Remember the K-shaped economy? That was a term used to describe the immediate financial impact of the pandemic, when businesses like restaurants and movie theaters suffered and others soared, such as manufacturers that could feed the frenzied demand for face masks.

An echo of that divide is showing up in an annual survey on Americans’ personal debt sponsored by Northwestern Mutual, the insurance and financial planning company.

More than a third of Americans — 35% — have as much or more debt than they’ve ever had before, according to the 2023 edition of the research series called the “Planning & Progress Study.” But an even larger share — 43% — said their debt is at or near the lowest it has ever been. (The survey excluded mortgages in its assessment of debt levels.)

Financial advisers trace the roots of the divide to the pandemic-era economy, but also to differences in how Americans are responding to this period of high inflation and rising interest rates. Some are concentrating on paying off debt such as home equity lines of credit to avoid the impact of higher interest rates.

Financial advisers trace the roots of the divide to the pandemic-era economy, but also to differences in how Americans are responding to this period of high inflation and rising interest rates. Some are concentrating on paying off debt such as home equity lines of credit to avoid the impact of higher interest rates.

Demographic factors also may play a role, some observers in financial services say, noting that younger generations in particular are more likely to be carrying student debt.

“When you’re older, you tend to want to have as little debt as possible,” says Jeff Marsico, president of The Kafafian Group, a bank consulting firm based in Bethlehem, Pa.

Read more:

- 1 in 3 People Plan to Borrow as Inflation and Recession Fears Take Toll

- What to Know About Higher Credit Card Spending & Consumer Debt

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Most Americans Putting a Dent in Their Debt

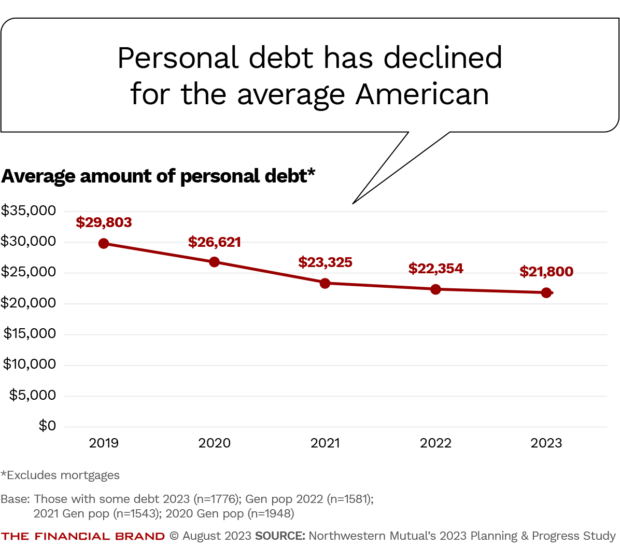

The good news is that Americans owe less, on average, than they did a year earlier, according to the Northwestern Mutual survey, which is based on 2,740 online interviews with U.S. adults conducted by The Harris Poll between Feb. 17 and March 2.

The average debt, excluding mortgages, is $21,800 this year, down from $22,354 in 2022 and $29,803 in 2019.

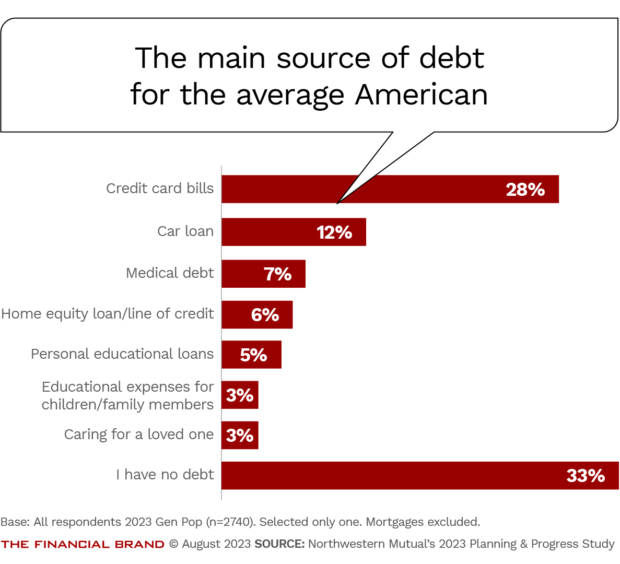

Credit cards represent the biggest share of debt for 28% of the survey respondents. The finding comes as Americans’ credit card debt surpassed $1 trillion for the first time in history, according to data from the Federal Reserve Bank of New York.

Car loans come in at a distant second, with 12% citing it as their biggest source of debt. This was followed by medical debt at 7%, home equity loans and lines of credit at 6%, and student loans at 5%. This year is the first that Northwestern Mutual asked about medical debt. Mortgage debt was an option for respondents in the past but not this year.

As might be expected, student loans weighed more heavily on younger generations. Nearly one in five members of Generation Z, or 17%, cited student loans as their main source of personal debt, compared with 10% of Millennials, 3% of Gen X and 1% of Baby Boomers.

