A theme increasingly heard in fintech circles is the need to “humanize” digital banking technologies. This can mean a range of different things, depending on who you’re talking to. Some might argue, for instance, that making banking technology more human involves sophisticated artificial intelligence that can make digital assistants more personable. No matter who you ask, most examples of such “humanization” strategies typically look to disguise the underlying technology as much as possible.

But Umpqua Bank has a different perspective. In their world, the best way to humanize banking in the digital age isn’t to layer one technology on another. Umpqua’s approach is built around real, live human beings.

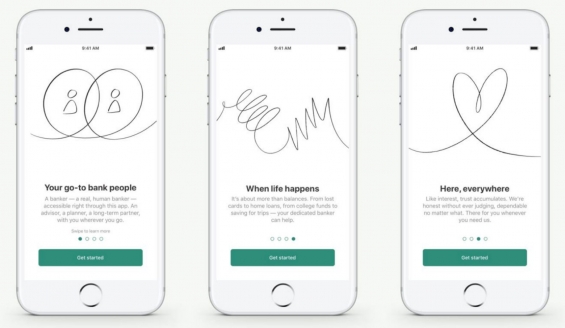

Following a 10-month pilot, Umpqua is launching a system wide rollout of its unique “human digital banking” platform that it calls “Go-To Banking,” a mobile app that essentially puts a banker in everyone’s pocket. All you have to do is press a button and you can be chatting with your own dedicated personal banker. You could call it an “anti-bot alternative” — Umpqua’s countermeasure to combat fintechs and other competitors who are aggressively pursuing tech-heavy, AI-saturated strategies.

Read More: Why Contact Centers Are a Key Part of a Human+Digital Banking Strategy

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Sustaining a Legacy of Innovation

Umpqua Bank has enjoyed an outsize reputation in retail banking for decades. Bankers trekked from all over the world to see its unique “stores” and hobnob with the community bank’s leaders.

But management knows that they can’t stay on top without changing. No matter how innovative its stores may be — offering fresh coffee, yoga classes, and striking designs — consumers these days just simply don’t visit branches as often as they did even a decade ago.

Embedded deep in Umpqua’s DNA is a burning desire to continually stay ahead of the pack.

“I’d rather be setting the pace than trying to catch up from behind,” explains Cort O’Haver, Umpqua Bank’s President and CEO.

The problem facing Umpqua’s leadership team was how to take the personal in-branch experience the $26 billion bank had so carefully nurtured and match that in a mobile environment. The answer required a big shift in perspective. Instead of seeing digital devices as efficiency tools that largely increase the distance between bankers and their customers, Umpqua decided to use technology to bring the two closer together, and do so in a way that was more convenient for everyone.

Umpqua’s thinking coalesced into what eventually became the “human digital” strategy that serves as the foundation of their “Go-To Banker” model. Now after a thorough road test, the app is ready for prime time. In September 2018, Umpqua rolled Go-To Bankers out to its entire retail customer base, and in 2019 the bank will extend Go-To to small business customers.

Read More: How This Ex-Umpqua Marketing Exec Will Shake Up Branding at BBVA Simple

No Boring Banker Bios Allowed in Go-To Lineup

Go-To Banking allows every Umpqua retail customer who downloads a dedicated banking app to choose a “financial expert” (the bank’s term). This person becomes the customer’s “go-to person” for any financial need or question — e.g., saving for a child’s education, that are more complex and tend to involve advice based on dialogue.

Quick Facts: Umpqua’s Go-To Banking Strategy

- 99% of interactions by secure text

- 69% increase in adoption rate of digital products (e.g. mobile billpay)

- 15% increase in “relationship depth” (products used)

- 90%+ customers say Go-To banking added to their satisfaction with the institution

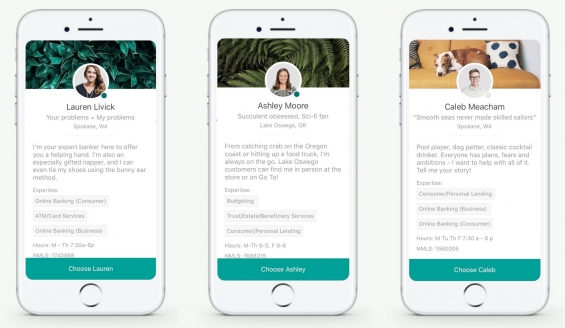

Each Go-To banker has a mini bio similar to what you’d see on LinkedIn. Customers scroll through the choices, selecting their banker based on any criteria they wish.

