I’ve come to the conclusion that there are five types of people who attend my conference presentations:

- Those who expect to get tips and advice on what they can do to solve all their problems and challenges when they get back to the office on Monday;

- Those who are thought-provoked by the ideas I present, but genuinely wonder how they’ll “get there from here”‘;

- Those who are intrigued by the ideas and immediately start to think about what their organization has to do to make it happen;

- Those who violently and vehemently disagree with every idea I put forth in my presentation; and

- Those who sleep through the presentation.

My evaluation scores are totally dependent upon the distribution of attendees across these segments. I mean, I know I give a great presentation, so a low score can’t be my fault, right? You might think I wouldn’t want Group 5 people at my sessions, but I’m OK with them (as long as they give me a good rating). It’s the Group 1 people that I wish wouldn’t show up. They’re always disappointed.

At a recent conference of credit union CEOs, I presented a session on The Future of Credit Unions and was fortunate to have a predominant mix of Groups 2, 3, and 4. I didn’t see anybody sleeping (it was a three-hour session, so I wouldn’t have blamed anybody if they had fallen asleep). And I’m pretty sure none of the CEOs were looking for quick fixes to implement come Monday morning.

After discussing at some length some ideas about what credit unions need to do to succeed in the retail banking industry of the future and change the basis of competition to better compete with megabanks, one of the CEOs asked:

“I don’t see how we get there from where we are now. How do you see this happening?”

My answer: You (and other credit unions) will develop new products and services to do what I’m saying you’ll have to do.

He could have — but didn’t — ask “OK, but how are we going to do that?”

And therein lies what I believe is a huge challenge for credit unions (and banks, for that matter): The lack of new product development capabilities.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

A Google search on “percentage of revenue from new products” turns up about 230 million results (at least it does when I do the search). One of the links points to a report published by Accenture which cites an AMR Research study that showed (well, it asserted) that “top quartile performers” in the consumer products goods industry generated 23% of their revenue from new products (defined as launched in the past three years) in contrast to the bottom quartile performers who generated just 3% of their revenue from new products.

An older study conducted by APQC found (oops, I mean claimed) that the “top 20% of businesses” got 38% of their revenue from new products, versus the 28% generated by the “average business.” The study involved companies from multiple industries, but I can’t determine if financial services firms were included (I bet they weren’t).

A Google search on “percentage of revenue from new products in banking” produces 186 million results. But I’ll be damned if I could find any links to what percentage of revenue banks were generating from new products. I can’t imagine, however, that it’s anywhere close to 23% or 28%, let alone 38%.

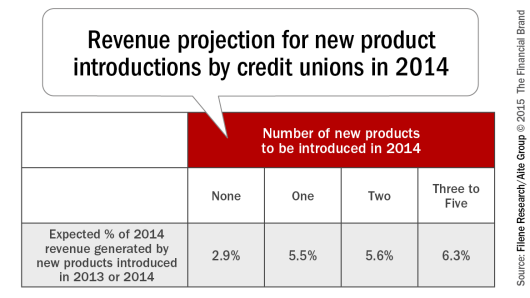

I do, however, have an estimate of what percentage of revenue comes from new products among credit unions. In a 2014 survey I collaborated with Filene Research on, credit union execs estimated that 4.3% of their 2013 revenue came from new products or services, and anticipated that percentage to increase to 5% in 2014.

One in four credit unions didn’t expect to launch any new products or services in 2014, another one in four expected to launch just one, and yet another one in four said they would introduce two new products and services. I’m not saying that banks and credit unions should be launching five or 10 new products/services a year–I don’t think there’s a “right” number.

But in looking at the list of the actual products/services that the survey respondents planned to introduce, I was struck by an unavoidable fact: The overwhelming majority — I would put the percentage between 99% and 100%–of the planned products and services were new to the credit union, but not new to the industry.

As you might expect, credit unions who planned on introducing the most new products in 2014 expected to generate a higher percentage of revenue from new products.

I didn’t survey community banks, regional banks, or megabanks to get their plans, but I’d be very surprised if the numbers were significantly different. In fact — at the risk of being seen as picking on community banks — I’d guess that even fewer community banks were planning to launch new-to-the-bank products or services, let alone new-to-the-industry.

There’s a disconnect here.

There is no shortage of articles and blog posts heralding every new development from every piddly little start up as being the new source of disruption in the industry. Coin is disrupting the industry! Loop is disrupting payments! Smartwatch apps are disruptive!

How are credit unions (and I would assert, banks) responding? “We have a new credit card!”

Granted, disruption won’t happen overnight, but if the threat is real, wouldn’t you expect incumbents to be launching something new or different to counter the insurgency?

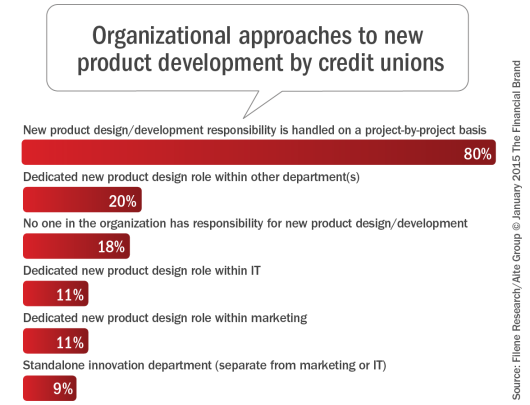

Not that I should really be expecting anything different. In the survey, we asked respondents how their organization approached new product development. Eight in 10 said they did it on a project-by-project basis. In other words, Janie and Johnny, who were responsible for who-knows-what on the last project, are now in charge of new product development for the new product project. And, of course, they’ll have completely different responsibilities on the next project.

Nearly one in five credit unions said no one in the organization had responsibility for new product design and development. That’s really not surprising, nor necessarily wrong. Many small institutions simply can’t afford to have that function in-house. And they’re not oblivious to the problem: A quarter of the smaller institutions said lack of new product development capabilities is a major problem for their organization, in contrast to just one in 10 credit unions with at least $500m in assets.

But it still begs the question: How is new product development going to get done?

I didn’t ask about new product strategy in the survey, but over the years I can’t tell you how many execs I’ve talked to who say that their organization is a “fast-follower.”

What a joke.

Being a fast-follower requires a competency as well-defined and honed as new product development. Someone has to address the questions: Which new developments should we copy? When should we copy them?

Being a fast-follower does not excuse you from new product development.

As I mentioned, I didn’t survey banks about their new product development capabilities and approaches. I would not be surprised to find that the larger banks ($10b in assets and above) have dedicated resources to new product development.

But this still leaves the banking industry with a dilemma:

The larger banks (who may have new product development resources) are too big to turn the ship in a timely fashion, and the smaller institutions (who are probably more nimble) have no one who knows how to turn the wheel.

I’m not a big fan of the term “disruptive.” I think it’s overused and — worse — misused. But the demographic shift in the US, the new technologies being developed and released, and the challenging economic situation and outlook are causing changes in the financial services industry.

Consultants will argue that there’s never a bad time to launch (truly) new products and services–just that some times are better than others. It would be hard to argue that now isn’t a good time to introduce new products and services in retail banking.

Only problem is, very few banks and credit unions appear to be well equipped to do so. Hence, the new product development dilemma in banking.