Situated right in the heart of San Francisco’s Financial District, Umpqua’s newest location feels more like a contemporary store or upscale café than a bank branch. It features mobile concierges, iPads, interactive touch screens, outdoor seating and a free “loaner” bike.

Internationally recognized for its unique banking experience, Umpqua Bank is once again challenging what a branch looks like, how it operates and how it interacts with the community.

“Banks need branches. People like to have a sense that their money is in a physical location and it’s accessible.”

— Eve Callahan,

SVP of Communications/Umpqua

Umpqua’s new San Francisco flagship location is designed to serve as an “interactive resource center, business hub and inspiration generator” all rolled into one.

“It is built to be a community hub in every sense of the word, boasting an innovative store design aimed at fostering collaboration and interaction,” explains Eve Callahan, SVP Corporate Communications at Umpqua.

Callahan says technology is changing the way people interact with their bank, and Umpqua is trying to embrace those changes rather than resist them. That’s why the branch is jam packed with iPads, six projectors and dozens of LCD screens.

“As mobile and digital technology continues to transform how people interact with companies, retailers must continue seeking new ways to create a compelling in-store experience,” Callahan says. “Umpqua’s San Francisco store offers new features designed specifically to engage consumers and businesses.”

Indeed Umpqua wants its new San Francisco location to be more welcoming, more inviting.

This is strategy is clear — literally; the location’s entire exterior is glass, opening the space up to the public and passersby.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

LCD screens facing the street feature a twitter feed using the hashtag #umpquasf, local weather, a calendar of events and bus schedules.

“There’s a huge intimidation factor with financial matters,” Callahan says. “We want to use our stores to make people feel more comfortable.”

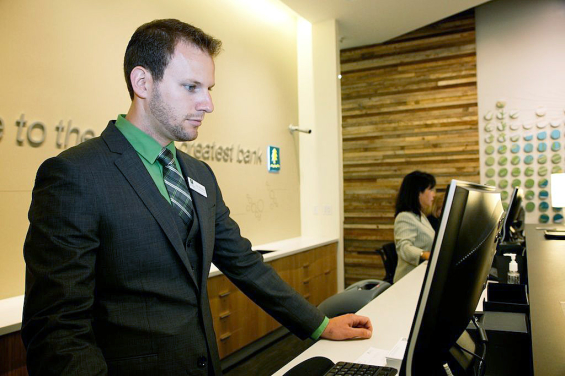

The branch will be continually staffed with two “Mobile Concierges,” roving bank associates equipped with iPads and headsets that help them open and service customer accounts anywhere in the store.

The transaction area (if it’s even fair to call it that) is intentionally designed to look more like a hotel registration desk than the teller ramparts seen in traditional banks.

With the rollout of this new location, Umpqua is also introducing the use of paperless instead of printed transaction receipts.

And hey, if someone needs to borrow a bike for a couple hours, no problem. They can check one out from the bike parking stations Umpqua keeps up front for just such occasions.

Read More: Umpqua Bank Debuts Next-Generation Store Model

The Catalyst Wall

Arguably the most pronounced and profound feature in the branch is the “Catalyst Wall,” a 20-foot long multi-part display exploiting all the five human senses — sight, sound, touch, taste and smell.

The left side of the display houses the “Inspiration Wall,” designed to immerse visitors in the style and flavor of a standout local business. The first business featured is TCHO Chocolates, a high-end confectioner. Customers can sample TCHO’s tasty treats from a “Demo Bar” while learning about the company’s history and approach on interactive touchscreens. A table-top display shows how TCHO makes its chocolates, with samples of real cocoa bean pods that customers can touch and smell. Executives from featured companies will speak at the branch and give entrepreneurs business advice. Companies featured in the Catalyst Wall will be rotated quarterly.

The left side of the display houses the “Inspiration Wall,” designed to immerse visitors in the style and flavor of a standout local business. The first business featured is TCHO Chocolates, a high-end confectioner. Customers can sample TCHO’s tasty treats from a “Demo Bar” while learning about the company’s history and approach on interactive touchscreens. A table-top display shows how TCHO makes its chocolates, with samples of real cocoa bean pods that customers can touch and smell. Executives from featured companies will speak at the branch and give entrepreneurs business advice. Companies featured in the Catalyst Wall will be rotated quarterly.

The other sections of the Catalyst Wall are a mix of resources and tools — some functional, others purely inspirational — spread across six more interactive touchscreens. The “Expert Minds” section features interesting thinkers and innovators from around the Bay Area, people like In the “Products & Goals” section, visitors can learn about the bank’s products using a “holistic interface” (e.g., “I’d like to retire when I’m 55” instead of the standard, predictable “Investments & IRAs” product tab other financial institutions would probably use). The “Digital Tools” section is an interactive showcase of mobile apps, including some from Umpqua as well as others the bank has curated.

Brimming With Branded Spaces

The “Spark Resource Center” space includes publicly available iPads loaded with subscriptions to publications such as the Harvard Business Review. There’s also “Recharge Bar” where anyone — customers or the general public — can juice up their mobile devices. And if you want to talk to Umpqua’s CEO Ray Davis, you can just pick up the hotline phone that’s piped straight into his office (no, this is not a gimmick; Ray will actually answer the phone, although Callahan says a majority of the phone calls the CEO receives are usually from people who don’t believe it’s true or from reporters).

“We believe the branch — the store — is our most powerful brand vehicle.”

— Eve Callahan,

SVP of Communications/Umpqua

The “Data Research Station” offers San Francisco businesses access to public and proprietary third-party resources providing insight into consumer and industry trends, including the coveted Lexis Nexus database.

The “Business Lounge” is an invitation-only space is designed for larger group meetings or sessions, and will feature events with local business and thought leaders.

Umpqua’s “Exchange Rooms” are flexible-use spaces open to everyone, not just customers. Umpqua associates can use them to meet with clients, but small groups can also reserve the rooms for free, where they can deliver presentations, hold virtual meetings or simply have a meeting.

Read More: Umpqua Unveils New ‘Neighborhood Store’

In the weeks building up to the location’s grand opening, Umpqua published tweets from Twitter users on the exterior construction wall of the building. Umpqua asked people to share their favorite San Francisco business. Local artists hand-wrote selected tweets on the wall, rotating them a couple times per hour. You can see a gallery here.

“For nearly 20 years we’ve been focused on creating a different banking experience, one centered on the idea that banks need to operate differently in order to remain relevant,” said Ray Davis, Umpqua Bank president and CEO. “Our new flagship is the latest iteration, built to reflect the preferences of today’s consumers and businesses and empower customers to engage with us in a variety of ways.”

Umpqua debuted its first “store” concept in 1995, which then evolved in 2003 to become a “community hub.” In 2007, the bank rolled out its first “neighborhood store” in Capitol Hill in Seattle.

The San Francisco flagship is Umpqua Bank’s eighth store in the greater Bay Area, adding to locations in downtown San Jose, Noe Valley, Novato, Corte Madera, Santa Rosa, San Rafael and Petaluma.

The new space was developed by Portland-based Huen in Portland and an architectural team from McCall Design Group in San Francisco.