Many in banking believe the future of the retail side of the business lies in moving from a transaction culture to one focused on advisory and financial wellness for consumers and small businesses.

Royal Bank of Canada is well advanced along the path to that goal. A series of artificial-intelligence-powered mobile banking innovations RBC has rolled out over four years have created significant differentiation for Canada’s largest bank.

RBC’s competitive presence in the U.S. has had a lower profile since it sold its U.S. retail banking operations to PNC Bank in 2011. However, RBC’s singular focus on digitization has marked it as a transformation leader. More than four out of five (83%) of its active customer base engage with the bank digitally, even though RBC still has about 1,300 branches.

Further, RBC has seen 17% to 20% year-over-year growth in mobile banking utilization from 2015 to 2019.

“Many banks believe they ‘are digital’ because they have a transactional mobile banking app. Not so,” states Bob Meara, Senior Banking Analyst for Celent. “Fully embracing digital requires banks to rethink their value proposition in its broadest context; how they establish and deliver value.” Meara goes on to say that value means experience, not sales, and that digital is the primary means by which this experience occurs. His comments appear in a case study he wrote about RBC after Celent named the bank its 2020 Model Bank of the Year.

NOMI Provides Four Distinct Types of Engagement

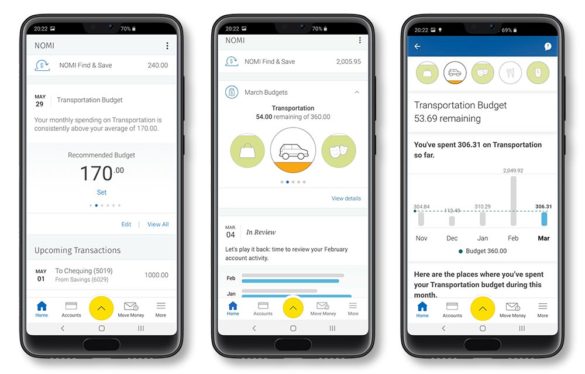

One of the most visible and successful manifestations of RBC’s commitment to digital personalization is its group of NOMI capabilities, all of which reside within the bank’s mobile banking platform. NOMI — a play on the words “know me” —currently consists of four components, all based on artificial intelligence software:

- NOMI Insights — near real-time personalized financial data.

- NOMI Find & Save — an automated saving function.

- NOMI Budget — a budgeting tool driven by Insights.

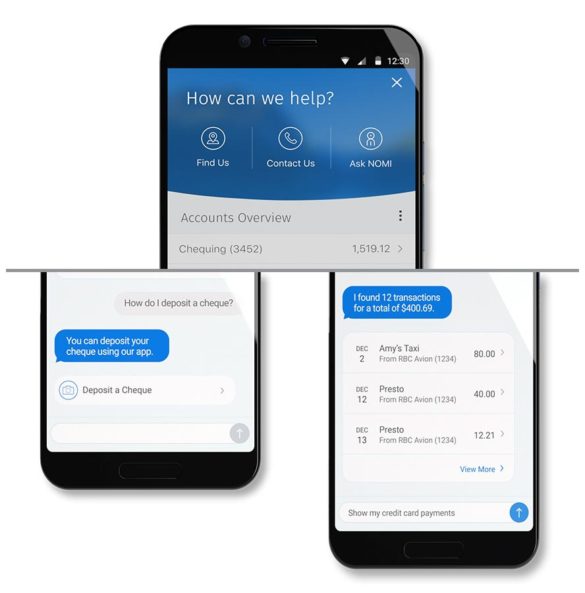

- Ask NOMI — a text- and voice-based chatbot.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The NOMI project began in 2016 and the first two features — Insights and Find & Save — launched in the fall of 2017. The capabilities are all based on Personetics’ Engage AI platform. Although a user has to decide to use NOMI tools, there is no configuration or setup required beyond the tap of a button.

According to Celent, there are 1.1 million monthly users of NOMI, as of the first quarter, 2020.

NOMI Insights. The foundation of the NOMI capabilities, Insights consists of “snippets” of financial information about a user gleaned from the person’s data and activities in RBC accounts. Rami Thabet, VP Digital Product for RBC, says there are now between 40 and 50 snippets, which produce such insights as a “second look” — i.e. asking a consumer if they might have been double-charged — as well as flagging changes in spending patterns, or gently asking “Did you know you spent such and such amount on coffee last week?” or providing a spending summary upon completion of a trip.

Of the consumers who begin using NOMI Insights, less than 1% turn it off, the bank states. Customers have read more than 1.1 billion insights since the feature was launched.

Thabet told The Financial Brand that Insights does not aggregate from other financial services providers the way some fintech apps do.

NOMI Find & Save. This capability uses AI to analyze an RBC customer’s checking account to identify funds that, if moved to savings, would not affect the person’s cash flow or normal living. It automatically pulls that amount into a savings account for those customers who have turned on the option. The feature has particular appeal to 18-30 year-olds, according to Celent.

