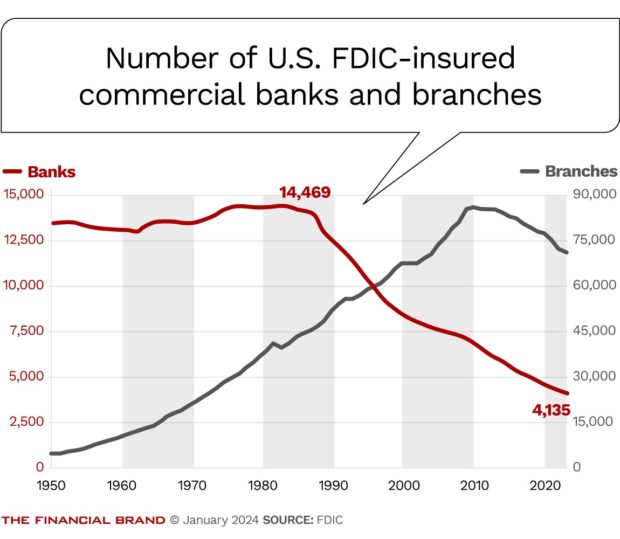

Reality check: The last time the number of physical bank locations actually increased was 2009: the same year Barack Obama took office and the swine flu pandemic had us washing our hands (not for the last time). Since then, there’s been a steady decline in the total number of branches: there were an estimated 100,000 bank branches in the U.S. in 2009.

Now, there are less than 72,000.

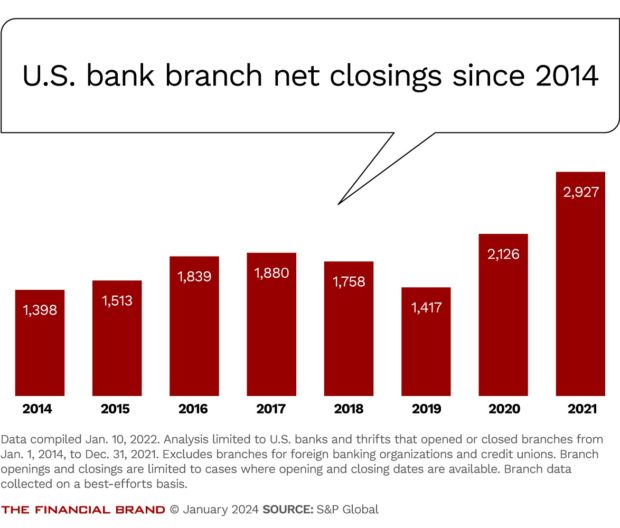

The pace of closures has not been uniform the past decade and a half, however, with the overall number of branches experiencing a steep decline during the pandemic’s toughest years.

The pace matters because it’s both a reflection of banks’ operational efficiencies and their perception of untapped opportunities among consumers as well as small- and medium-sized businesses. It’s also indicative of how banking itself has changed, as more businesses and consumers forgo in-person services, increasingly making use of online banking capabilities instead.

So, are steep declines of bank branches the new normal? Will we see widening “banking deserts,” where in-person capabilities are not available?

Let’s look at the data.

In 2020, the first year of Covid, net closings rocketed to 2,126 — a record. In 2021, the record was broken again, when net closures grew by a staggering 38% to just under 3,000, according to data from S&P Global Market Intelligence.

