Pot banking advocates are excited about what they believe is their best chance yet at a federal law that allows financial institutions to serve the marijuana businesses more easily.

The Senate Banking Committee passed the SAFER Banking Act by a vote of 14-9 in September, clearing it for a vote on the Senate floor. This marks a key milestone for legislation offering federal protection to banks and credit unions serving state-sanctioned marijuana businesses. A pot banking bill has never made so much progress in the Senate before, and it has advocates feeling cautiously optimistic that they may finally have the momentum needed for success.

The House of Representatives has approved the particulars of the original bill, called the SAFE Banking Act, repeatedly since it was first introduced in 2013, whether in standalone form or attached to other legislation.

SAFER is the Senate version, which was introduced on Sept. 21 and was approved by the Senate Committee on Banking, Housing and Urban Affairs with amendments on Sept. 27. It is bipartisan legislation introduced by Democratic Sen. Jeff Merkley of Oregon and Republican Sen. Steve Daines of Montana. Language added to the bill by Sen. Cynthia Lummis, R-Wyo., helped it garner support from three Republicans (out of 11) on the Banking Committee. Democrats hold a narrow majority on the committee (12 to 11) and in the Senate.

While it’s uncertain if Congress can put this bill in front of President Biden, banking executives will want to know just how much protection it grants for deposit accounts, commercial loans and even mortgages tied to marijuana businesses.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Progress on Making Pot Banking Legal

The disconnect between federal and state law over marijuana businesses has long been a concern for executives at banks and credit unions, who worry about the threat of enforcement action.

Every state in the country has updated its marijuana laws in some way, creating a patchwork quilt of regulations for financial institutions. Minnesota and Delaware are the latest states to pass full legalization of marijuana use. There are just seven states where both medical and recreational use remains illegal.

As more states have companies growing, transporting, storing, and selling marijuana, advocates and lawmakers have stepped up efforts to resolve the hurdle to pot banking at the federal level.

Banks and credit unions are not entirely without direction. While legislation bounced around in Congress, the Financial Crimes Enforcement Network issued guidance in consort with the U.S. Department of Justice in 2014. In defining “how financial institutions can provide services to marijuana-related businesses consistent with their BSA obligations,” the agencies said they aimed to “enhance the availability of financial services for, and the financial transparency of, marijuana-related businesses.”

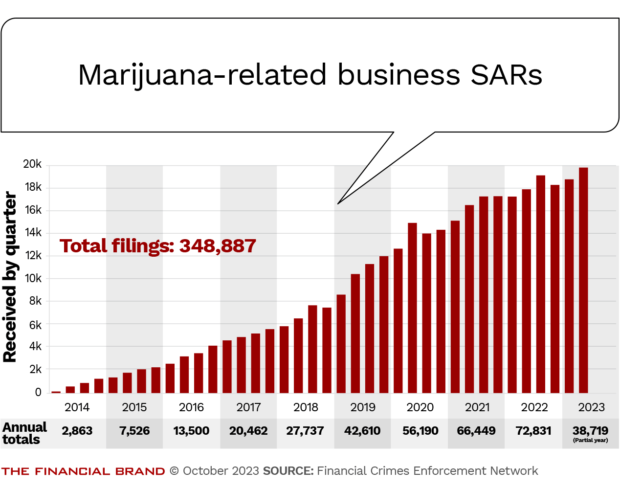

Since then, financial institutions providing deposit services to legal marijuana companies file suspicious activity reports.

These SARs are not the “priority” type, which are meant to notify authorities of a possibly illegal business interacting with the financial system. They are known as “limited” SARs, which were created to accommodate banks, credit unions, and other financial companies that do business with state-legalized marijuana businesses.

The number of marijuana-related SARS has climbed every quarter since FinCEN began tracking them in 2014.

What the SAFER Banking Act Says

Media coverage of the pot banking legislation has focused on the implications of the state-federal mismatch for deposits.

But the impact on lending is another point of friction for banks and credit unions. Consider commercial loan documents, for example. Breaking a federal law is defined as default. What institution wants their collateral to be seized by federal law enforcement?

It’s a challenge even for financial institutions that are not engaging directly in pot banking. Banks and credit unions cannot prevent all landlords from renting to dispensaries, or land owners from renting land to cannabis farmers, or trucking companies from transporting cannabis. Assets associated with loans are being used by the marijuana industry in every state where it has a level of legality — and that’s just about all of them.

