If it is possible to engage in a bit of irony in the COVID-19 era, there is so much sobering data out there about the present and post coronavirus economy that treating liquor stores as an essential service won’t help soften the facts.

You don’t need a doctorate in economics to look at the costs of the disease itself and of the lockdowns and shutdowns, and attempts to ease the impact. They are enough to bring on a cold sweat that no amount of spirits will quell.

Here’s how the nonpartisan Congressional Budget Office sizes up the situation:

- The unemployment rate will average 14% in the second quarter of 2020, versus 3.8% in the first quarter, and rise to 16% in the third quarter. CBO projects improvement in the fourth quarter after social distancing is over, furloughed employees begin returning to work, and business activity rebounds.

- By the end of 2021, CBO projects the unemployment rate to decline to 9.5%. CBO anticipates that social distancing will remain in place, overall, through the end of June, and potentially in less-stringent form through the middle of 2021.

- Real Gross Domestic Product is projected to fall by about 12% in the second quarter — the equivalent of a 40% annualized drop.

- Assuming that no further federal COVID-19 spending package passes — not a good bet at this writing — CBO projects that the fiscal year 2020 federal deficit will hit $3.7 trillion and $2.1 trillion in fiscal 2021. Before the coronavirus and shutdown hit, CBO projected deficits of only $1 trillion for both years.

The CBO may even be a bit optimistic about unemployment. In several settings in late April White House Economic Advisor Kevin Hassett stated that “this is the biggest negative shock that our country has ever seen.” Hassett predicted that the unemployment rate could approach that of the Great Depression. In 1933 unemployment peaked at almost 25%. During the Great Recession, unemployment peaked in 2009 at 9.9%.

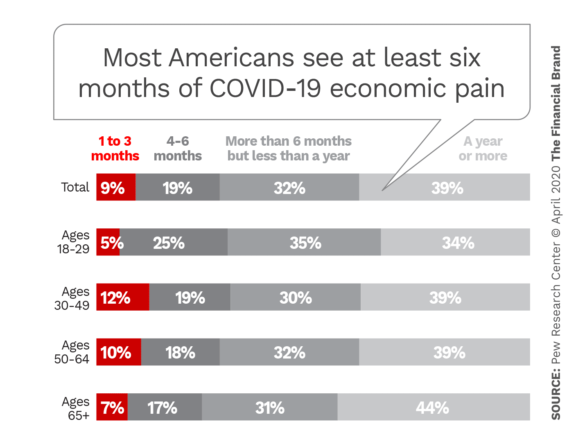

Many Americans foresee a much longer period of pain before recovery begins, compared to the CBO’s view, according to research by the Pew Research Center, as shown in the chart above.

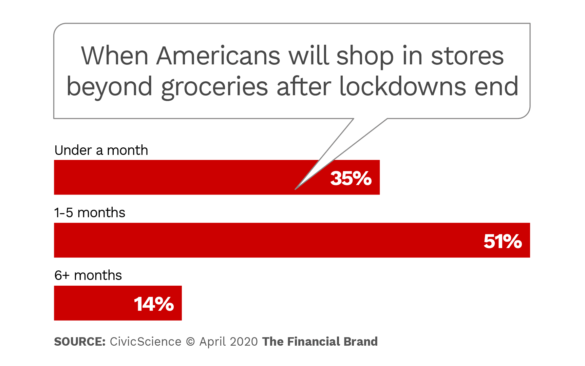

J.D. Power asked consumers in mid-April how soon their state should reopen from the coronavirus shutdown. 36% opted for four weeks or fewer — around mid-May. 31% opted for more time, 5-11 weeks. And 14% felt 12 more weeks of lockdown was warranted. 16% had no idea what would be right.

Yet the movement to reopen America is catching on here and there. In some quarters there is a sense that “if they don’t bring things back soon, there won’t be much to go back to.”