Student loans as the top source of personal debt

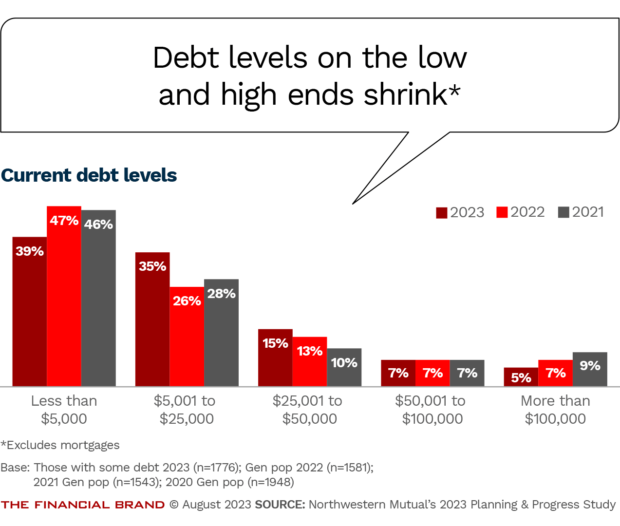

In addition to the decline in the average debt load, Northwestern Mutual has tracked changes in the distribution around that average. In short, fewer people have debt levels at the low and high ends of the scale.

The share of people with non-mortgage debt up to $5,000 shrunk to 39% in 2023, down from 46% in 2021. The share of those with debt over $100,000 also fell over the same period, from 9% to 5%.

As a result, the percentage of people in the middle of the debt scale surged. Half the survey respondents have debt between $5,001 and $50,000, up from 38% in 2021. (Those with $50,001 to $100,000 of debt held steady at 7%.)

A third of the survey respondents said they have no debt.

Read more: How to Define the Generations: The Ultimate Guide for Marketers

Age, Income, Pandemic Experience Could Factor into the Debt Divide

The questions that led Northwestern Mutual to identify the debt divide were not asked in previous versions of the annual survey so there is no comparison data. But the firm broke out numbers that indicate age plays a role.

People carrying at or near their highest-ever levels of debt are most likely to belong to Gen Z, with 38% of this cohort indicating they were at an apex. For both Millennials and Generation X, the figure was 37%, which is not significantly lower. For Baby Boomers, it was 29%, according to Alap Patel, a wealth management adviser at Northwestern Mutual.

Income is another factor in the divide.

People with household income of less than $75,000 a year are more likely to be at or near peak debt levels. Of survey respondents in that income range, 38% say they have the most debt they’ve ever had, versus 32% of those with annual incomes above $75,000, Patel says.

The difference is starker for those at their lowest levels of debt. Among those with household incomes higher than $75,000, nearly half, or 47%, have pared down their debt to its lowest or near-lowest levels. The figure is 37% for households with income below $75,000.

The divide also may reflect the lingering impact of the pandemic, says Bryson Roof, a financial adviser and certified financial planner at Fort Pitt Capital Group in Harrisburg, Pa.

In many states, people working or owning businesses in food service, hospitality, leisure and entertainment struggled when government orders forced their operations to close, Roof says. Record levels of inflation have only compounded problems, he adds, noting that federal stimulus checks may not have been much help.

“During Covid, there were clear winners and clear losers from an economic standpoint.”

— Bryson Roof

Other sectors, such as the technology companies that helped people connect virtually or manufacturers that could pivot to new products, thrived. With little else to spend money on during the pandemic, people in those sectors tended to pay down debt and bolster retirement savings, Roof says.

“During Covid, there were clear winners and clear losers from an economic standpoint,” he says.

Read more:

- Student Loan Repayments Return Amid a Shifting Credit Landscape

- Consumers Feel Less Secure & Crave Financial Wellness Help

One Reason for Lower Debt? People Are Purposely Steering Clear of It

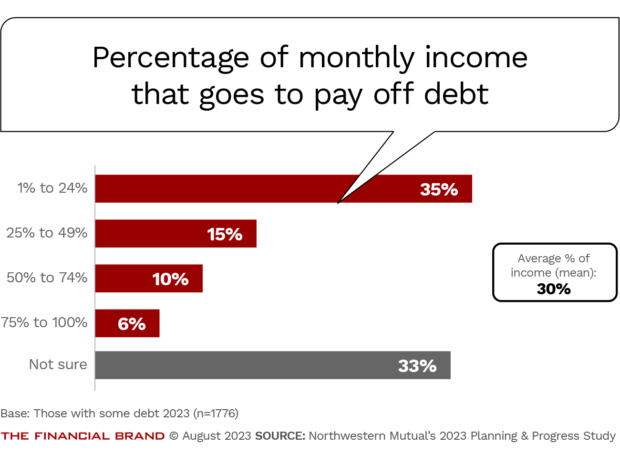

Rising interest rates would suggest that people would have to spend more to service their debt. However, the Northwestern Mutual survey found that people are actually spending less on debt service this year — in part because many are carrying less debt.

For the average American, the share of income going toward debt is 30% in 2023, down from 32% in 2022 and 34% in 2019. And people are more optimistic they can pay their debt off within five years.

Nearly half of Americans — 49% — expect to pay off their debt within five years, up from 43% last year. “This indicates that people are being smarter about their debt by not taking on more than they can handle and having a plan to pay it off,” Patel says.

Some borrowers just needed to see steadily rising interest rates as a sign they should start paying down rate-sensitive loans, such as home equity lines of credit. That has been the experience for Derek Amey, managing partner and co-chief investment officer at StrategicPoint Investment Advisors in Providence, R.I.

Amey, whose clients are generally over 55, says he has had several recently decide to close out home equity lines.

In other cases, clients are looking for alternatives. One client is planning a $100,000 addition to their home, he says. A few years ago, a home equity line would have been a “slam dunk,” he says. But now, “people are avoiding debt.”