The 2024 Retail Banking Crystal Ball research project gathered input from large global and national banks as well as regional banks, community institutions, credit unions, fintech firms, vendors and advisors spread across North America, Europe, Asia and other regions. To answer questions facing financial institutions as we enter the new year, the Digital Banking Report asked people in the industry to provide their projections regarding what will happen in the future … and when?

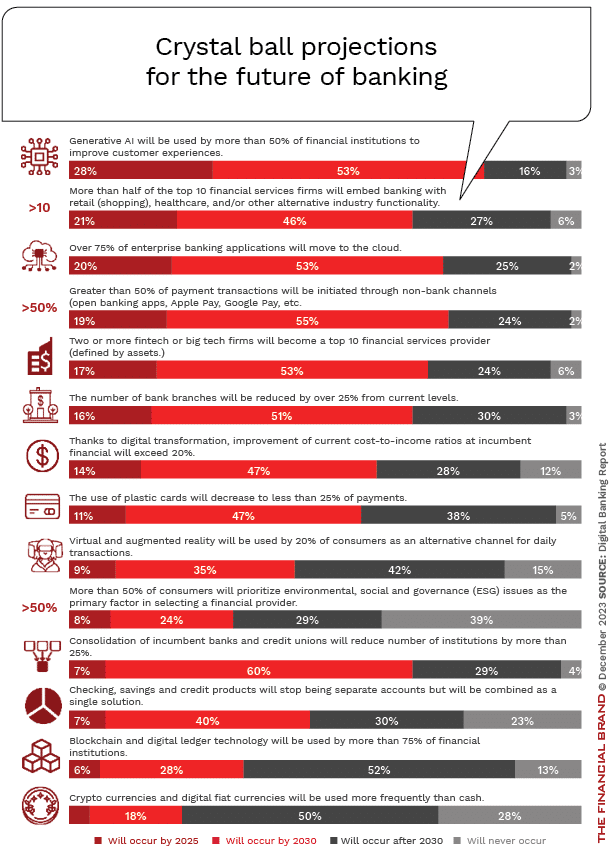

The research focused on 14 perspectives — shown in the first chart, below — within four key areas of banking:

- Competition and Consolidation

- Modern Technologies

- Payments

- Digital Transformation

The insights collected are very enlightening but they obviously need to be taken within the context that no specific component of financial services can be forecast with certainty. That said, the projected speed of adoption of some tools and techniques —e.g., use of generative AI and movement to the cloud — can’t be ignored. Likewise, the slow adoption of other projections (e.g. impact of social responsibility and use of blockchain technologies) should not be assumed.

There was significant diversity in the anticipated speed and extent of change in some areas, but a few powerful themes emerged consistently:

- Digital disruption will dramatically alter retail banking. New competitors, technologies and customer behaviors are colliding to force the pace of change faster than many expect. Leaders see a vastly different competitive landscape emerging by 2025.

- Change will be uneven. Innovations in areas like modern technologies and payments will likely outpace the ability of banks to transform legacy systems, processes and culture. This mismatch creates risk.

- Being digital is no longer enough. Delivering excellent digital experiences is merely the price of admission today. The winners will combine digital maturity with customer-centricity, agility and efficiency.

Read more: 14 Surprising Predictions on the Future of Banking

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The Only Consistent Theme: ‘Change is Everywhere’

As can be seen in the chart below, the greatest consensus among retail bankers was around the likelihood of generative AI being used by 50% of financial institutions. Close to 30% of financial institutions expected this to occur by 2025, with another 50% expecting this level of acceptance by 2030. In 2021, our research showed that almost four in ten executives who responded to the survey thought there would be a 25% consolidation by 2025. (Upon reflection, this mid-Covid-era estimate was too aggressive).

Compared to all of the other findings, the projection around deployment of generative AI solutions had the lowest number of respondents thinking it would happen after 2030 or not at all. Interesting, given that the technology was introduced to the world barely one year ago.

As was the case in 2021, on the other end of the spectrum, the least number of respondents saw cryptocurrencies being used more than cash in the near or mid-term, with the highest number of respondents seeing cryptocurrencies surpassing cash use only after 2030 — if ever.