And that sets the stage for a level of stress that many Americans are feeling for the first time in their lives.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Time to Ponder Gives Way to Time of Fears and Worries

Not surprisingly, the combined effects of actual and anticipated unemployment, business ownership angst, worries about loved ones and oneself catching COVID-19, social isolation, and a host of unfamiliar functions and tasks have been taking a toll. So does the constant barrage of news and information of every conceivable kind about the coronavirus pandemic.

We steep ourselves in it constantly, on TV, social media, the internet and when we speak with each other. Reruns of old sitcoms make a wonderful painkiller, but at the end of the episode reality remains.

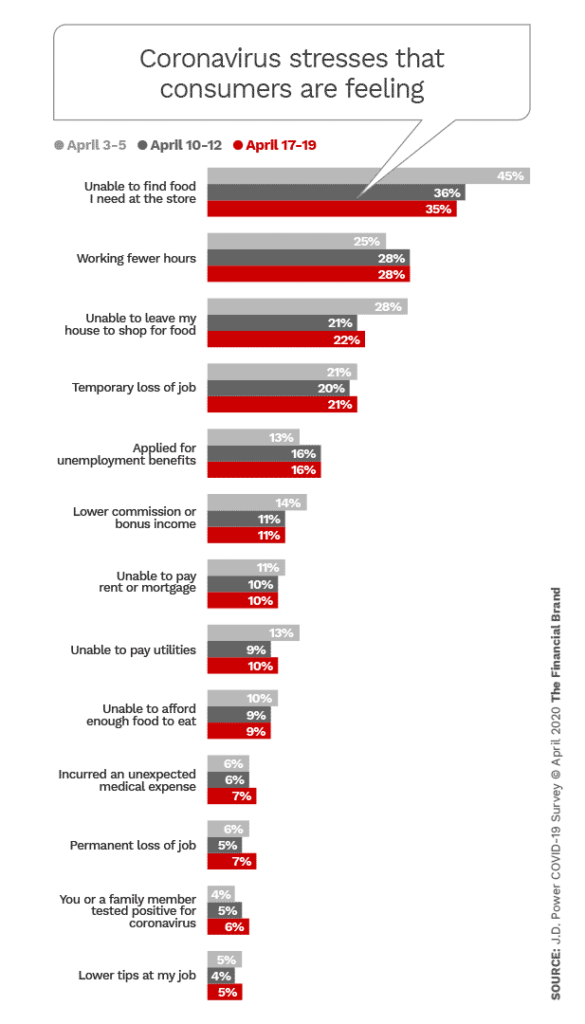

Virtually everyone has been impacted in some significant way, with some suffering deprivation of basics. For example, J.D. Power found that one out of ten Americans are unable to afford enough food to eat directly as a result of the coronavirus pandemic.

What results is a vicious circle that many mental health organizations have tried to address with articles, blogs and videos either for people trying to cope with depression inspired by COVID-19 or for those attempting to help them. A quick Google search turns up dozens of online aids. Reading some of it, unfortunately, can trigger thoughts you hadn’t even realized you might be having.

J.D. Power probed consumer stresses in the wake of the pandemic. Among the trends reported:

