The consumer banking landscape in 2023 was defined by rising interest rates, increased fees and limited access to credit due to economic uncertainty.

Meanwhile, consumers felt squeezed by the rising cost of goods and services. Looking ahead into 2024, banks will likely continue diversifying their revenue streams beyond interest income as demand grows for banking services that provide value and ease during economic uncertainty.

Nationwide, 32% of retail banking customers are now open to switching their primary bank, according to Rivel Banking Research’s 2023 Q3 data. Major pain points that are driving customers to consider a move include high fees, poor rates on their deposits and loans, an antiquated digital experience and the institution failing to support their financial well-being.

With astute planning and customer-centricity, banks can strengthen their consumer banking offerings even in the face of challenges like a possible downturn. Below are the four retail trends that we are keeping an eye on — based on our research — over the next year.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

1. Growing Needs of a Stressed Gen X

Gen Xers (aged 43-58, as of December 2023) are often referred to as the “sandwich generation” because they are simultaneously caring for their aging parents and raising their own children. A study by the Pew Research Center reported that 54% of Gen Xers have a parent both over 65 and currently raising a child or supporting an adult child financially. This can put a significant strain on their finances and time.

Life stage understanding and awareness is key to supporting Gen X in their banking experience in 2024. In the next year, 35% of Gen X banking consumers are amenable to finding a new primary bank — the highest in four years. Banks should consider catering to this group to ensure they have both the customer support they need as they balance multiple checkbooks and timelines, as well as access to solutions that can make banking easier.

Where the Loyalty Lies:

Over one third of Gen X banking consumers may switch their primary banking provider in 2024.

According to a Bankrate survey, 60% of Gen Xers say money pressures negatively impact their mental health. Offer workshops, seminars and online resources to help these Gen Xers learn about managing their parents’ finances, including topics such as estate planning, long-term care planning and financial power of attorney.

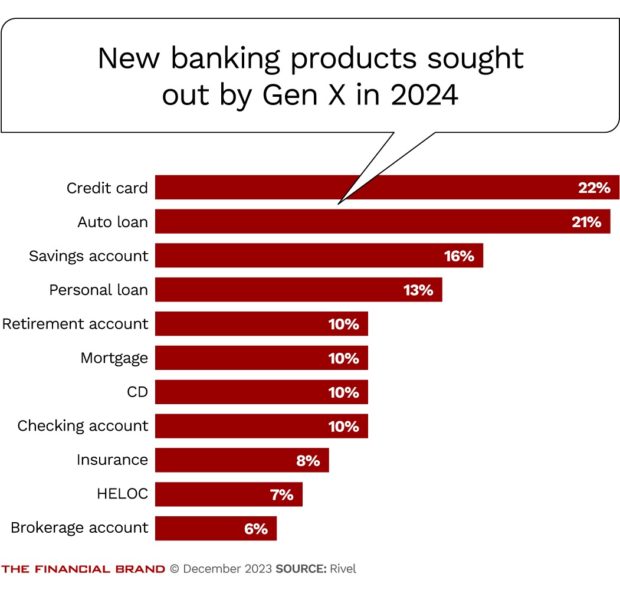

Within this age group, there is adequate product demand to grow your bank: 61% are looking to add at least one new product this year and 35% are seeking two or more. Gen X is also in their prime earning years—having the highest nationwide household income, which brings assets and a variety of needs. Banks should consider growing this experienced consumer base, alongside the future ones.

2. Demand for Sustainable Finance

22% of the 280,000 U.S. consumers that Rivel Banking Researched surveyed in their latest benchmarking interviews are now concerned about their bank’s environmental impact. Up from 17% cited in our last benchmarking study earlier in 2023, consumers are making it clear they consider the climate impact and action of a bank when deciding where to do business.

A study by Morgan Stanley found that 75% of consumers are interested in sustainable investing, with 86% of Millennials’ interest leading the age cohorts. Moreover, according to Nielsen, 69% of global consumers feel sustainability is more important to them today than two years ago.

Banks and other financial institutions are playing a key role in the transition to a sustainable economy through providing financing for renewable energy projects, sustainable agriculture and other environmentally-friendly businesses.

Banks practicing sustainable operations, like energy efficiency and reduced paper usage, also resonate with today’s consumers — and should share that fact in their advertising and branding! By demonstrating shared values and helping customers invest in line with their principles, sustainable finance allows banks to differentiate and gain market share.

