Financial institutions have an opportunity to expand their relationships with small and midsize businesses by advising them on key operational issues where they need help, according to a study by the market research and consulting firm Phase5.

Many of these businesses say they would like to improve in areas such as payment processing and cashflow management, but are unsure where to go for guidance. They often turn to fintechs, accounting platforms and others, in many cases without even thinking of their primary bank or credit union as an option.

One of Phase5’s key findings is that financial institutions must be more proactive about reaching out to business customers to say that they can help in specific areas the study flags as opportunities. Not doing so imperils these relationships, the risk being that businesses increasingly get their needs met elsewhere.

The risk is especially pronounced with businesses that opened in 2020 or later, which the study refers to as the “COVID class.” Phase5 highlights pivotal ways that this group differs from businesses that have been around longer, uncovering insights banks and credit unions can use to make their offerings more compelling.

Read more: Killer Small Business Banking: What Fintechs Do That Banks Ought To

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

High Satisfaction, But Not a Lot of Loyalty from Small Businesses

The Phase5 study arrives at a time when economic uncertainty and other challenges have left small and midsize businesses of all types looking hard at how to become more efficient. They are also still adjusting to changes in the way people work and shop.

To navigate this environment, businesses are looking increasingly to fintechs, accountants, business associations and even online service providers as sources of knowledge and advice, the study shows.

The good news for financial institutions is that their customers generally give them high marks. More than nine in 10 businesses using credit unions say they offer user-friendly mobile and online banking, and more than eight in 10 say the same about their banks. An overwhelming majority of respondents also score their financial institutions favorably for helping them select the right banking services and understanding their business.

Even so, one in five assign a high likelihood to the possibility that they could leave their primary bank or credit union in the next year or two.

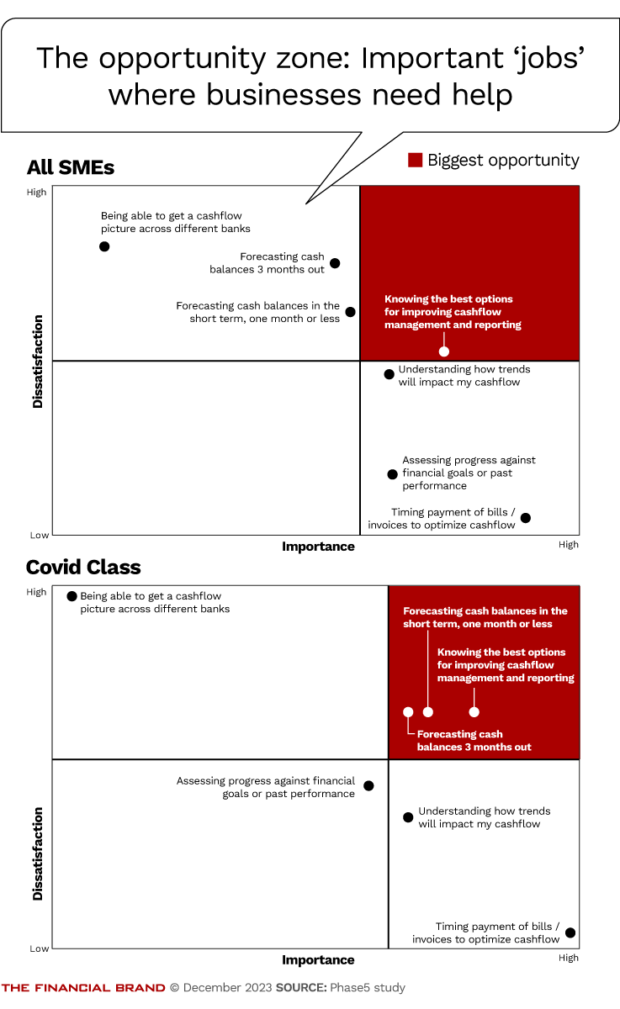

Businesses are intent on getting “jobs” done, which takes precedence over “relationships” with particular financial providers, the Phase5 study says. So financial institutions should focus on developing expertise in the “jobs” that businesses consider to be their biggest pain points. Then they can more effectively foster the relationships they covet.

Pain Points for Small Businesses Are Opportunities for Banks

Phase5 designed its study to identify the top areas of opportunity for financial institutions. It surveyed just over 1,000 U.S. businesses across six sectors: travel, food and entertainment; retail and wholesale; healthcare and social assistance; professional, scientific and technical services; construction; and other. The businesses ranged from $100,000 to $5 million of revenue; from less than a handful of employees to nearly 100; and from less than three years old to more than a decade.

To identify underserved needs, Phase 5 asked respondents about business functions where they felt like they needed improvement.

In the cashflow management category, they want to be able to better forecast cash balances for the next month and the next three months, for example. In the payments category, they are eager to minimize transaction fees and reduce delays in processing. The need for a comprehensive understanding of options cut across nearly all six of the categories the study covered.