It’s a powerful feature, says Thabet. “Consumers tell us, ‘I have a hard time saving, my cash flow really can’t sustain it because I’m paying bills’.” But the AI shows that they can save and the bank does it for them.

“This is not a rounding-up feature,” the banker adds. “We’re not talking a few cents left over after you buy a coffee. These are meaningful chunks of dollars.” He says the average saved moves up and down but currently is about $225 a month. Nearly 250,000 customers have opened a Find & Save account, according to the bank.

Read More:

- Banking Execs Say AI Will Separate Winners From Losers

- How Banks Can Begin to Catch Up with Amazon’s Personalization Genius

NOMI Budget. This feature is one of Thabet’s favorites, perhaps because he is among those for whom budgeting is a chore.

“Budgeting is not something most people naturally do,” he says. NOMI Budget is built for the 80% of the population who don’t want to spend the time to track every transaction. “We let the AI do the work,” he says.

Closely connected with the Insights feature, Budget is based on what the analytic engine sees about a person’s spending and then creates budget suggestions for them and tracks how they’re doing. The application calculates how much a person is spending on dining, entertainment, transportation and shopping, the four categories most consumers consider discretionary.

“When a client spends more than their usual amount in a category for consecutive months, NOMI recommends that they set up a budget,” Bob Meara states. NOMI then uses the power of AI to recommend an amount for the person’s budget that is based on their pattern of spending.

The consumer is always in control, says Thabet, and can adjust the suggested budget at any time. The app provides guidance along the way, noting when a person has used 25% of their dining budget, for example. If they consistently exceed the budget it “will nudge you to set a more realistic budget,” Thabet adds.

A bank spokesman states that nearly 750,000 customers have set up more than 1.2 million budgets since the feature was launched in 2019.

Read More: Capital One Doubles Down on Chatbot with New Features and Marketing

Ask NOMI: A Multi-Lingual Chatbot

The most recent NOMI addition is Ask NOMI, an informational capability. Thabet says RBC had planned to launch it in the summer 2020, but accelerated rollout to mid March. They found that in the early days of the coronavirus pandemic, customers needed a way to get questions answered quickly.

Since Ask NOMI was launched, more than 350,000 unique users have asked and received answers to 1.9 million questions, the bank states.

Ask NOMI can respond to both text and voice queries, and would be considered a chatbot by most in the industry, Thabet states. He likes to think of it as something a little bigger than a chatbot, however, because of its multilingual capabilities. Canada has numerous immigrant communities and Thabet says the bot can handle 13 or 14 languages. “You can ask the question in English and have it come back in Farsi or Chinese and vice versa,” he says.

A key capability of any advanced chatbot is to be able to seamlessly hand off a consumer to a human contact. Ask NOMI can do that, Thabet states. “This is not your typical chatbot where you load up answers to a bunch of questions” with the idea of keeping the questioner away from an advisor. Even though Ask NOMI can handle about 75% of the questions it gets within the app, it recognizes more complex questions such as “How can I extend my payments longer?” and suggests speaking with a human, according to Thabet.

One App, With Macro and Micro Tailoring

The NOMI capabilities are far from the whole story regarding RBC’s mobile banking innovations.

“At a macro level, we’re creating unique experiences for specific segments, like students and entrepreneurs, and at a micro level we’re tailoring advice and insights to the individual through our NOMI suite of capabilities,” states Peter Tilton, SVP Digital, RBC.

It’s a defining concept for how RBC approaches its mobile banking channel. Rather than have separate apps for different segments — small business and consumer, for example — the bank has one app that is personalized by segment.

“With a single mobile app we can personalize the experience to suit a particular consumer’s need,” Thabet states. “So in the same app where you pay your bills you will see Find & Save and a very tailored investing experience.”

These various capabilities are not all AI-initiated. Many come from direct consumer input, which RBC uses extensively in designing its products.

For the “Student Edition” of its mobile app, for example, the bank worked with about 400 young adults to hammer out what features would both appeal to them and be useful.

It was eye-opening working with these young adults, says Thabet. “They dispelled our notions. For example we had this preconception that young adults would want to see influencers and would want to see videos and other entertainment-type concepts inside the mobile experience. But they told us, ‘No, banking is serious’.” Many in this a group came of age during the 2008 financial crisis, Thabet adds, and they take financial matters very seriously.

Among the features that this outreach led to:

- Ability to customize the app with colors, nicknames and photos of friends and personal payees.

- Banking terms explained: tap on underlined words to get a non-technical definition.

- An action button makes it easy to access page-specific tools, like sending money to friends with one tap.

“RBC’s personalization has led to multiple successful outcomes,” Bob Meara writes in his Model Bank case study. “It has led to a reduction of customer attrition (currently less than 2%, versus 7% to 8%, typical for banks in North America).” In addition, the analyst states that the time RBC customers spend on the mobile app (dwell time) has increased by a third over the past three years, “to the point RBC believes they have the longest mobile app dwell-time of any similar bank.”