While the big, crisis-driven mergers of recent years are done, M&A activity is far from over — especially for smaller banks as they continue to deal with a slow economic recovery and the high costs of complying with increased regulations. What is the impact on customers, and how can banks minimize the negative impacts on service during a merger?

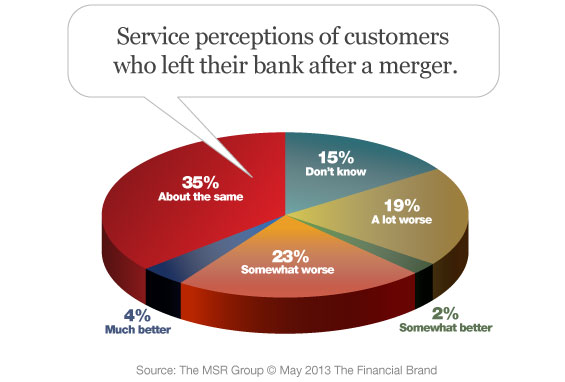

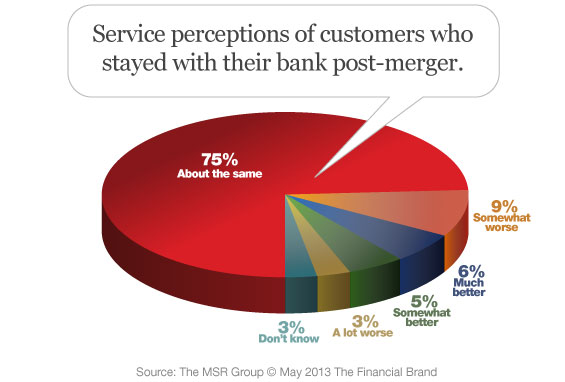

In a national study conducted by The MSR Group, one quarter of all retail banking consumers report they have experienced a bank merger or acquisition within the past three years. 15% of these customers chose to leave their bank after the merger. Among customers who left, 42% perceived the customer experience after the merger to be worse. Even among customers who stayed with their bank after the merger or acquisition, 12% say the service is worse. This group continues to be at risk of leaving.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Read More: How To Keep Customers From Jumping Ship After A Merger

While some attrition is inevitable, continuing to focus on service quality throughout the transition can help minimize this fallout.

One of the key metrics The MSR Group tracks is “Net Advocacy Rating,” a score based on customers’ likelihood to both recommend and repurchase from a company. Research has established a strong correlation between advocacy, customer retention and increased revenue for financial institutions.

Customers who experience a merger or acquisition have an Net Advocacy Rating of 40.7 compared to a 61.3 for customers who have not. That’s a huge gap. While it’s impossible to prevent all negative feelings among customers, recognizing these feelings exist and having an action plan to address them should be a part of every financial institution’s M&A process.

Read More: Lessons from the Chase/WaMu Merger on Twitter

Mergers often involve changes to product structure, fees, personnel and branch locations. But the way these changes are communicated can make a big difference in how customers perceive and accept them. This means doing more than sending out standard, dry, legalistic account notifications. Communication that is easy to understand, respectfully and thoroughly addresses concerns, and clearly explains what customers are supposed to do — combined with processes and procedures that make it as easy as possible — demonstrate your commitment to a service-oriented philosophy.

However, before you can create an effective customer communication plan, you need a well-developed employee communication plan. To ensure interactions with customers are positive and consistent with outgoing organizational messages, employees must understand how the transition will occur and feel as confident about their role in it.

Read More: Capitalize on Banking Mergers and Steal More Relationships