Net Branch Closures Finally Eased in 2023

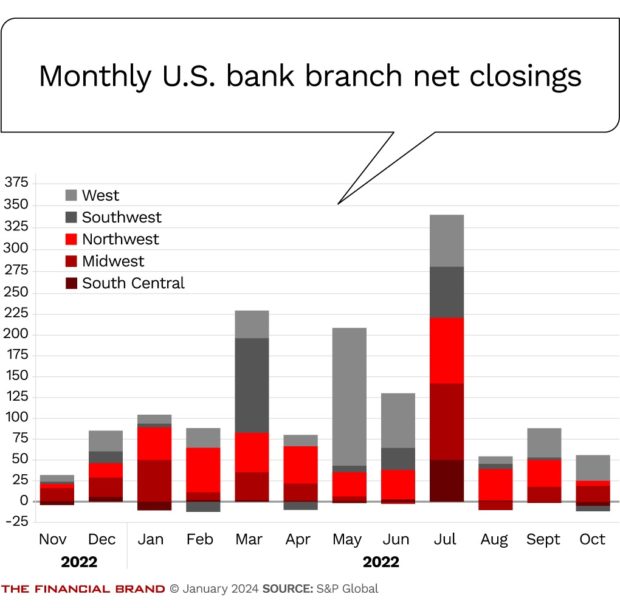

As Covid faded, the branch closure trend moderated. A review of last year’s data reveals an estimated 3,000 branches closed, but this time against 1,000 openings, placing the net closures more in line with pre-Covid levels. At just over 2,000 net closings, 2022 totals show an overall deceleration in branch closings.

What about 2023? The trailing 12-month average for net branch closings, which includes the end of 2022, stands at 117 — compare that to 172 this time last year, according to S&P Global Market Intelligence, and there’s a clear slowdown. If the rate holds, that will amount to another decrease in the pace of overall closings for 2023.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

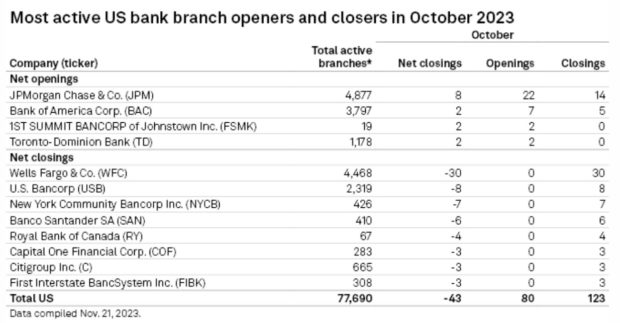

Reinforcing that trend are totals from September and October, when there were 73 and 43 net closures, respectively.

What remains to be seen is how much 2023 branch openings will offset 2023 closures. In many cases, that comes down to individual financial institutions and where they fall in the branch optimization cycle.

Overall, Wells Fargo continues to shutter the most branches, with 30 closures in October and no openings. On the other end of the spectrum, JPMorgan Chase reported only 14 closings against 22 openings in the same timeframe, a net gain.

Overall, Wells Fargo continues to shutter the most branches, with 30 closures in October and no openings. On the other end of the spectrum, JPMorgan Chase reported only 14 closings against 22 openings in the same timeframe, a net gain.

Some banks may have simply run out of branches to close. In the case of JPMorgan Chase, the co-CEO of consumer and community banking, Marianne Lake, says its branch network has “less and less accretive opportunities to consolidate.”

Most of the optimization has already taken place, she says, meaning branch totals will most likely be flat or could even increase.

Branch Trends in 2024

Multiple banks have already announced their intentions for further reductions, including PNC, where at least 19 branches are set to be closed by February across multiple states. Huntington Bank recently announced the intended closures of 34 branches by the end of March. Smaller institutions, likewise, have already announced plans for trimming brick-and-mortar locations.

Additionally, after a near-freeze in 2023, bank M&A activity may pick up next year, meaning further company consolidations — and more branch reductions.

“We’ve seen banks look to shrink their branch networks, with a focus on cutting less-profitable branches that generate less customer traffic.”

— Nathan Stovall, S&P Global

Some segments are already showing an acceleration that will spill into 2024, such as supermarkets, where branches are comparatively closing seven times faster.

“In-store branches have fallen out of favor at many banks,” Nathan Stovall, head of financial institutions research at S&P Global Market Intelligence, told CNBC. “We’ve seen banks look to shrink their branch networks, with a focus on cutting less-profitable branches that generate less customer traffic.”

While banks like JPMorgan Chase may have nearly bottomed out, others, like Wells Fargo, may not be anywhere near a bottom. As Wells Fargo CEO Charlie Scharf acknowledged in a recent earnings statement: “This company is not efficient — like period, end of story.”