“We encourage the bankers to put personal background in their bios,” says Eve Callahan, EVP and Chief Communications Officer at Umpqua. The associates took this to heart complete with references to the local food delicacies and sports affiliations. The idea is to strike a chord of connection as customers peruse the choices. Sometimes people choose a Go-To banker because they met the banker at a branch, says Callahan. Other times the choice hinges on a shared interest or background.

And, yes, customers can change bankers if they wish.

Unlike the usual call-center model — including at Umpqua — where incoming call queues make it unlikely that a customer will reconnect with the same service representative again, the Go-To model intentionally aims to cultivate a friendly relationship between the two parties. That’s not a huge stretch for Umpqua, which has built its brand around a particular flavor of service noted for its warm, personal touch — what they describe as a “concierge experience.”

That’s one of the reasons there are no balance requirements and no fees associated with the Go-To Banking program.

“People aren’t willing to pitch the human connection under the bus just for convenience.”

— Cort O’Haver, Umpqua Bank

“All customers — whether they’ve got one dollar or a million dollars on deposit — have access to a personal experience through use of a digital device,” O’Haver says. “You don’t have to be a private banking customer to get that experience.”

“I’m a big believer that, given the chance, people won’t choose a fully-integrated technology solution over a human being,” O’Haver states. “People aren’t willing to pitch the human connection under the bus just for convenience.”

Interactions May Be Primarily Mobile, But They Get Surprisingly Personal

Some Go-To bankers work in the branches where they continue to meet customers in person as before. Others work out of centralized location. By the first of the year, all 270 branches will have a Go-To banker.

Frequently Go-To bankers find themselves engaged in some rather unexpected conversations. Eve Callahan, who heads up Umpqua’s communications team, loves to share the story about the guy who texted his Go-To banker with a few questions about buying a car. After he and his banker built a rapport, the customer they eventually ended up talking about the customer’s possible marriage plans. The customer was deliberating whether — or more accurately when — he should ask his girlfriend to marry him. The customer even asked his banker’s opinion about whether he should pop the question and where to get the ring!

“Fortunately,” Callahan recalls fondly, “the young woman said ‘yes!'”

Then the conversation shifted to how the young man should pay for the wedding. Now the banker and customer stay in touch regularly.

Umpqua expected video chat to be more popular, but so far it’s been a no-show.

Somewhat to the surprise of the bank’s Go-To team, 99% of consumer/banker interactions have been by secure text. The bank had expected video chat to be more popular, but thus far it’s been a no-show.

It’s also possible to email and call Go-To bankers, or schedule in-person meetings with them. But, as Callahan notes, texting allows people to communicate on their terms and time. It’s also less inhibiting, as the marriage example illustrates.

O’Haver initially was skeptical that people would share personal financial details via text. But a test conducted by Pivotus Ventures, Umpqua’s in-house fintech incubator, convinced O’Haver that it would work. Subsequently Pivotus designed and built a new secure texting architecture as part of the Go-To app.

O’Haver explains that customers who wouldn’t think of asking a teller some questions don’t hesitate texting in a mobile chat.

“They’ll talk about how much money they make and how much debt they’re carrying,” he says, “as long as they know it’s not a bot on the other side.”

“The times when money and life intersect are when customers want to connect with a live person.”

— Eve Callahan, Umpqua Bank

This willingness to text pairs well with research cited by O’Haver that 71% of consumers want financial advice, but only 28% say they ever receive it from their bank.

