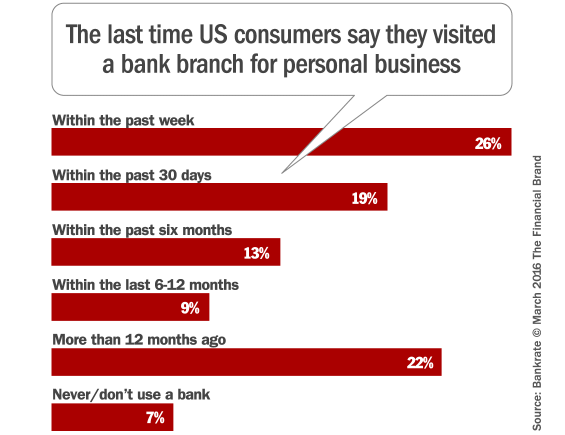

A recent poll from Bankrate found that 45% of Americans had visited a bank branch for personal business within the past 30 days. In fact, their research revealed that only about one in five Americans has gone an entire year without visiting a bank branch.

Somewhat surprisingly though, loyalty to branches cuts neatly across all demographic lines, according to Bankrate. In their study, they found that 4 in 10 Millennials have been in a branch within the past month. That number jumps only slightly to 48% for people between the ages of 50 and 64.

“There is no major distinction among those who are branch loyalists. They are going to branches because of consumer financial behavior, not because they are younger, more educated or have more money,” says Dan Geller, Ph.D., behavioral finance scientist at Analyticom, a behavioral economics and finance firm.

Affluent people seem to have more banking chores. People with higher incomes visit banks more often than people with lower incomes, according to Bankrate’s survey. More than half, 54%, of people earning more than $75,000 per year reported a visit to a bank within the past month compared with 40% of those earning less than $30,000 per year.

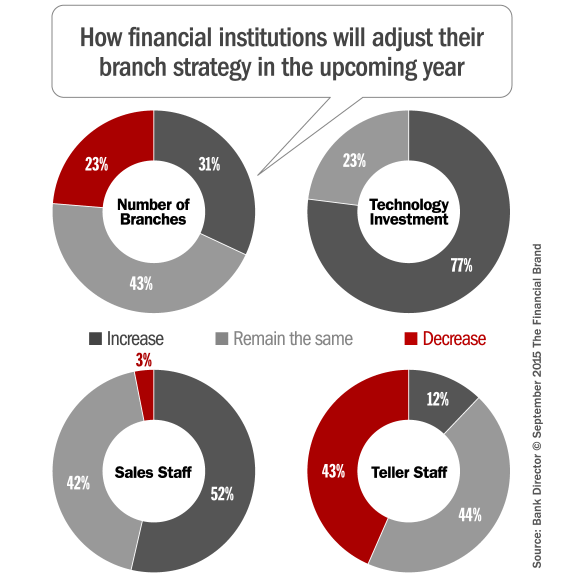

An SNL Financial analysis shows that in 2015, U.S. banks continued to shrink their collective branch count, trimming it by an aggregate of 1,614 locations.

According to the FDIC, the number of bank branches peaked in 2009 at 99,550 and had dropped to 97,337 by 2012. SNL says that the U.S. banking sector finished 2015 with 92,997 branches.

| Bank | Total Branches (Dec. 31, 2015) |

Net Change in 2015 |

% Change in 2015 |

|---|---|---|---|

| Wells Fargo | 6,272 | -39 | -0.6% |

| Chase | 5,459 | -195 | -3.6% |

| Bank of America | 4,769 | -88 | -1.8% |

| US Bank | 3,209 | -35 | -1.1% |

| PNC | 2,745 | -94 | -3.4% |

| TD Bank | 1,321 | -1 | -0.1% |

| Fifth Third | 1,282 | -36 | -2.8% |

| Capital One | 814 | -67 | -8.2% |

| Huntington | 803 | 48 | +6.0% |

| Associated Bank | 224 | -13 | -5.8% |

Bankrate says that huge banks that have historically depended on having large networks of national branches to drum up business are cutting back. In 2012, Bank of America had 5,656 U.S. branches; now it has less than 4,800 branches. In 2013, JPMorgan Chase had 5,694 bank branches in the U.S.; now it has less than 5,500.

“In 5 or 10 years, it seems pretty likely that branch networks will start to become significantly smaller,” says Greg McBride, Chief Financial Analyst with Bankrate. “People who like to bank in person will need to either switch to a bank that has prioritized keeping physical branches in their area, or just bank online like everyone else.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fewer Banks Means Fewer Branches

Bankrate is keen to point out that there are fewer banks now than there were 20 years ago. There were 6,270 commercial banks and savings institutions at the end of September 2015. In 1995, there were 11,971, according to the FDIC.