This is where the SAFER Banking Act promises to help: For the purposes of federal law, “the proceeds from a transaction conducted by a state-sanctioned marijuana business or service provider shall not be considered proceeds from an unlawful activity,” it says.

The bill bars any federal banking regulator from limiting or terminating “deposit insurance or share insurance of a depository institution under the Federal Deposit Insurance Act.” The bill even protects insurance providers selling policies to state-sanctioned marijuana businesses and service providers.

For the purposes of federal law, “the proceeds from a transaction conducted by a state-sanctioned marijuana business or service provider shall not be considered proceeds from an unlawful activity.”

— SAFER Banking Act

A residential mortgage, including individual units of condominiums and cooperatives, “underwritten, in whole or in part, based on income from a state-sanctioned marijuana business or service provider, shall not be subject to criminal, civil, or administrative forfeiture of that legal interest,” the bill stipulates.

Banking regulators are also barred from taking corrective supervisory action on a loan solely because a borrower has ties to a marijuana business. Neither may they take corrective action against “an employee, owner, or operator of a state-sanctioned marijuana business or an owner or operator of real estate or equipment leased to a state-sanctioned marijuana business,” the SAFER Banking Act says.

Read more: Cannabis Banking: Are the Rewards Worth the Risks?

The Road to Passage for the Pot Banking Bill

Congress has been through a few rodeos on the SAFE Banking Act, in all its various forms. Despite support from a broad coalition of trade associations — including the American Bankers Association, Independent Community Bankers of America and the Conference of State Bank Supervisors — the bill touches a deeper political nerve, one that makes passage more complicated.

Threading the needle to the needed 60-vote threshold in the Senate will prove tricky. Some Republicans, and even some Democrats, see broader provisions outside what’s proposed in the SAFE Banking Act as nonstarters. Progressives also may not want to vote for legislation aimed at marijuana businesses without addressing broader debates about this issue: Should Congress pass legislation now to help banking serve marijuana businesses or should this all just be taken care of in a full legalization bill?

Some lawmakers also want the pot banking bill to reach into the criminal justice system with an amendment to expunge the criminal records of individuals arrested for nonviolent marijuana crimes.

Adding more smoke to the already thick political fog are controversial government activities from the past, such as “Operation Choke Point” where federal agencies attempted to block financial institutions from serving companies such as payday lenders and businesses involved in firearms and ammunition sales. The SAFER Banking Act restricts federal banking regulators from pressuring financial institutions to cut off particular types of businesses.

Some politicians — concerned about this history as well as public pressure campaigns — also want to add amendments to the pot banking bill that would make it harder for financial institutions to refuse to serve legal businesses.

Opinions vary widely on Congress’ and regulators’ role in deciding which industries receive or do not receive access to the banking system.

Read more:

- Crypto & Banks: Regulators Shouldn’t Just Say No to a Whole Industry

- 4 Ways to Dodge Trouble When Using Generative AI

Even If Pot Banking Succeeds, Some Issues Remain

The bill’s success or failure in Congress will likely depend on how much lawmakers try to add to it.

“I think now it’s what does the amendment process look like on the floor,” says Steve Keen, senior vice president of congressional relations for the Independent Community Bankers of America. “The more that the bill can focus on banking and not bring in potentially controversial provisions,” the likelier it is to become law.

Things could go either way, says Heidi Urness, co-chair of the cannabis practice group for the law firm McGlinchey Stafford in Seattle. “I think there’s excitement over some actual bipartisan movement,” she says. “We’ve also seen some real pushback.”

What are the chances Congress approves the pot banking bill?

“I do feel more momentum now than before.”

— Steve Keen, ICBA

While a safe harbor for financial institutions would be a welcome change, the pot banking bill wouldn’t fix every legal issue facing the marijuana industry. Credit card networks still would not facilitate payments for marijuana operators. Businesses in the cannabis industry cannot take federal tax credits or deductions either.

Stocks also will still have some quirks. Canadian marijuana businesses can list themselves on U.S. stock exchanges, but U.S. marijuana businesses cannot. The U.S. companies have to list their stock in Canada instead, due to the differences in federal approach.

However, “U.S. operators seem to believe that SAFER would allow access to those exchanges,” says Tyler Beuerlein, chief strategic business officer for Safe Harbor Financial, a company that facilitates access to financial services for marijuana businesses.

ICBA’s Keen expresses cautious optimism. “We may have a fairly long road ahead still. I’ve been at this a while and seen it fail multiple times,” he says. “I do feel more momentum now than before.”