Many banks and credit unions say they focus on small business banking, but success with this market hinges on the ability to deliver the right user experience, starting with the account opening (or loan application) process. And according to Javelin Strategy, most banks and credit unions struggle with digital account opening.

In their research, Javelin found that only six of the top 30 banks offered a digital checking account application to small businesses. This correlates with data from Aite Group, who found that three quarters of large and midsize banks feel their current process is inefficient or not where it needs to be. And if larger institutions admit they have significant shortcomings, you can only imagine how smaller banks and credit unions are struggling.

Opening an account or applying for a loan is only the first step in the customer journey, but it’s critical to get it right. After all, first impressions matter.

There are nearly 30 million small businesses in America.

“Account opening is a tremendous opportunity for banking providers to demonstrate their omnichannel competence, save on costly administrative and transactional branch visits, cross-sell additional accounts and products and onboard new customers into digital services that build engagement and lead to long-term profitability,” notes Javelin.

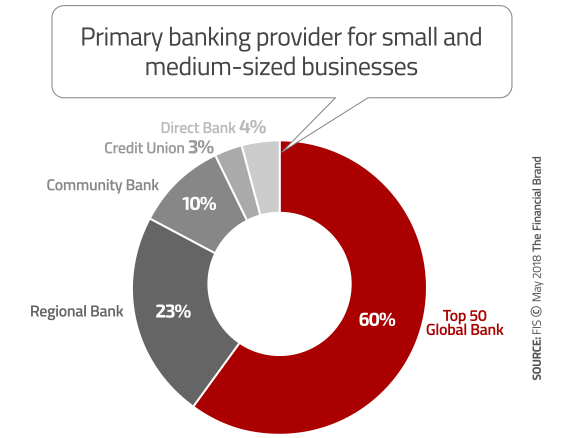

Despite deficient processes like digital account opening, big banks still lay claim to 68% of the small business market (vs. only 41% of retail consumers). Even though small businesses are more likely to bank with a large financial institution, that doesn’t mean they want to. Many would love to have a relationship with a smaller institution — one who knows the local market and takes the time to understand their business — but they worry that community banks and credit unions are less likely to have the technology conveniences they crave, and rightfully so.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Small Institutions Struggle, But Big Banks Don’t Satisfy Either

According to FIS, megabanks have the lowest satisfaction rating among small business owners. So why don’t they use smaller institutions? According to research from FIS, one in five small businesses say it was because their local community bank or credit union didn’t offer the products and services they wanted.

“Business customers have been vocal in complaining about the lack of leading-edge products and digital solutions available to them,” explains Anthony Jabbour, Chief Operating Officer of Banking and Payments for FIS.

One in three small business owners say their bank’s mobile app is too limited for business banking.

— ath Power Consulting

Only 28% of small businesses say their bank or credit union is innovative. 40% say that technology providers such as Square, Mint and Bill.com are more likely than their traditional financial institution to offer products and services that they would be willing to pay for such as accounts payable and receivable reporting and employee expense tracking and analytics. Only one quarter of business banking products can be opened digitally, and less than one in ten can be completed from a mobile device.

Read More:

- How to Nail the Small Business Banking & Lending Market

- Fintechs + Ecosystems = Big Pressure on Banks’ Business Lending Role

- The Banking Industry’s Critical Role In Saving Small Businesses

The Rise of the Non-Banks

What’s missing is convenience. Small businesses have been turning to alternative, non-bank lenders including peer-to-peer lenders like SoFi, Funding Circle and LendingClub and marketplace lending platforms like Kabbage because they are fast and easy. FIS found that more than one-quarter (27%) of small businesses in the U.S. are using alternative lenders like these. Among Millennial business owners, that percentage is double (48%). And yet only 7% say they are using these platforms for lower interest rates; in most cases, banks and credit unions offer better rates. FIS also found that small businesses have been turning to non-bank financial apps to make B2B payments.

“Fintechs and alternative financial service providers will continue cutting into banks’ markets if they fail to offer digital payment solutions for a younger entrepreneurial community seeking enhanced mobile banking experiences,” warns FIS.

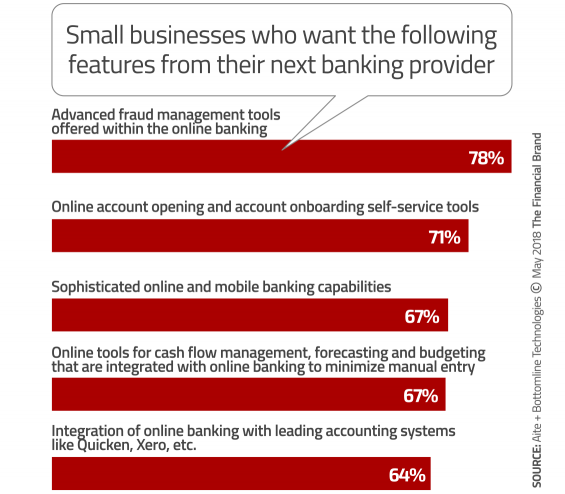

In research conducted by ath Power Consulting, two-thirds of small business owners said they would consider switching to a competing banking provider if it offered products and services to help them better manage and grow their business, and over half (54%) would consider switching to a non-bank alternative for the same reasons.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

“Small business owners value their relationship with their bank,” Frank Aloi, ath Power Consulting founder and CEO. “In fact, 64% would prefer to have their business loans funded by a traditional bank or credit union. The issue is that interaction and advice capabilities are lacking, in addition to subpar business digital offerings. To retain their small business clientele, banks need to offer advanced features designed specifically for business users, while also providing adequate in-person business guidance and expertise when needed.”

