engage with beyond the mobile app.

“Community-based financial institutions represent a ‘sweet spot’ to help revive affordable small-business access to credit.”

— Raddon Research Insights

“By virtue of their local orientation and high-touch approach, smaller, community-based financial institutions represent a ‘sweet spot’ to help revive affordable small business access to credit,” Raddon states. But these institutions need to implement more efficient processes so that small-dollar business loans are profitable and the loan terms — and speed of approval — are attractive to small businesses.

Read More:

- Under Attack: Outsiders Threatening Traditional Business Banking Models

- 5 Ways Traditional Business Lenders Can Beat Digital Disruptors

- Don’t Kill Business Banking Relationships With Digital

Roadmap For Profitably Lending to Small Businesses

If community-based financial institutions implement fintech-like processes and technology to reduce costs and accelerate approval and funding rates, they can capitalize on a major opportunity, Raddon suggests.

The research firm’s report lays out the key elements for this transformation.

1. Segment applications by loan size. As fintechs have shown, small-dollar business loans can successfully be handled in nontraditional ways. Here is a simplified example of how this segmentation can be set up:

| Loan Request | Underwriting Approach |

|---|---|

| Less than $100,000 | Application only |

| $100,000 – $1 million | Light underwriting |

| Over $1 million | Full underwriting |

2. Use technology to speed application, analysis and funding. A streamlined loan process entails two distinct applications of technology. First, it involves a portal — a digital application system where core information about the business and loan request can be submitted by the business owner. Then you need a decision engine that evaluates the application and further directs the loan process based on preloaded policies and product structures, pulling in credit reports and industry information and consolidating this information into a credit package.

3. Optimize credit policy and process. For larger small-business loan requests, the decision engine can analyze the credit package and rate the credit quality of the borrower before sending it to a credit analyst for final review and vetting for compliance. For the loan review process, banks and credit unions can segment the small business portfolio by risk and allocate the most resources to the highest-risk loans, with lower-risk loans assessed less frequently.

Report author Greg Ulankiewicz, Raddon Senior Research Analyst, notes that “technology should step in to handle low-value-add parts of the process, freeing up resources to handle greater loan volume while allowing financial institutions to keep their ‘hands on the wheel’.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Build or Partner With a Fintech?

Raddon’s report runs through several loan examples showing the impact on profitability of using a streamlined small-business lending model. One assumption used is an annual cost of $60,000 for advanced loan software for a $2 billion institution. Overall the report projects that a bank or credit union using an improved lending model could grow its small business loan portfolio by 25% with negligible increases to fixed costs.

Ulankiewicz says that partnering with a fintech firm to upgrade a bank or credit union’s loan platform may be the most logical approach rather than expending cost, time and resources on building or modifying an internally managed solution. Even JPMorgan Chase took that route in partnering with online lender OnDeck.