If you ask businesspeople about the American economy today, many — perhaps most — would tell you that it’s roaring ahead.

Inflation is off its highs (give or take). Wages have risen at the fastest pace in years. And unemployment is seemingly holding near a 50-year low. A “soft landing” is today seen as far more likely than the recessionary downward spiral many once fretted over.

But under the surface, there’s another story unfolding: Millions of Americans have seen their financial situation abruptly take a turn for the worse. This dual narrative is playing out amid this year’s presidential race, as Democrats and Republicans try to persuade voters that their financial well-being is either better or worse than it has been.

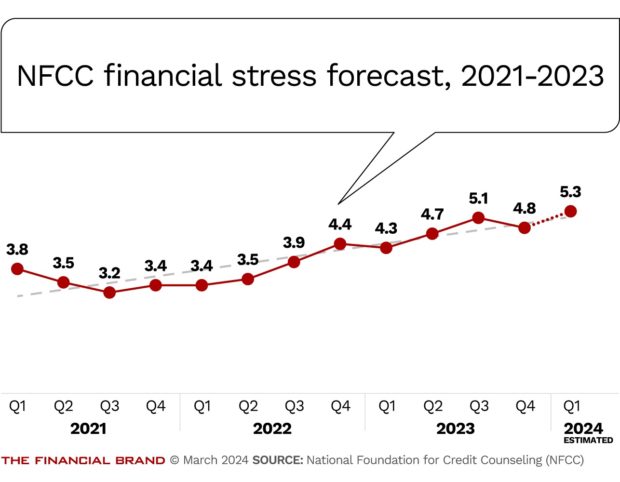

According to the recently released Financial Stress Forecast — produced by the nonprofit financial-advocacy group the National Foundation for Credit Counseling (NFCC) — Americans’ economic insecurity is ratcheting up. In the first quarter, the measure increased substantially, jumping to 5.3 from 4.8 on a 10-point scale in the previous quarter, which represents a 49.9% rise from a low of 3.2 set in the second quarter of 2021, when pandemic payments propped up household budgets.

“This is a bellwether for the consumer, and the slope of the curve is extraordinarily steep, meaning we don’t expect to see any improvement in the months ahead,” says Mike Croxson, CEO of the NFCC.

High-interest-rate environments are always challenging for financial services providers. But the current mixed-message market makes it especially hard for them to separate signal from noise. Particularly in an election year, banking companies are likely to be identified as both an economy’s problem and its solution — with the pressure rising as consumer credit issues emerge.

“This is a bellwether for the consumer, and the slope of the curve is extraordinarily steep, meaning we don’t expect to see any improvement in the months ahead.”

—Mike Croxson, NFCC

While spring 2024 is certainly not summer 2007, BankRate finds 36% of adults today have more credit card debt than emergency savings, and 55% are living paycheck to paycheck, according to Metlife. Meanwhile, there are more ways than ever to easily tap credit, whether through digital banks or a broad range of other fintech innovations, such as Buy Now, Pay Later plans.

The Financial Stress Forecast is a quarterly economic indicator — a real-time snapshot of financial health that is predictive of consumer sentiment in the subsequent quarter. According to Croxson, the NFCC’s quarterly report differs from the Conference Board’s monthly consumer confidence index by focusing narrowly on consumer debt. Where investors monitor CPI closely because of its diverse range of economic insights, he says, the Financial Stress Forecast can serve as a deep-dive datapoint in estimating consumer spending, which accounts for two-thirds of GDP.

The NFCC, founded in 1951, deploys more than 1,200 counselors in 50 states to help consumers draft action plans to get their debt under control. The organization is increasingly working with creditors, including banks and card companies, to help them identify troubling consumer-debt levels. That helps creditors in two ways, Croxson says: Maintaining good relationships with customers who are likely to use them again and reducing losses because 90% of consumers who use counseling pay back their debts in full.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Rising GDP, Rising Debt

By any measure, the present moment would seem to be a good time for just such a deep dive. On one side, GDP growth accelerated in the fourth quarter and for all of 2023, while wages advanced 4.3% during the October-to-December period and the benchmark stock market index climbed to a fresh record in December. But that good news hasn’t been evenly distributed.

