Anyone in the small business lending field knows Live Oak Bank. Launched in 2008, it became the number one SBA 7a lender in the country just nine years later, a position it continues to hold today by a wide margin.

That accomplishment alone is notable. But for the Wilmington, N.C.-based bank with one branch and total assets of $8.6 billion it’s just a prelude to becoming “America’s Small Business Bank,” its anticipatory tagline.

You can’t become a small firm’s primary bank by lending alone. For most of Live Oak’s 6,000 customers, the relationship is credit-based. It is a relationship based on a high degree of personal contact, however, unusual in small business lending. Live Oak owns three company planes, which it uses to fly about 60 bankers to visit with clients around the country, to sell, check up and reassure. Airplanes are much cheaper than owning branches, observes Mahan.

But for several years, the bank has been trying to solve the deposit side of the equation. With only one branch, most deposits come through online channels. Despite the higher cost of funds of that arrangement, the bank performs very well. In Q1 2022, the company’s net interest margin was 4.02%, its ROA 1.5% and ROE 18.9%. The quarter was in fact the best ever for the company.

Eye on Future Winners:

Live Oak Bank has been investing in fintechs for almost a decade, longer if you count nCino, the bank software company it built and spun off.

“We pay market rates on deposits, like Ally Bank or Marcus,” the CEO states. “But our internal cost to raise deposits is about seven basis points.” Even if you add seven basis points to a 1% money market rate that the bank pays, he says, it still comes out ahead of most of the industry.

But Mahan wants the model to be even better, which he believes it will, “when we become the Stripe of the non-interest-bearing deposit business,” as he tells The Financial Brand.

How Live Oak Bank plans to accomplish that is covered below. A key to its plans is a modern core banking platform. One that it helped finance and develop.

Read More: Core Banking Tech Provider: It’s Game Over for Legacy Systems

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Niche Banking and Beyond

For those not familiar with the Live Oak Bank, it is in many ways the original niche bank. Beginning in 2008 with a single vertical market, veterinary practices, the company now has 35 verticals. (Others include funeral homes, self-storage, investment advisors, bioenergy, senior housing, hotels and the poultry business.)

The SBA 7a program allows banks to lend to 1,100 different industries. Mahan thinks Live Oak will top out at somewhere between 100 and 150 verticals served. He expects to keep adding them at a rate of two to four a year.

The bank’s more recent focus, however, has been on a two-part “generalist strategy.” One part involves hiring experienced SBA lenders and setting them up in various cities around the country. Right now Live Oak has about 30 lenders in 28 cities, according to Mahan. He expects to have these lenders installed in a hundred U.S. cities “in a relatively short period of time.”

The second part of the strategy is making conventional loans to small businesses — something the bank avoided initially. With the combination of more verticals, more SBA lenders based geographically and more conventional business loans, Mahan believes Live Oak can continue to grow 15% a year organically, putting it in very select company.

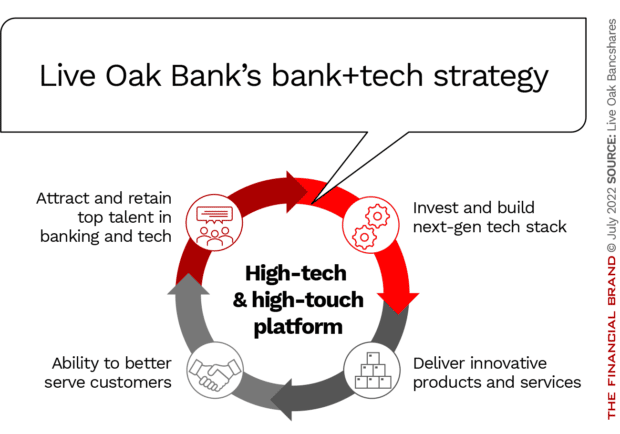

The bank’s highly successful formula is enabled by one other significant factor: its long-term focus on efficient, modern technology.

Read More:

- Banks Tap Fintech Partners to Address Embedded Banking Threat

- How Square is Building a Small Business Banking Powerhouse

- Digital UX Key for Banks to Win Back Small Businesses from Fintechs

Banking+Fintech Investing Strategy

Live Oak Bancshares is as much a technology company as a bank. Three years after the bank opened for business, it created a wholly owned subsidiary to sell the loan origination system the bank’s engineers had developed. The subsidiary was named nCino.

In creating nCino, says Mahan, “we learned a lot about building cloud-native, API-first software.” nCino grew so rapidly that the bank spun the company out to shareholders in 2014.

