Who is going to get the better part out of Google’s decision to pilot deposit-account partnerships with banks and credit unions? While the blockbuster announcement in November 2019 for a Google checking account initially covered just two financial institutions — Citibank and Stanford Federal Credit Union — Google intends to work with other institutions as well.

Experts speak of banking becoming an embedded function in others’ services, leading to predictions that the fate of those few banking institutions that survive financial evolution will be to function as “dumb pipes” — just a carrier used by other companies. Is that the fate of Citi and Stanford and other institutions that follow their lead with Google or other big-tech partnerships?

Remarks at an industry gathering by Michael Corbat, CEO at Citigroup, help explain Citi’s strategic thinking and how the history-making deal with Google may play out as it moves forward.

Avoiding Being ‘Dumb Utilities’ When Partnering with Tech Firms

During a panel discussion, Corbat acknowledged the talk over who wins the best part of the bargain. Corbat said that a few years back he met a young Silicon Valley executive who, in his recollection, said: “We’ve come to eat your lunch, old man.” (Corbat says he’s never dismissive with fintechs. “Any time you’d like to be highly regulated and be traded at ten times multiple, we’d be happy to have you join us,” Corbat replied.)

Is a deal with Google a risk? “We’re very conscious around not being the dumb utility … of not giving away the client-customer ownership that’s there,” said Corbat of tech partnering. He admitted that this is always a risk of partnership. But he said the tone of the conversation with fintechs and big techs has changed to favor coexistence. However, he warned financial institutions to be careful how much they put into partnerships versus how much they get.

“What we’ve seen is a coexistence,” Corbat observed. “We are developing many of our own things. We are partnering. We are buying. Some of the fintechs are tremendous partners on our platforms. Some of the fintechs are terrific clients of the firm, in terms of services that we provide to them.”

It’s become more or less accepted that Google’s interest in these arrangements isn’t becoming a bank, per se, nor having any access to deposits. The tech giant is taking part in these deals through its underperforming Google Pay service. This is perceived to be both to increase volume and to gain access to mounds of transactional data.

“We’ll have access to the data, Google will have access to the transactional data and the search listing that in many cases they already have today,” Corbat said during the panel discussion. In fact, Corbat portrayed payments as an enticement for tech companies as well. “With consumer payments in particular,” he said, “you can come in, you don’t have to be regulated, it’s not capital intensive, per se, you get paid to do it when you get swipe fees, and you get consumer data to decide how you’re going to expand those boundaries.”

Industry executives and pundits keep consulting the skimpy batch of tea leaves available concerning the Google-Citigroup transaction account partnership expected to go live in 2020, trying to figure out what the two giants will do. In the absence of many facts, considering the pending arrangement in the wake of Citigroup’s retail banking strategies of recent years puts the deal in perspective as a potential piece of a larger strategy. “We think it’s a very efficient way to bring new clients into the bank,” said Corbat and this helps explain the connection to the larger view.

Read More: 5 Risks Banks and Credit Unions Face By Partnering With Google

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Evolving Towards a ‘Branch Light, Digital Heavy’ Model

Partnering with a company that began as a search engine may seem quite a change for a megabank with deep history, but ever since the financial crisis Citi has known little but change, rebuilding, revamping and rethinking a giant that had to go on a corporate diet and exercise program.

“We have gone back to our roots as a bank,” Corbat testified to Congress in April 2019. “We are no longer the financial supermarket of the past. We have simplified our structure by shedding over 70 businesses and divesting over $800 billion of non-core assets.” Total Citi assets fell to $1.9 trillion at the end of 2018 from almost $2.7 trillion in 2007.

Corbat, a Citi lifer who started with the bank in 1983 right out of Harvard, became CEO in 2012. Just previously he headed Citi Holdings, a portfolio of businesses slated for divestiture. He has overseen a massive reorganization of Citi and its leadership, characterized overall by retirement or departure of business heads and promotion of the next generation within Citi. The most recent major move was the appointment of Jane Fraser to be Citigroup President as well as head of Citi’s Global Consumer Bank, which includes its U.S. consumer banking operation and its card operations. Fraser is seen as a potential heir to Corbat’s post.

Years ago, community bankers across the country worried about ultra-competitive Citibank moving to town. During an acquisitive, expansionary period it did buy banks and savings and loans and opened de novo offices across state lines. But that strategy changed over time as banking channels and consumer habits evolved, and later as Citi’s financial troubles took center stage.

