Every year, the team here at The Financial Brand sits down and plays with Google Trends, an incredibly simple but fun tool that helps you tease out the major memes that are on consumers’ minds, and giving you a glimpse into the themes that are dominating discussions in boardrooms and C-suites around the banking world.

Using Google Trends, you can gauge the level of interest in virtually any given topic. The data can be reported globally as far back as 2004, or broken down for a specific country and/or time period.

The horizontal axis for each Google Trend graph represents time. The vertical axis represents the relative increase (or decrease) in the number of searches Google’s users performed for each term over time, with the top level in each chart signifying peak activity/interest (the “high water” mark).

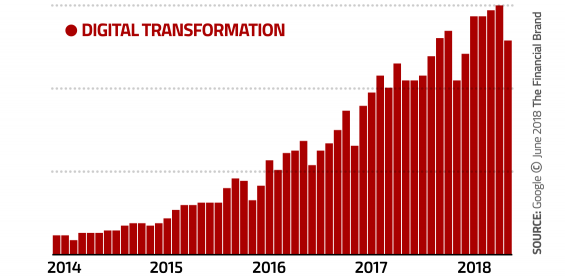

Digital Transformation Roadmaps

Just as recently as 2014, the concept of “digital transformation” wasn’t even a thing. Now it’s the number one subject driving strategic plans for banks and credit unions everywhere. More and more executives are worrying whether their organization has the tools and talent it needs to remain competitive in a digital-first world. It’s a race for relevancy… maybe survival.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

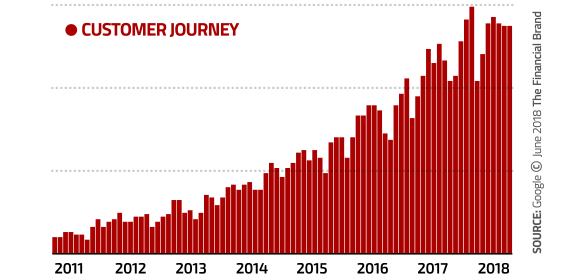

Mapping the Customer Journey

It’s nearly impossible to plan your “digital transformation” roadmap if you don’t have a complete understanding of the customer journey. Leadership teams are increasingly mapping customer journeys — all the starting points, all the ending points, and the myriad of touchpoints and decisions in between — to identify any weaknesses that need to be addressed.

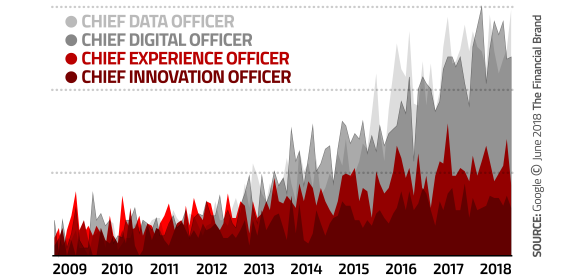

The Expanding C-Suite

Titles in the C-suite are reflecting the shifts towards digital channels, data and CX. The most trendy — and arguably necessary — emerging role is that of Chief Data Officer, followed closely by Chief Digital Officer. But more organizations are also creating roles like Chief Experience Officer and Chief Innovation Officer to place a greater emphasis on those aspects they feel will give them the greatest competitive edge.

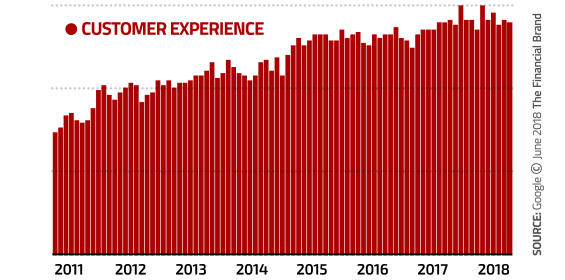

The Customer Experience Economy

The titans of Silicon Valley — companies like Google, Apple, Netflix and Amazon — have raised consumer expectations to the point that CX has become the main point of competitive differentiation in nearly every sector. CX is particularly critical in a service industry like banking, where there isn’t any tactile product; it’s all about the experience you deliver. We’ve evolved from an agrarian economy, to an industrial economy, to a service economy, and now ultimately the experience economy. As you can see in the chart below, interest in CX has nearly doubled in a seven-year period.