The greatest diversity in response range was seen when we asked financial industry executives whether consumers would use plastic cards for less that 25% of payments. While 58% saw this happening before 2030, a modestly smaller percentage (42%) saw this consumer trend happening beyond 2030 or not at all. Interestingly, while 32% of banking executives saw ESG (environmental, social and governance) issues as being important to consumers by 2030, the “not at all” perspective for this projection was the highest of all projections (39%).

Read more: Five Megatrends Impacting Banking Forever

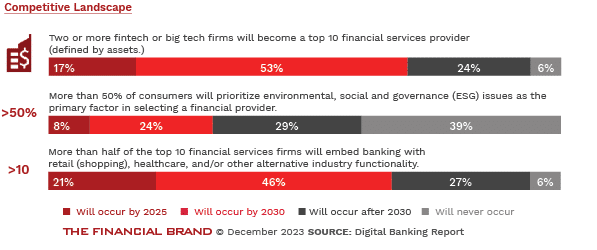

Bracing for Competitive Disruption

The opening salvos have already been fired heralding imminent collisions that will dramatically reshape the banking battlefield.

Big tech and fintech encroachment continues to accelerate, with 70% of respondents believing two or more fintech or big tech firms will crack the top 10 of financial services providers by 2030, increasing from 63% in 2021. Given that the previous research was conducted three years ago, an increase in near-term likelihood of this scale is unusual.

While not believed to be the most imminent scenario by 2025, two-thirds of executives surveyed thought that more than half of the top 10 financial services firms will embed banking inside non-financial services by 2030. Only 55% of respondents felt this way in 2021.

As mentioned above, the belief that ESG will drive consumer selection of financial services organizations remains tepid at best.

These perspectives indicate retail banking may look completely different in just a few years. Pressure from digitally savvy competitors will likely force difficult consolidation decisions for weaker players. Even industry leaders cannot afford complacency, especially when we look at the area of embedded banking.

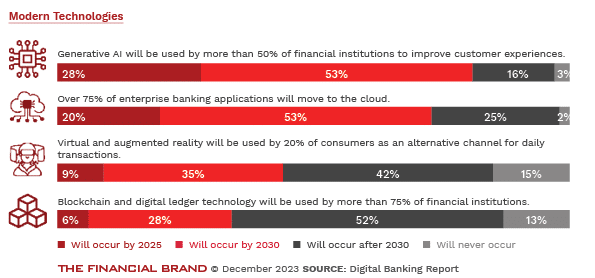

Modern Technologies Redefine Banking

Emerging innovations will profoundly reshape banking in coming years. Over 80% of financial services executives believe that generative AI will be used to improve customer experiences by 2030, with 83% of institutions seeing the vast majority (75%) of enterprise bank applications shifted to the cloud by 2030.

Surprisingly, views diverge much more on legacy modernization. Less than 50% think digital improvements like augmented reality and blockchain technology will be mainstream by 2030, with both of these projections being less aggressive than in 2021. This reveals lingering doubts on banks’ willingness and ability to transform aging infrastructure, especially during times of economic uncertainty.

The crystal ball views of modern technology deployment illustrate that while promising technologies are emerging, realizing their full potential depends heavily on financial institutions overhauling obsolete systems and processes. Banks that drag their feet on modernization may find the innovations only make competitors stronger rather than benefiting their own institutions.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

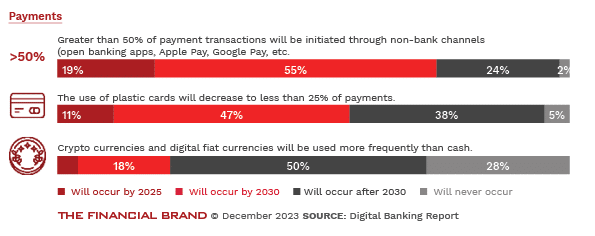

Speed of Payments Changing Expectations

The digitization of retail payments will advance markedly by 2030 according to financial services industry oracles. More than two-thirds say that greater than 50% of purchase transactions will be initiated through non-banking channels by that date. This highlights the crucial role mobile technology and digital wallets will play in payments connectivity and the speed of money transfer. These projections are similar to what we found in 2021.

Plastic card usage will eventually plunge as mobile wallets and payment apps gain favor, but a majority still expect plastic cards to retain dominance through 2030, indicating the resilience of older payment types. This stubbornness of payments transformation is reinforced by the fact that the projected movement away from cards is actually lower than what was projected in our 2021 research.

