Retail banks and credit unions are confronting an enormous task as a result of the COVID-19 crisis. Not only must organizations manage their own earnings and financial challenges, but they must also respond to the financial and non-financial needs of consumers and small businesses. This requires re-imagining the way products and services are delivered and also the types of solutions offered. There is no playbook for the times we are experiencing.

The behaviors of small businesses have changed significantly since the onset of the pandemic in March. Many small businesses have had to shut their doors entirely, while others have had to pivot to meet consumer desires to transact digitally. Facing almost immediate financial hardships, small businesses have looked to their financial institution partners for help in forgoing loan payments, while hoping for assistance in taking advantage of government assistance initiatives such as the Paycheck Protection Program (PPP).

Beyond financial events that have occurred, many small businesses have also needed to take steps to ensure safety of patrons and workers going forward. This is at a time when many businesses are teetering on the potential of complete closure if the impact of COVID-19 can’t be reduced or eliminated in the near future.

Read More:

- Banking Must Support Small Businesses Beyond Providing Loans

- Alibaba Shows How Banking Can Support Small Firms Beyond Loans

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Small Businesses Face Extreme Challenges

According to the findings from the first-ever “State of the American Small Business Banking Experience” research, sponsored by Phase 5, the challenges facing small businesses may be greater than imagined. The research was conducted by surveying 1,300 small business executives in the U.S. and Canada both in December of 2019 and June 2020. This provided a unique perspective of the impact of the current pandemic.

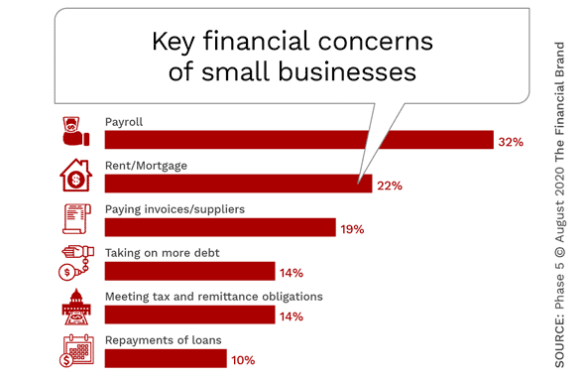

More than half of small businesses have been closed, according to the survey, with six in ten taking a direct hit to sales. As many as 30% of small businesses may never reopen. With almost two thirds of small firms concerned about the lasting impact of COVID-19 on business, their worries vary, including the inability to make payroll or rent, the inability to pay suppliers, the need to take on more debt or the ability to repay the debt already on the books.

During normal times, many financial institutions would view small businesses with these challenges in a negative light, concerned that they may represent significant business risk.

These are not ordinary times.

Financial institutions must get creative in the way they partner with small businesses or risk losing large numbers of small business customers forever. The lasting impact on complete communities could be devastating.

Financial Institutions Lacking in Response

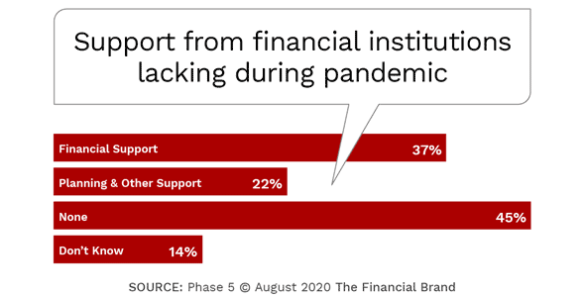

Despite the significant challenges faced by most small businesses, financial institutions have not been as responsive as small businesses would have expected. According to Phase 5’s research, close to half of the small businesses surveyed had not received any offers of support. Another 14% could not remember if they received any — not a good sign.

When asked, “Has your bank reached out to see how your business was doing?,” 57% of the small businesses surveyed said ‘”no,” with another 10% unable to recall if they had been contacted. Fortunately for most financial institutions, small businesses have only modest expectations of their bank or credit union, with 36% saying their financial institutions is doing the best they can to handle a higher than normal volume of requests.

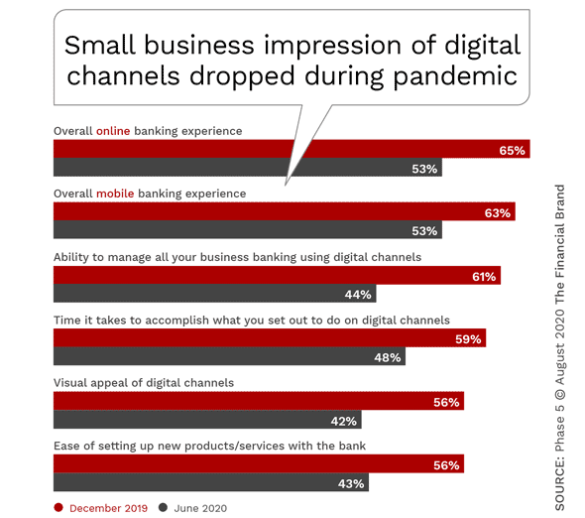

As part of the research done by Phase 5, a trend analysis was done around small business perceptions of their financial institution’s level of innovation, channel experience and overall customer service between December 2019 and June 2020. In each category, the scores dropped significantly. For instance:

- Innovation – Most small businesses believed their FIs offered undifferentiated products and services, lacked industry insights and lagged on the offering of digital technologies. In every category, scores dropped by a third or more from December 2019 to June 2020.

- Channel User Experience – While performance scores dropped across all measures of channel experience, the drops were not as significant as in the innovation category.

- Customer Service – As with the innovation category, perceptions of customer service dropped significantly between December 2019 and June 2020. The biggest dropped in the category of overall customer service experience, speed of call center response and the ability to provide proactive recommendations.

“Many small businesses are hurting , so it’s not surprising to see ratings of their bank’s innovation, digital offerings and customer service drop between December and June,” says Michael Dolenko, partner at Phase 5. “What is surprising is how much they dropped, and how so many banks have missed opportunities to support their small business banking customers. ”

“Many small businesses are hurting , so it’s not surprising to see ratings of their bank’s innovation, digital offerings and customer service drop between December and June,” says Michael Dolenko, partner at Phase 5. “What is surprising is how much they dropped, and how so many banks have missed opportunities to support their small business banking customers. ”

Communication is the Foundation for Success

While most financial institutions did not score well from an innovation perspective, small businesses are more likely to want their bank or credit union to communicate proactively than to have the most modern technology solutions. In other words, “Show me you care about my survival.”

Before the pandemic, financial institutions were aggressively trying to build stronger relationships with small businesses that were experiencing extended periods of growth. The competition was fierce, not only between traditional financial institutions, but also with non-traditional players. Once COVID-19 closed half the businesses down, communication with the same businesses dwindled.

It is more important than ever for banks and credit unions to engage with the small businesses that need help the most. Even when small businesses are not asking for help, they want to know their financial institution “has their back.” Business advice, planning support and financial relief could not only save a relationship … it could save a business.

“One of the things that stood out was how important just reaching out to small businesses and being sympathetic is,” states Dolenko. “When we look at how small businesses rate their bank’s performance during COVID-19, the impact of someone from the bank contacting them to see how their business was doing – a simple check-in – had a similar impact as their bank offering financial relief in the form of deferred loan payments, or interest rate relief.”