Roughly one out of every five consumers shopping online for checking accounts are age 50 or older. To target this segment of checking shoppers, research says banks and credit unions should focus on search engine marketing, buying keywords like”surcharge free ATMs,” “free ATMs,” “online bill pay” and “overdraft protection.”

In a recent survey on FindABetterBank, about 18% of respondents currently shopping for checking accounts were over 50 years old, while 42% were under 30. Most acquisition marketing efforts are geared towards Millennials (and rightly so), but older consumers looking for new checking accounts warrant some attention as well.

When comparing how people use their checking accounts by age, reveals some (unsurprising) behavioral differences. Younger consumers use ATMs at least weekly more so than those over 50. And the average low balance for shoppers over 50 is $2,300 vs. slightly more than $700 for shoppers under age 30.

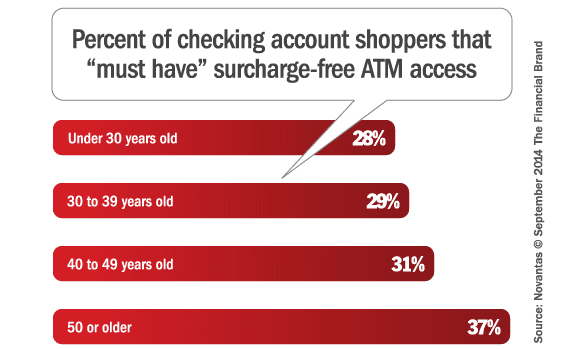

But some of behavioral differences don’t jive with the features consumers say are most important when selecting a new checking account. One would think that young consumers — those who are most socially active — would be the segment most interested in surcharge-free ATM access. However, more than 37% of shoppers over 50 indicate they “must have” access to surcharge-free ATMs. Only 27% of shoppers under 30 must have this feature.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

More Counter-Intuitive Insights About Checking Account Shoppers Over 50

Nearly half want overdraft protection, even though 59% say they never overdraw their accounts. Logically, people who overdraw their accounts most frequently would be most interested in having overdraft protection. Frequent ATM use correlates with increased overdrafts. However, older shoppers express a strong interest in overdraft protection, even though they use ATMs less frequently.

While 25% “must have” unlimited check writing, 36% must have online bill pay. Everyone, regardless of age, uses their checking accounts to pay bills. It’s not surprising that many more older shoppers want unlimited check writing privileges compared to younger shoppers (only 9% of shoppers under 30 indicate they “must have” unlimited check writing). But shoppers over 50 are also more likely to want online bill pay (only 25% of shoppers under 30 must have online bill pay).

Despite carrying higher balances, demand for interest on balances is no more than among younger shoppers. It makes sense that people carrying higher balances would be more likely to say their next checking account must earn interest on balances. Despite carrying three times the balances of Millennials, the same proportion of shoppers over 50 want interest on balances as Millennials.