The bank invests directly in promising fintechs through Live Oak Ventures and also through the Canapi venture capital fund, a subsidiary of the holding company. The bank uses the software of many of the companies it invests in.

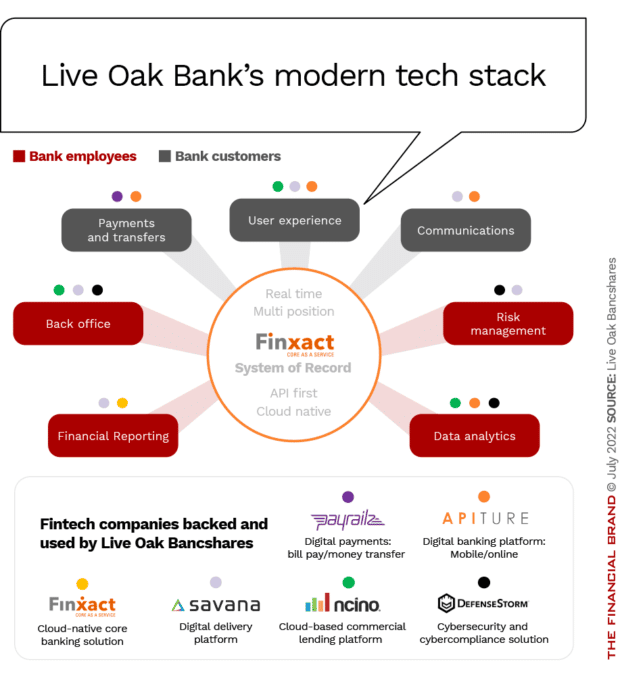

At the center of the diagram above is FinXact, a modern real-time bank core system built on Amazon Web Services (AWS) cloud service. Live Oak was instrumental in getting FinXact created and funded.

Mahan is well-versed in both technology and the needs of startups. Even though he began his banking career as a commercial lender at the old Wachovia Bank, Mahan helped launch one of the very first internet banks (Security First Network Bank) in 1993. He also founded bank technology company S1 Corp. and led it for 12 years. As head of Live Oak Bank, Mahan in 2016 helped persuade his friend and bank technology icon Frank Sanchez to build a next-generation core banking system using AWS. Live Oak Ventures capitalized the new business, which was called FinXact. In April 2022 Live Oak sold its stake in FinXact to Fiserv for $125 million in pretax cash.

That gain enables several things, according to Live Oak CFO William “BJ” Losch III, speaking during the bank’s Q1 earnings call. Among them, he said, it will fund additional loan growth, enable the bank to accelerate several tech initiatives including hiring more tech talent, and permit redeployment of capital into other fintech investments.

But it’s the bank’s own use of the FinXact technology that is most significant. Both Mahan and Losch believe this modern core system will shortly lead to a defining moment for the bank.

Read More: Why KeyBank Believes ‘Embedded Banking’ Is the Future of the Industry

Embedded Banking: Low-Cost Deposits At Last

Live Oak Bank’s long search for a way to attract low-cost deposits without a branch network is about to be solved, Mahan believes. In the third quarter of 2022 the bank will launch an embedded banking strategy that combines its deep vertical expertise with the advanced technology it now has in place.

“All the work that we’ve done to build a cloud-based, API-first bank will allow us to create not only unique products and solutions, but also to deliver them in unique locations,” bank President Huntley Garriott told analysts. He noted that big fintech companies like Plaid and Stripe have made it very easy for companies to embed financial services solutions. They do this with simple developer portals that use well-structured APIs.

Market Expander:

Embedding banking services in small business software programs could be a tool for grabbing new accounts and loans well beyond a branch-defined market area.

Live Oak will launch just such a developer portal to be used by the thousands of software companies serving the needs of the verticals that the bank already lends to. The first one will be its original niche vertical, veterinarians. As Mahan explains, practice management software is how vets run their business — handling appointments and ordering the meds and other supplies they need. With the bank’s new portal, it will be a 30-minute exercise for a practice management software company to embed Live Oak Bank’s lending and deposit capabilities inside their software, says Mahan.

“Embedded banking will provide us with two critical elements,” Garriott states. “The first is a unique distribution channel. You can think of each of these software companies as a branch that will allow us to source low-cost customer acquisition of these small businesses. The second is increased stickiness of these customers as their financial services are embedded in their day-to-day business.”

Live Oak Bank’s management is counting on the fact that veterinarians will not only borrow from the bank, but keep non-interest deposits there. As soon as the veterinary vertical is up and running, Mahan says he will unleash his sales team to call on every practice management software provider among the 35 verticals.