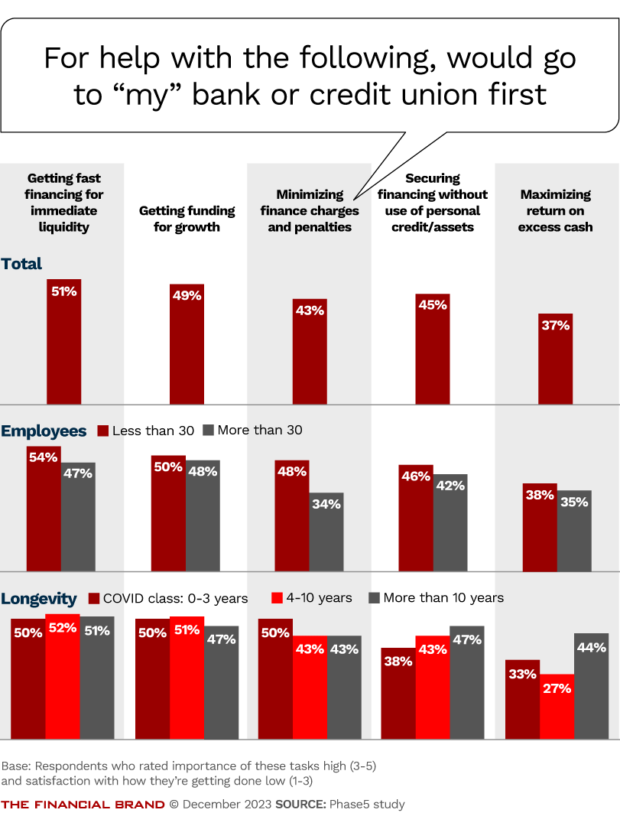

But when businesses seek help with needs like these, their own primary financial institutions are often not in the mix. Only about half say their bank or credit union would be their first call for advice on reducing transaction fees. For tackling payments delays, it’s 29%, and for finding the best options for cashflow forecasting, 26%.

Even when seeking help with access to short-term funding, fewer than half of the businesses surveyed say they would go to their bank or credit union.

“This study shows that, in this day and age when people have more options than ever to turn to for finding products and services or getting support, banks are finding themselves being less of a primary source of information,” Stephan Sigaud, Phase5’s chief marketing officer, tells The Financial Brand. “Small business customers these days are looking at all their options. So, banks beware.”

The best approach for financial institutions is “to seize the opportunity and put in place a proactive strategy of reaching out to small business customers to help them understand their options,” Sigaud says.

Read more:

- Inside Comerica Bank’s Innovative Co-Op Program for Small Businesses

- Banks Trying Out New Ideas to Connect with Female Business Owners

Cozying Up to the ‘COVID Class’

The small and midsize businesses in the COVID class see more areas where their operations have room to improve, compared with those that have greater longevity.

But they were far less inclined than the others to approach their bank or credit union for help with these matters. For example, just 17% in the COVID class say they would ask their bank or credit union about providing financial solutions for their customers, compared with more than 40% of the businesses that are four years or older.

It’s not because they have been put off. The COVID class tends to be just as satisfied with their primary financial institution as the other survey respondents.

Yet, comparatively, the COVID class is also 33% more likely to leave their institution.

The study didn’t try to answer why directly (though some of that could have to do with their shorter banking relationships). Instead, it zoomed in on what could be done to better attract and retain these business customers, who, in their desire for more help, represent more opportunities for bankers, albeit with the attendant caveats on risk.

In the expenses category, for example, survey respondents overall cite only one job they consider to be both highly important and a pain (easily tracking whether a payment has been made). The COVID class has three such jobs (evaluating the options for improving how the business pays expenses, routing invoices to staff for approval, and tracking payment due dates).

Takeaways for Banks to Improve Their Strategy for Serving Businesses

1. Pick your spot.

The study advises bankers to “boil less ocean.” In other words, instead of trying to develop solutions that’ll work for every small business, find subsets, like the COVID class, where your institution can help in ways that will make an outsize impact. Then cultivate that niche.

2. Take a holistic approach when analyzing how you can help.

Don’t just focus on products. Look across services, communications and pricing for what you can do differently that would move the needle for businesses in their daily operations.

(Take a look at Comerics’s Small Business Co-Op for some inspiration. Or Oxford Bank in Michigan.)

3. Give everyday tasks another look.

Consider how you can improve on even the basics like payment tracking and late-payment collections. Some of the best opportunities are in unsexy jobs like those, the study says.

4. Be proactive.

Talk up the ways that you can help with a wide range of challenges. Given that businesses are, more often than not, going elsewhere when they have a need, it is mostly up to bankers to initiate the conversation about what they can do to make something that’s hard for businesses a little easier. Even if that is just giving some advice on what their options are, as the last takeaway stresses.

5. Share your insight generously.

Be ready with information and advice, says Steve Hansen, a partner at Phase5 and chair of its data analytics practice. The idea is for the banker to become an advisor who is not only trusted, but also top of mind.

Just walking businesses through what they could do in a given situation builds relationships, regardless of whether it leads to a sale, Hansen adds. “Knowing what the options are is half the battle, and I think there’s an opportunity for some business bank out there to do a better job of that,” he says.

Other research backs this up. J.D. Power’s annual study of small business banking satisfaction also concludes that providing advice is a fantastic opportunity to strengthen relationships with customers in this segment. When small businesses receive advice, ratings of satisfaction, likelihood to recommend and likelihood to reuse the bank increase significantly, the J.D. Power study shows.

In addition, small businesses that receive advice are more likely to apply for credit, report better approval rates for new credit and are more likely to use services like cash management, lines of credit and wealth management with the bank.