“That’s a huge gap,” O’Haver observes, which makes “having a financial expert you can ping when you have a question all the more appreciated.”

According to Callahan, Umpqua is looking to bridge the gap in those critical moments when life and money intersect. Examples include how to pay for elder care, setting up a new business or just making ends meet.

“When money comes to the forefront, that’s when customers want to connect with a live person versus relying solely on information they found in a blog,” says Callahan.

Read More: Why the ROI of AI Falls Short for Nearly Everyone

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Bots Are Not The ‘Next Step’

O’Haver is often asked if Go-To banking is just an interim step — a temporary bridge to AI-powered banking bots like Erica (BofA), Eno (Capital One), and of course Alexa, the world’s best-known chatbot.

But he adamantly — perhaps even a bit defiantly — insists that isn’t the case. O’Haver is committed to the Go-To banking concept, and believes his human digital strategy is a long-term differentiator.

That notwithstanding, O’Haver acknowledges the value of AI and machine learning to enhance the capabilities of human bankers, but not with the object to replace them.

The tech stack supporting Go-To bankers does not currently incorporate AI, but O’Haver says the team over at Pivotus is working on various AI applications. He concedes that bots can handle some things like balance inquiries more efficiently than real people, but that capability will more likely impact the bank’s call center, where, he says about four out of every five calls are either password resets or balance queries.

By contrast, very few customers ever contact their Go-To banker about account balances, in part because they are mobile-savvy users who know how to find that information on their own. Generally speaking, Go-To interactions are deeper and more personal.

The same platform that Umpqua Bank is now using for its Go-To banker program is available to other financial institutions from Pivotus, according to the bank. The platform is called Pivotus Engage.

Read More: More Digital Banking Experiences Means Humanizing the Tech Beast

How To Scale ‘Personal Banking For All’?

The one question every bank and credit union executive wants to know is: How scalable is a human digital program like Go-To banking?

O’Haver makes two points in that regard.

First, he says that no new employees were added to support the program.

“We selected associates who raised their hand and thought it was a cool idea,” he says. Those who elected to participate were given an special training to help reps make the shift from a role that was primarily geared around problem-solving to one that is more advisory, O’Haver explains.

Second, when asked how about scope and sustainability, O’Haver says that Go-To banking is more scalable than most people would ever suspect. Why? Because customers don’t use it that frequently. The most common interactions, it turns out, are handled by other channels like the regular banking app and call center. As a result, one Go-To banker can handle the financial needs of roughly 1,000 customers the bank found during the pilot phase.

O’Haver says the program has brought in new customers, but did not cite any numbers. “We will make those figures public at some point,” he says. “The investment community wants to know, too.”

Not Just Another CRM Cross-Selling System in Disguise

Umpqua Bank has seen a 15% increase in the depth of its relationships since the inception of the Go-To pilot. In other words, the number of products customers are using — a metric some bankers refer to as “depth of wallet”, “wallet share”, or “products per household” — is up 15% among those participating in the Go-To program.

But O’Haver responds bluntly when asked about the cross-selling potential of the program.

“Let me state clearly: We’re not using this to sell people stuff they don’t need,” he states emphatically. “Go-To shouldn’t be viewed as a sales tool like CRM. We don’t have sales goals, depth-of-relationship, or products-per-person goals for the program.”

“Obviously if there is an opportunity to provide a financial product that is of value to somebody, that’s our job,” O’Haver continues. “In fact, it’s a disservice not to offer such solutions. But I don’t view this program as a way to push products. It’s a way to create a relationship with the customer that’s convenient for them.”

Another interesting statistic from Go-To banking: digital adoption — use of digital tools such as mobile deposit and mobile bill pay — has increased a staggering 69%.

Callahan says Umpqua actually wondered if it might fall. But as management studied the data, they realized that Go-To bankers were introducing people to features and functions of digital tools they weren’t familiar with.

Even O’Haver, who has a Go-To banker himself, admits that they pointed out at least two features of the bank’s mobile app that he didn’t know about.