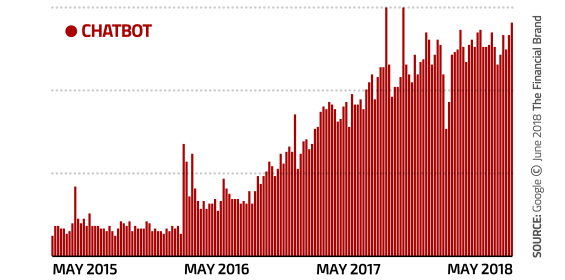

Rise of the Chatbots

This Google Trend for the search term “chatbot” should give you an idea for how quickly things can change. In less than three years, chatbots went from relative obscurity to becoming a major trend.

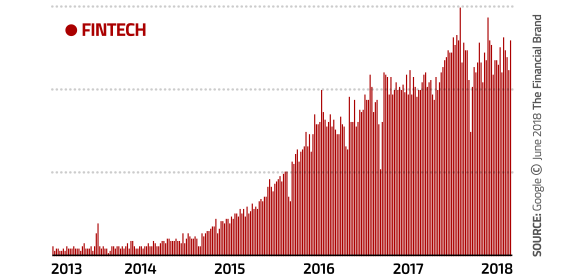

The Fintech Fever Breaks

It looks like the fintech fever that had swept across the banking industry in recent years is starting to break. There’s certainly intense interest in all things fintech, but it appears that the frenzy of “blind panic” has reached its crescendo, and now the subject is normalizing at a more even, constant, steady level.

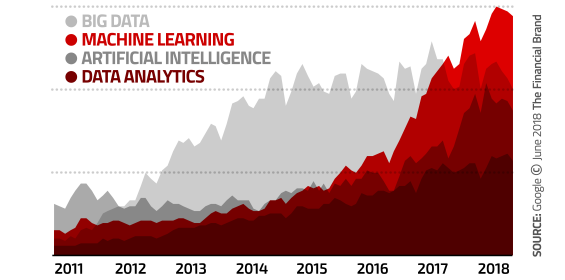

Data Is the New Oil

Most people struggle to differentiate between the various disciplines of data analytics — machine learning, predictive analytics, artificial intelligence, etc. Whatever term(s) you want to use, one thing is clear: data is now the lifeblood driving decisions in the digital age.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

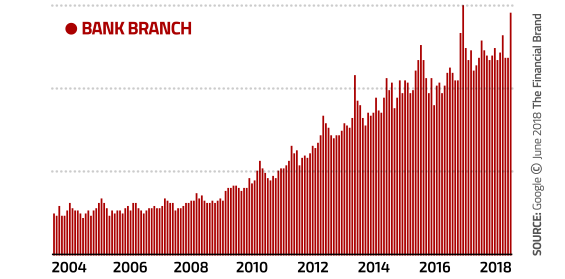

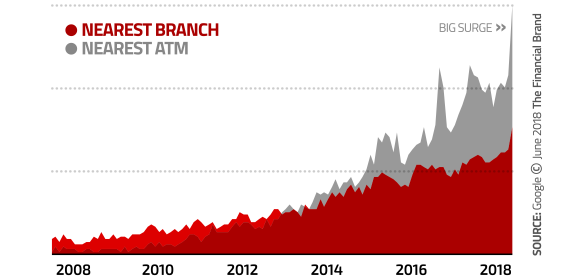

Branches & ATMs

If digital channels are killing branches and ATMs (as many in the banking industry have argued), then why are searches for physical locations continually on the rise? Sure, there are a lot fewer branches today than there were a few years ago — the result of closures and consolidation — and maybe people are struggling to find the branch or ATM nearest them. But that alone doesn’t seem like a sufficient explanation.