3. Empowering Financial Well-Being

With consumers increasingly focused on achieving financial security, financial wellness programs represent a major opportunity for banks to provide value and deepen customer relationships.

Only 20% of consumers use a financial advisor, yet all consumers are looking for some guidance according to Rivel’s research: savings strategies (36%), retirement planning (35%) and budgeting (32%) are all commonly sought. Knowing that bank switching is on the uptick, institutions providing and promoting some low-cost but educational events to their customers can stand out from the crowd. A recent Forrester Research study found that 88% of banks and credit unions surveyed said that less than half of their customers actively use the tools they provide.

Optimize Your S*#%:

Nearly nine out of 10 banks and credit unions surveyed by Forrester said less than half of customers use their institution's tools.

Digital technologies have made it easier than ever for customers to connect with brands and products, and banks should be no exception. “My bank understands my needs” was more important to consumers’ satisfaction in our third quarter research than attractive rates on deposits or loans, convenient branch hours and ease of opening accounts online.

Expand your share of wallet with current customers by providing them what they need the most from you — a trusting financial relationship.

Check out all our financial education coverage for more specialized insight.

4. Prioritize Experience Now, Retain Customers Forever

In today’s competitive banking landscape, customer service is not just a department or a function — it is a strategic imperative. As customer expectations rise and new technologies emerge, banks that prioritize customer service will be well-positioned to attract and retain customers, drive revenue growth and build a lasting brand reputation.

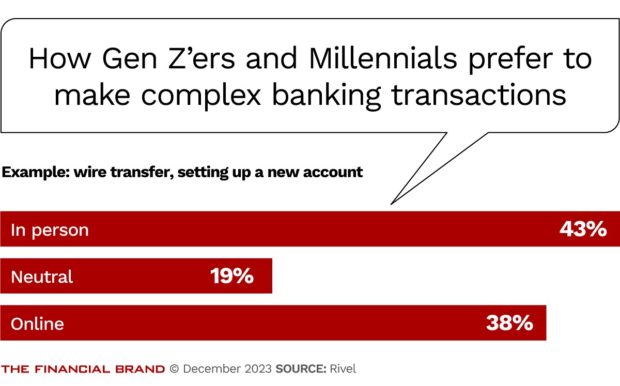

In fact, in Rivel’s most recent research, consumers’ overall positive perception for banks’ “good customer service” has fallen to 56%, even lower (52%) among Gen Z and Millennial customers. Moreover, these younger generations are going to need the most support on adding new services, many for the very first time such as mortgages and retirement accounts. Knowing a bank can help them through that process (if they decide to utilize it!) will leave a lasting positive impression.

Regularly measure and track these customer satisfaction metrics to identify areas for improvement and ensure continuous progress in service delivery. Utilizing primary research associated with your own customers’ experiences helps identify and build the essential word-of-mouth recommendations that bank perceptions are built on.

Customers demand personalized service, seamless interactions and immediate responses to their inquiries. Banks should continue to innovate when providing responsive customer support to help customers resolve any issues they may have quickly and efficiently. This includes offering multiple ways for customers to contact customer support, such as by phone, email, chat and social media.

Read more:

Chatbots, for example, can provide tailored financial advice, provide 24/7 support to customers, responding to inquiries in real-time. According to the CFPB, all 10 of the top commercial banks in the country, use chatbots and AI, of varying complexity, to engage with customers right now.

What To Do Right Now?

In the dynamic banking landscape of 2024, banks must prioritize four key trends to thrive: growing through Gen X consumers, providing sustainable banking options, supporting financial wellness and delivering excellent customer service.

Data is the lifeblood of modern banking; banks can leverage data analytics to gain insights into customer behavior, identify growth opportunities, and make informed decisions about strategies such as product development. Stand out from the crowd by understanding what your future customers think of you today to meet them where they are with the service messaging that they need.

By implementing a well-informed (and locally proven) plan, banks and credit unions can address the trends that are shaping the banking industry in 2024 and position themselves for success in the years to come.

Editor’s note: In 2024, The Financial Brand partner with Rivel Banking Research to deliver data-driven insights into the rapidly changing banking behaviors and preferences of consumers, based on Rivel’s semi-annual and monthly surveys. Watch for this exclusive content beginning in January. For more information on Rivel Banking Research’s benchmarking, market opportunity highlights and on-hand brand perception insights for your institution, contact Corey Wrinn at [email protected]