- Feeling worried or anxious often 54%

- Sleeping too much or too little 46%

- Feeling angry, frustrated or irritable more than usual 40%

- Feeling down, depressed or hopeless 39%

- Change in appetite or weight loss or gain 33%

Money Worries Eating at Many Americans

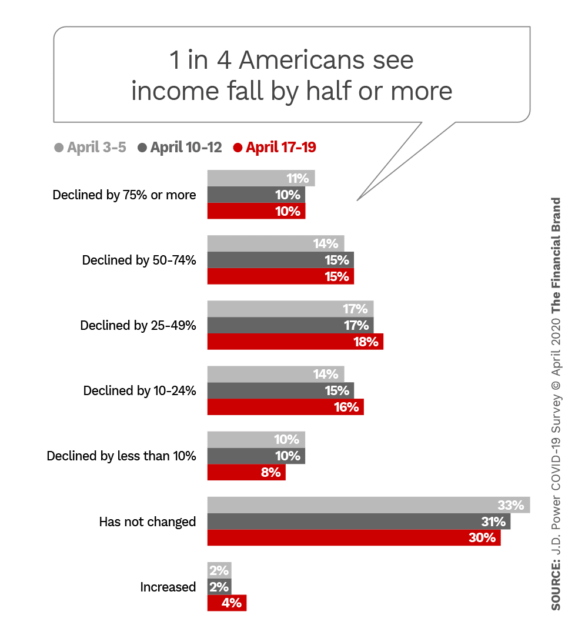

Many consumers have had direct financial setbacks due to the COVID-19 crisis and the concurrent shutdowns. As the chart below shows, one in four have seen their income drop by half or even more. J.D. Power’s research indicates that nearly one in ten people say their finances have been “devastated” by coronavirus at some level and in its mid-April survey, three out of five said the pandemic has hurt their financial situation at least somewhat.

While three out of five polled by J.D. Power in mid-April had not had trouble making monthly credit payments, some categories showed trouble among the rest of the sample group:

- Credit card 22%

- Auto loan 11%

- Mortgage 11%

- Student loan 11%

- Personal loan 9%

- Home equity loan or line 5%

- Business loan 4%

While many lenders have offered a shot at some loan relief, as of mid-April 53% of Americans had not asked for this for any type of loan. 10% thought they might need to do so, though.

In terms of the duration of their personal financial pain, J.D. Power’s respondents gave this estimation in mid-April.

- Less than 1 month 3%

- 1 to 2 months 16%

- 3 to 5 months 33%

- 6 to 12 months 25%

- 1 to 2 years 10%

- 3 to 5 years 3%

- 6 or more years 1%

- Don’t know 9%

Seeking ‘Retail Therapy’ from Near Solitary Confinement

Financial stress vies with physical stress as people brave the email or envelope containing the latest report on their retirement plan or confront a stack of bills for spending that happened before things were shut down. Numerous personal financial sites, and even some psychological sites, have been publishing articles about how to reframe thinking about spending, how to revamp a budget, and where to cut.

“35% of Americans admit they have made impulse buys to deal with stress from the pandemic. Nearly half — 45% — are doing this weekly, and 17% admit to doing it daily.”

Depression can trigger the need for “retail therapy,” which helps many people cope in the short run, though inevitably every binge must be paid for. But what sets this time apart is that many of those falling into this habit haven’t had to worry about where their next buck was coming from … until mid-March 2020.

A survey by Credit Karma found that 35% of Americans admit they have made impulse buys to deal with stress from the pandemic. Nearly half — 45% — are doing this weekly, and 17% admit to doing it daily.

Of those spending more than before the pandemic, one in ten have broken their budget by over $1,000.

There is nothing like an Amazon Prime account for what ails you, it seems.

It’s not that they are overspending, necessarily. Credit Karma reports that just one in five say they are spending more or a lot more. Remember, many monthly expenses, like commuting, dry cleaning, lunches out have disappeared, freeing up cash as many work from home. Three out of five say they are spending less, or much less, even if they have done some impulse buying. Gasoline is cheap, though most people aren’t going much of anywhere except grocery shopping.

Still, beyond a certain point stress spending is unhealthy.

“These kinds of coping purchases can often lead to more stress, which in turn can lead to more spending,” Credit Karma reports. The study notes that both those spending more and those spending less cite the same reason — being home under lockdown. Perhaps while some binge to feel better, others have time to reflect on the strength of their savings and are trying a bit of austerity.