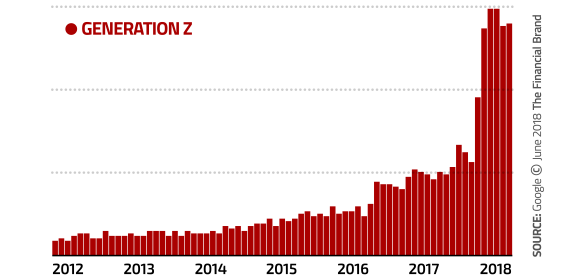

The Next Generation

Generation Z, which is loosely defined as those born from the mid-1990s to the early 2000s, make up one quarter of the U.S. population, making them a larger cohort than Baby Boomers or Millennials. The oldest members of Gen Z are just now graduating college and entering the workforce, explaining why most marketers have only recently begun to take an interest in this generation. But financial institutions need to wake up and start connecting with Gen Z now, lest they make the same mistakes they did with Millennials.

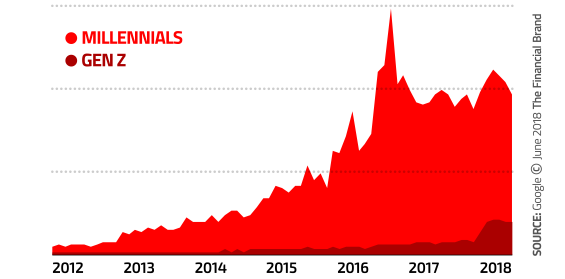

Millennials Matter Even More

Gen Z may be rising in importance, but relative interest in Millennials dwarfs the younger cohort. Even though Google searches for Millennials have ebbed down 25% from their high point in mid-2016, interest in Millenials is still five time greater than Millennials. The same chart for Gen Z is superimposed on top of the chart showing search activity for Millennials in the chart below.

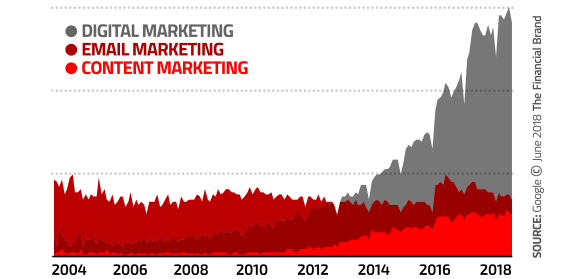

Marketing Strategy

Nearly the entire marketing ballgame is played in digital channels these days. Content marketing is rising in popularity, and email marketing holds steady — the perennial workhorse of marketing worldwide.

Digital Marketing Trends

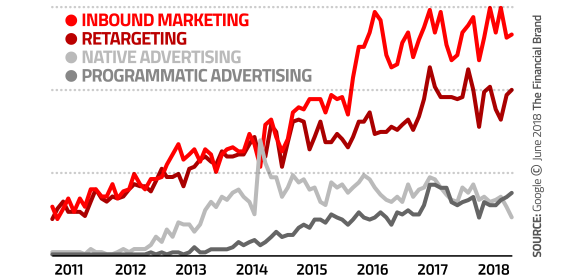

Marketing strategies are increasingly incorporating new concepts like “inbound marketing”, where you use a combination of relevant and helpful content, social media and SEO to attract consumers. Other trends include “retargeting” (showing marketing messages specifically to those who have interacted with your organization), “native advertising” (a new term to describe online advertorials), and “programmatic advertising” (buying online media space with a bidding system based on clicks and/or impressions).

Online Advertising

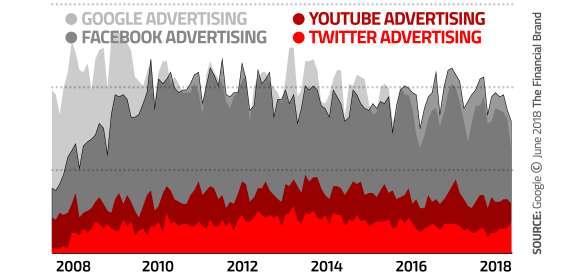

The online advertising space is dominated by two major players: Google and Facebook. These days, it really doesn’t matter what size institution you’re talking about, every bank and credit union in the world should be designating some of their advertising media budget to these two channels. YouTube is also a viable option. Advertising on Twitter just doesn’t make sense for most financial institutions, particularly those with limited resources.