Digital tools and solutions aren’t the only delivery challenge community banks and credit unions need to worry about. Branches are also an important touchpoint. In the ath Power Consulting study, almost twice as many small businesses say that branches are their primary banking channel: 28% of small businesses vs. only 15% of retail consumers.

Some of the largest financial institutions have partnered with alternative small business lenders to deliver quick loan decisioning and funding to small businesses. JPMorgan Chase partnered with OnDeck back in 2016 and although there’s been little word on how the relationship is going, Chase did announce that was extending its contract with OnDeck for four more years.

Several banks, including Santander, ING and Scotiabank have also partnered with Kabbage. The small business lender offers its platform as a white-label product for financial institutions. Citizens Bank and Regions Bank have partnered with Fundation, which offers a suite of offerings from digital applications to end-to-end lending platforms.

It’s not just bigger banks that are making headlines. Here’s a roundup of smaller banks and credit unions — and one startup backed by a traditional bank — that are working to address the needs of the small business market.

Read More: The Stakes Have Shot Up for Small Business Banking

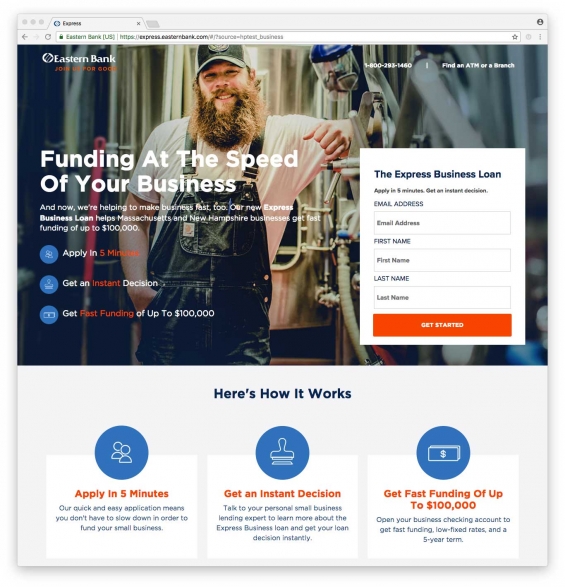

1. Eastern Bank – Business Lending

Another bank is offering loans fast but without partnering with an alternative lender. Eastern Bank, the top SBA lender in New England for seven years running, launched Express Business Loan in 2016, an online funding option of up to $100,000 for Massachuesettes businesses approved in under five minutes. The bank’s technology incubator, Eastern Labs, built the new loan original system in just over a year.

“We’re not aware of a faster and easier way to borrow money in the world. The tech we built is unlike anything else in the market,” gushes Dan O’Malley, Eastern Labs Founder and the bank’s Chief Digital Officer.

2. BBVA Compass – Azlo

Azlo, owned by BBVA Compass, is a digital business account designed specifically for freelancers and others who are members of the gig economy. It offers customized digital invoices and other features specifically for small businesses. Azlo’s brand position is about empowerment, community and social justice — designed to appeal to young, multicultural business owners.

The bank states that it’s on a mission to empower entrepreneurial communities that have traditionally been underserved and overlooked by financial institutions. It hosts the “Azlo Success Hub” with online and offline community and events, workshops and resources to help small businesses.

(March 2021 Editorial Update: Azlo told The Financial Brand it would be closing all of its accounts as of March 2021, noting a large portion of its clients transferred to FDIC-insured NorthOne.)

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

3. Sunrise Banks – Payday Loan Alternative

Sunrise Banks is one of 100 U.S. banks certified by the U.S. Treasury as a Community Development Financial Institution (CDFI). The bank focuses on lending directly to small business, especially those that are in lower-income areas. But what’s unique is how the bank builds relationships with small businesses by offering to help those businesses’ employees.

Sunrise Bank offers loans up to $3,000 to employees of its small business customers as an alternative to payday loans and other high-priced alternatives. Employees pay back the loans with paycheck deductions. Not only does this program provide goodwill between the bank and the employer, but between the bank and the employers’ employees.

4. Digital Federal Credit Union – Crowdfunding Business Loans

Digital Federal Credit Union and offers a service to small businesses to raise capital and give its members an opportunity to invest in community business. The credit union has partnered with GrowthFountain, a funding portal of crowdfunding solutions. Tennessee Valley Federal Credit Union has also done the same thing.

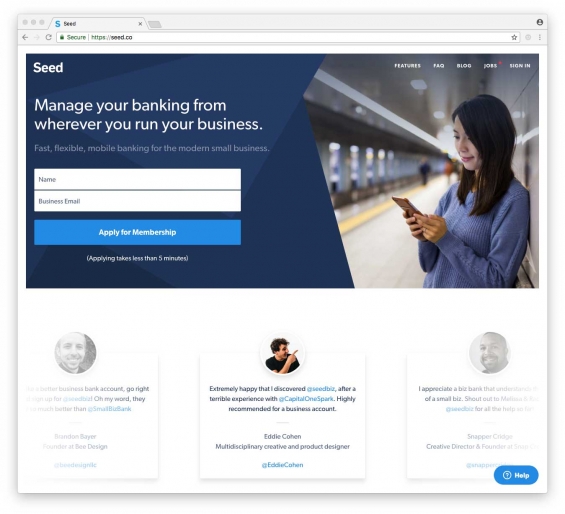

5. Seed – Digital-Only Business Banking

San Francisco startup Seed is a free mobile-only banking service for small businesses, who can get a checking account and a debit card through Seed’s partnership with The Bancorp and have access to bill payment, mobile check deposit and ACH and wire transfers. Seed is sort of like Mint and QuickBooks except that Seed directly partners with a FDIC-insured bank (like how Simple started out). There’s not a physical checkbook in sight.

Read More: Intuit Muscles into Banking with AI-Powered Primary Checking Account