To some degree, inflation is the culprit. “Our data reflects the disconnect many Americans are feeling,” Croxson says. “They’re hearing about an improving economy but are still struggling to pay for necessities like food and utilities while also covering their debt payments.”

Unprecedented support from federal and state governments during the Covid outbreak led to massive cash transfers, record-low mortgage rates, forbearance on rent and student loans, and soaring stock prices.

Over time, as savings ran out and inflation pinched shoppers, consumers failed to adjust their behavior, Croxson says. Levels of unsecured debt rose.

Americans had $1.1 trillion in credit card debt at the end of 2023, an increase of $50 billion, or about 5%, from the July-through-September period, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data. Serious credit card delinquency, defined as 90 days or more delinquent, spiked to 6.4%, up from 4% a year earlier, led by younger borrowers. Likewise, delinquency rates rose for all debt types, except for student loans, owing to forbearance.

Americans “are hearing about an improving economy but are still struggling to pay for necessities like food and utilities while also covering their debt payments.”

— Mike Croxson, NFCC

High inflation and interest rates have spurred consumers to use more debt. Heading into 2022, as stimulus payments, tax credits and forbearances slowed or stopped, the price of almost everything skyrocketed – from food and energy prices to cars. That year, the rate of inflation as measured by the consumer price index (CPI) averaged 8%. Just two years earlier, it had averaged 1.6%.

“If people use unsecured debt to pay for daily spending, they tend to get in trouble,” Croxson says. “Inflation has contributed to that. And high interest rates are especially a problem when a consumer gets behind on payments. That can crimp cash flow.”

As consumers poured on more debt, many eventually were tapped out, losing access to fresh cash. That’s how the house of cards collapses, Croxson says.

The NFCC CEO says the growing popularity of neobanks and other innovative fintechs during the pandemic have made credit especially attractive to younger generations, and added to the debt load. Still relatively new at the time, BNPL products enabled consumers to pay for purchases in installments.

These days, Croxson says, creditors are intervening on behalf of overburdened customers earlier — to the benefit of both. “I can’t stress enough the importance of creditors interceding early. I call it ‘enlightened self-interest.'”

That’s why about 500,000 consumers are likely to use nonprofit credit counseling this year to set up payment plans, he says. Another 2 million people will use debt settlement, a process for those who don’t have the ability to pay back debts. In both scenarios, consumers are prevented from accessing loans until creditors are made whole. Only then can they take out new debt.

The challenging environment faced by many Americans has made it harder for this year’s presidential candidates to effectively plant their feet.

Dig deeper:

- Which Banks Offer HSAs to Customers (And Why Yours Should)

- The Top 5 Impacts of Debt (and What Banks Should Do About It)

Will November Politics Make a Difference?

When asked how the two major political parties mine economic reports to make their case to Americans, Croxson says consumers in financial distress typically shut out the noise and vote according to the size of their bank accounts — or debt burden.

“If you are in financial stress and you don’t see anything changing in your situation,” he says, “the realities of the broader economy and what people are saying about it do not matter. When you pull that lever, your personal experience guides how you’ll vote.”

The incumbents clearly have it harder this cycle, as they seek to emphasize the economy’s strengths while still acknowledging and being responsive to the consumer’s increasing burden. President Biden’s continued emphasis on the fight against nuisance fees, which once again made an appearance in his State of the Union address, is just a small part of that effort.

On the other hand, GOP nominee former President Donald Trump also has the challenge of saying the economy is a problem, even as there is a steady drumbeat of reports of strong economic indicators.

Based on the Financial Stress Forecast, the degree of difficulty will only rise as the year progresses, both for candidates and consumers.

Parris Kellermann is a freelance writer based in Vermont. He has worked at several financial publications including MarketWatch, TheStreet, Bloomberg and Equities News.