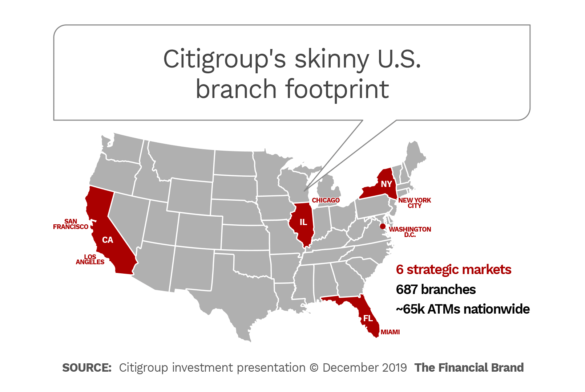

Today, when Citi executives speak about the company’s U.S. branch network, they likely brag on how finely tuned and minimalistic it is. While Chase, Bank of America, and Wells Fargo each have thousands of branches in the U.S., Citi has under 700, radiating from six cities. Overlaying that physical network is a massive nationwide ATM network but more importantly a growing investment in digital channels. Parallel to that is Citi’s national bank card customer base of approximately 28 million, about two-thirds of which reside outside of Citi’s physical footprint. All told, Corbat said during an earnings call, Citi touches on roughly 70 million consumers in all states.

Huge Potential from Co-Brand Relationships

Many of its cardholders don’t have deposit relationships with Citi, historically, and the company has been laboring to change that. The company’s ATM network overlaps substantially with the portions of its cardholder base that are outside of its physical footprint.

“We have the opportunity to be a digital challenger with a large, untapped existing customer base, supported by a national ATM network,” Anand Selvakesari, Citi Head of U.S. Consumer Banking, told a November 2019 investor conference. During 2019, Selvakesari said, deposits raised via digital channels have increased four-fold. He added that about two-thirds of those new deposits came from outside of the bank’s branch footprint.

Corbat has indicated that Citi clearly sees the data generated by its card operation as critical to growing deposits and other business from its cardholder base. Beyond Citi’s own card base are the cards issued on behalf of partners, such as Costco Wholesale. This accounts for approximately 200 million consumers with either co-branded or private label cards.

“We have the ability to continue to build on that and be smart around the advantage we have, and that is that we know these people,” said Corbat. “We know where you live, we know what you spend, we know how much you earn. And, by the way, we know who your bank is.”

Corbat sees this as a huge opportunity to target potential new consumers, including depositors.

“It’s very much a unique opportunity, because there is really no other bank out there that has the same national presence that we have from our cards portfolio,” Corbat added.

Having all the data Corbat described is permitting Citi to approach these prospects with a high degree of personalization.

CFO Mark Mason told analysts that Citi knows which types of incentives its card customers like, for example. “So we’re able to create packages for them that reward them with benefits they respond to.”

Read More: 7 Things You Don’t Know About Wells Fargo’s New CEO

Why Partner with Google? Transaction Accounts

Through the first three quarters of 2019 Citi raised $4 billion in deposits through digital channels, and thus far the company has characterized such digital efforts on more than one occasion as “experiments.” These preliminary successes are important to Citi because it has not had the same access to inexpensive checking deposits as its competitors. Chase, for example, has been bringing physical branches to new markets with much fanfare. Citi isn’t opposed to new branches, but would likely build only after digital growth established a community of customers who might benefit from offices.

The Regents Research blog on the Seeking Alpha website observes that the Google partnership “could help close the huge gap to peers in the size of its U.S. deposit franchise, lowering funding costs and boosting returns. … given how weak its U.S. deposit franchise currently is, there is hardly any downside to teaming up with Google.”

“Because of its much smaller branch footprint, Citi has ‘less to fear from giving Google a foothold in the market.'”

From Google’s side, the blog observed that “knowing about spending patterns is a much more powerful tool than knowing browsing patterns.” The document goes on to say that because of its much smaller branch footprint, Citi has “less to fear from giving Google a foothold in the market” than the other large U.S. banks.

While Google is not your garden variety fintech startup, Citi is hardly a newcomer to the partnership dance. Multiple elements of the company work with fintechs in different capacities. Citi has sponsored the Digital Money Symposium for seven years, on top of an international network of innovation labs. In a March 2019 speech Corbat pointed out that while the labs initially concentrated on Citi-built solutions, more recently their focus has been partnering with fintechs.

“On the one hand, fintechs gain access to our global network of more than a hundred million clients, our physical presence in nearly 100 countries, and our more-than-200-year-old trusted brand. We give them scale,” said Corbat. “On the other hand, we gain access to fintechs’ agility, entrepreneurial culture, and new technologies. We give innovation.”

One final point regarding Citi strategy: A major new focus for the company is turning more of its existing consumers into multi-relationship customers. In part this entails gathering consumers through a multilevel funnel. Relationships may begin with Citibanking, the company’s mass market line, followed by Citi Priority, for the emerging affluent. Finally there is Citigold, for affluent consumers and the source of over half of the company’s U.S. deposits today.

A key target for Citi is younger consumers who can in time move all the way through that funnel and that is one of the benefits of the card programs. These younger consumers have the most affinity for opening an account affiliated in some way with players like Amazon and Google, studies have shown.