“We are seeing a reduction in bank branches in rural areas,” says Bert Ely, a consultant to the banking industry and founder of Ely & Co. Inc. “Bank consolidation is leading to a drop in bank branches. A lot of that drop-off is in small towns and rural areas. That is happening across the country,” he says. People in rural areas in Bankrate’s survey were more likely to have been to a bank in the past month than those in urban areas — 50% compared with 44%.

What do rural folks do in the face of branch closings?

“They have to drive further,” Ely says.

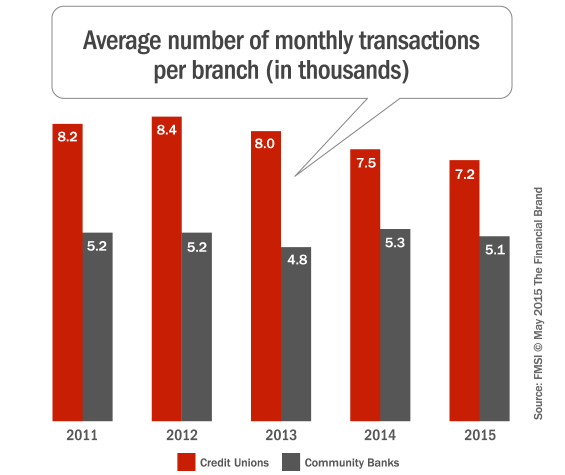

Transaction Volumes Down

FMSI says average branch monthly teller transaction volumes for financial institutions have declined more than 45% in the past 20 years. Their ongoing study continues to reflect a steady drop in branch teller transaction volumes. Credit union teller-transaction volumes per hour decreased 20% between 2007 and 2013 (from 10 down to 8), while teller-transaction volumes per hour at banks decreased more than 32% (from 7.1 to 4.8).

In 2007, FMSI says the average cost per-transaction among community banks and credit unions was 85¢. But by 2013, it had risen to $1.08, an increase of more than 25%. Banks suffered the worst with this metric, with their average cost per-transaction rising 34% from 2007 to 2013. By 2013, it was $1.22 for community banks.

The Impact of Digital Channels

Many financial institutions offer the ability to open bank accounts online, and some even allow users to do so on mobile. Even so, just 23% of new checking accounts are opened online, according to a November 2015 report by Aite Group. Consumers open 28.3 million checking accounts in person annually, but only 7.2 million of those were through a bank or credit union website, and less than 2 million originated on smartphones and tablets, according to Aite’s research.

Of course, not all banks and credit unions offer online or mobile account-opening. For those institutions that do, Bankrate says consumers have a wide variety of reasons why they still prefer to open an account in person: concerns over security, ease of use, lack of awareness, and a desire to meet the people they’re entrusting their money to face to face.

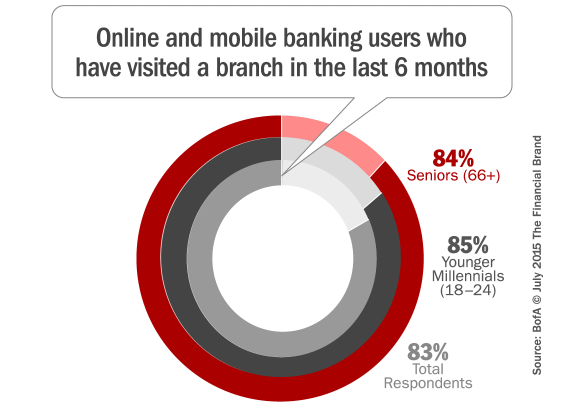

“While the rise of online and mobile banking have made it convenient to do most of our routine financial transactions remotely, it doesn’t mean that bank branches are about to go on the endangered species list,” says McBride with Bankrate. “They’re not going to go away, but the function is going to change, the number is going to change.”

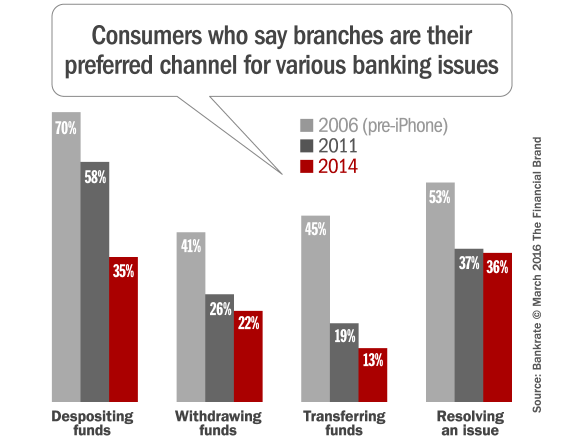

The tide is definitely shifting to digital channels though.

Anne Pace, a spokeswoman for Bank of America, told the Wall Street Journal that branches are still an integral part of their retail delivery model. “Customers want to pay their bills online for convenience. They are using mobile banking to check their balances. They are using ATMs to deposit their checks,” she says. “The banking center is becoming more and more a place not only for basic transactions, but for people to discuss complex issues.”