As for newer payment rails, adoption timeframes remain hazy. Only 22% expect blockchain transaction volume to hit mainstream scale by 2030. The doubt around cryptocurrencies is reinforced by the belief that 28% don’t ever expect crypro to overtake cash.

These outlooks signal that while mobile wallets clearly represent the next era of retail payments, yesterday’s payment formats will continue to play a role for some time. As a result, banks should prepare for a hybrid payments environment where digital and analog formats coexist for many years to come.

Read more: Payments Trends 2024: As Shopping, Buying and Paying Blur Together, Banks May Lose Ground

Digital Maturity: An Imperative for Growth

Consumer expectation studies and ongoing research by the Digital Banking Report resoundingly show that digital maturity has graduated from nice-to-have to an indispensable capability for retail banks.

At the same time, we have found digital banking maturity to be lacking at the majority of banks and credit unions.

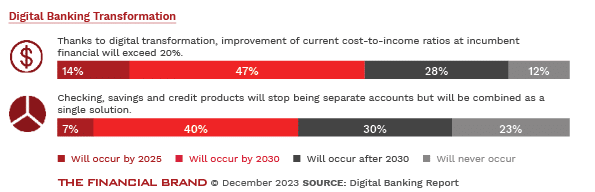

Digital Banking Report asked financial executives about the possibility of a move from a product-centric business model to a customer-centric model, in which checking, savings and lending are combined as an integrated solution. Only 7% of those surveyed saw this happening by 2025, with a modest 40% saying it would happen by 2030.

Not surprisingly, more of those surveyed saw increased economies from digital transformation in the near-term, with nearly two-thirds of executives believing a cost-to-income improvement of more than 20% will be achieved by 2030. As we move forward, financial institutions should focus on key elements of digital transformation that will support customer engagement to halt silent attrition. These include:

- Wellness replaces wealth. Rather than maximizing share of wallet, forward-thinking banks will focus on share of customer life, improving financial wellbeing through holistic digital advice and guidance.

- Speed of first impression. Banks and credit unions must build new account opening and loan application processes with an inside-out digital support platform. These platforms must be able to execute the entire process in less than five minutes … entirely on a mobile device.

- Hyper-personalization rules. Segment of one marketing powered by data and analytics will surpass broad demographic clusters. Banks must tailor solutions to individual identity, behaviors and life stage journeys.

The research provides a mixed read on banks’ internal digital transformation progress. Significant pluralities see legacy constraints hampering competitiveness and limiting institutions from realizing the full benefits of emerging innovations.

While external digital forces impacting banking seem clearly mapped, survey responses on the pace and success of banks’ own digital maturity journeys remain murkier, showing divergence. To be sure, consumer-facing innovation often outpaces tedious back office overhauls. But this gap portends risk if not closed quickly.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Mapping the Road Ahead

Like any research exercise, the 2024 Crystal Ball project offers directional guidance rather than promising definitive certainty. But several key insights stand out that retail banking leaders can ill afford to ignore as they chart strategies for thriving in the coming years not just surviving:

- The competitive field will bear little resemblance to banking as we know it today. Big tech, fintech and lean digital players will push their way up the league tables as legacy institutions face pressure from both disruption and consolidation forces.

- Mobile-first, cloud-supported and AI-driven will constitute the new norm. Emerging innovations will gain widespread adoption as consumers flock to providers delivering seamless digital money management integrated into their daily lives.

- Banking must replace obsolete systems, processes and mentalities. While instantly implementing every shiny new innovation is not the answer, banks must carefully balance digital agility with stability and resilience.

- Holistic financial wellbeing and hyper-personalization will drive differentiation. Succeeding with fickle digital natives and savvier boomers alike means understanding their financial lives deeply and delivering intuitive money guidance tailored to individual needs and life stages.

- Transformation must focus on customer lifecycles. Improving pieces of the banking business will no longer suffice. “Reinvention of the wheel” must be supplanted by customer journey reinvention, with the enterprise conceived, designed and orchestrated around delivering exceptional end-to-end experiences.

While grappling with all these monumental forces may seem daunting, the research provides reason for optimism. Banking has evolved for centuries by leveraging new innovations, talent and ways of thinking. With clarity of purpose, commitment to customers, and courage to change, banks can adapt for the future. The clock, however, is ticking.