Impulse buying begins to look less fiscally forgivable when seen in the light of these debt trends found by J.D. Power in mid-April:

- “I have a manageable amount of debt, or no debt” 47%

- “I can pay my full credit card balance most of the time or do not have a balance” 33%

- “I have a good credit score” 45%

- “I can pay all my bills on time” 55%

In addition, the same survey found that just under half — 48% — of consumers polled have $500 in cash or savings for emergencies and only 32% say their monthly income is greater than their expenses.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Where America is Buying, and Where Stimulus May Go

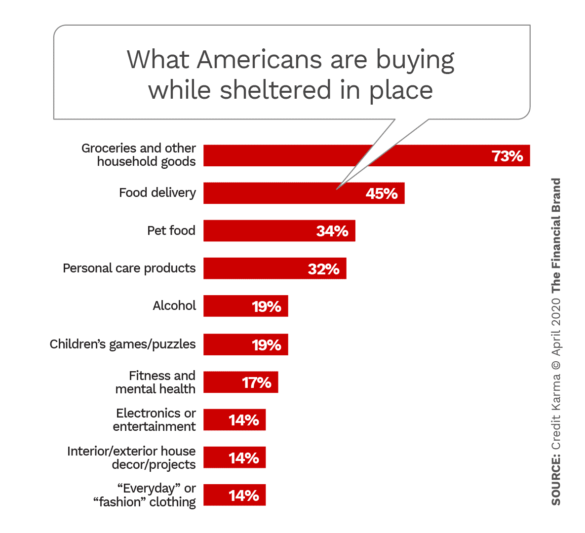

Not every purchase made has been an impulse buy. The chart below traces what Credit Karma learned about consumers’ current at-home spending habits.

The research found a difference in spending by gender. Men are spending more on food delivery — 51% versus 37%. Men are buying alcohol much more — 28%, nearly triple the 9% among women. On the other hand, Credit Karma says women say they are spending more on personal care products, 38% for women versus 28% for men.

It’s a bit early to say where federal consumer stimulus payments are going, with many still lined up for mailing, though millions of checks are being sent weekly. However, indications are being seen in weekly spending data being compiled by Facteus.

One place stimulus money seems to be pouring is the categories of wholesale clubs, discount and dollar stores, which jumped in mid-April.

It’s quite possible that for people still receiving income that the arrival of stimulus checks will furnish an excuse for an outing. Gloved and masked, no doubt, but a change from the same four walls!

However, even with takeout and delivery available, the Facteus data indicated no extraordinary impact on spending on restaurants.

Cigarettes and Whiskey Finding New Homes

Another category that has generally done well through the coronavirus period, with one falloff, has been beer, wine and liquor stores, according to Facteus. In the week of April 26, they saw a 40% rise in volume.

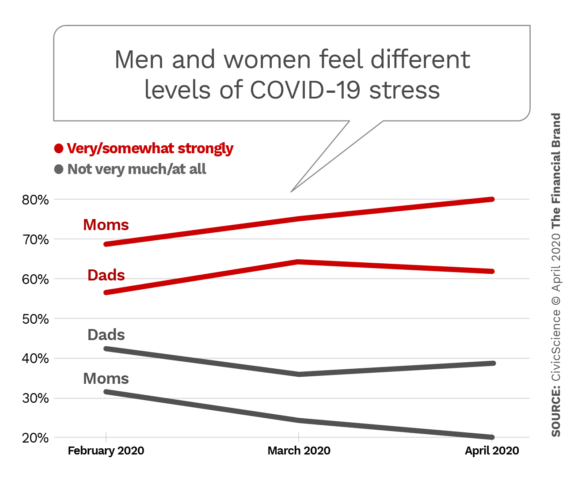

Stress in the home, as people shelter in place, has had other impacts. Research by CivicScience indicates that among families, smoking has increased slightly. But where it has increased more often is mothers lighting up more than fathers. Mothers who smoke rose from 17% in February to 24% in April. 15% of fathers smoked in February, versus 18% in April. On the other hand, mothers are drinking wine much less: in February 59% imbibed, while 50% did in April. Fathers’ consumption hit 58% in February, dipped to 44% in March, and rose back to 54% in April.

CivicScience also reports a higher degree of stress among mothers than among fathers. “Heightened stress among moms could be due to an imbalance of at-home education responsibilities between spouses,” CivicScience states. “The data show that U.S. moms of school-age children are bearing the brunt of this homeschooling labor, which is likely a source of the increased stress levels indicated.” Where one spouse or partner handled this task completely, 76% of fathers surveyed said they didn’t handle any of it.