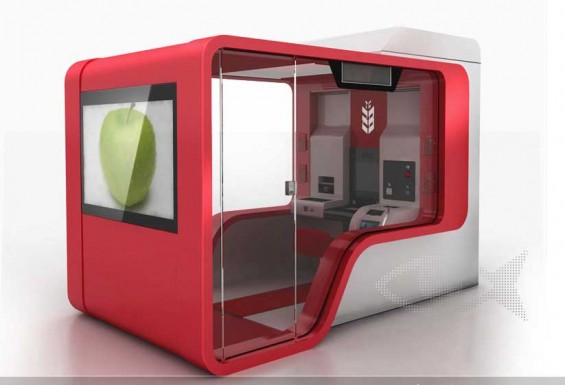

Ziraat Bank has what it claims is the first tellerless branch network in Turkey. The modular, freestanding unstaffed units — dubbed VTMs — use videoconferencing technology to connect customers with tellers at the bank’s contact center.

Ziraat Bank has what it claims is the first tellerless branch network in Turkey. The modular, freestanding unstaffed units — dubbed VTMs — use videoconferencing technology to connect customers with tellers at the bank’s contact center.

The system allows customers to deposit and withdraw money, buy and sell foreign exchange, pay bills, transfer money and buy bonds but does not allow a customer to requests loans.

VTMs also serves non-customers, allowing them to pay bills and transfer money through Ziraat’s system free of charge.

Ziraat keeps its VTMs open 24 hours a day, 7 days a week, 365 days a year.

The bank says that a normal teller could on average perform 76 transactions in a day, whereas with this system this number has increased to 140.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Although Ziraat admits vandalism is a concern — at 70,000 Euros (around US$100,000), the VTMs are not cheap — but feels its customer/account security is sound. Customers verify their identity by a fingerprint scan.

The bank is looking to deploy as many as 1,000 units.

“We are going to introduce the VTM technology specifically in areas that do not have Ziraat branches, especially in Anatolia, and around large Turkish cities. VTMs will also be installed in a number of shopping centers, airports, bus, metro and petroleum stations,” Mesut Güraylı, Deputy GM at Ziraat Bank, told the Hurriyet Daily News.

Ziraat Bank — which translates from Turkish as “agricultural bank” — serves a mostly rural and residential audience.