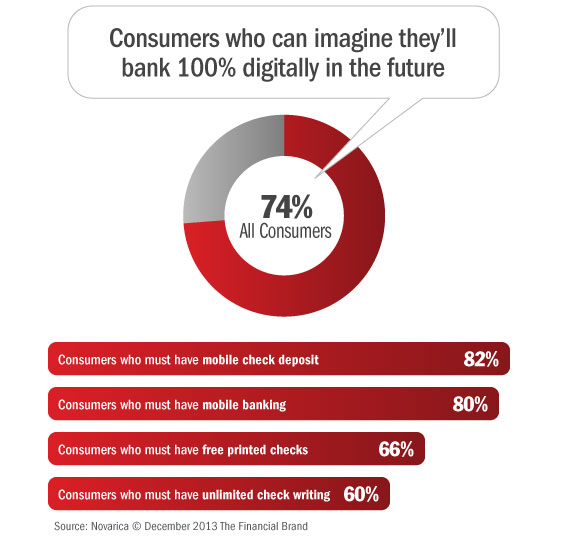

Many banks and credit unions are winding down branch network size and downsizing existing branches while expanding digital service channels to support customers. This makes sense: Nearly three-quarters of bank shoppers believe they’ll do all their banking virtually in the future. The paradox is that branches are still very important for new customer acquisition. Today, many consumers choose the institution with the most convenient branch locations and many will go into branches to open accounts. But after that, most will visit branches very infrequently, if ever.

According to data from FindABetterBank, consumers who are specifically interested in mobile banking services are very likely to believe they’ll bank 100% virtually in the future. While fewer banking “traditionalists” (those using checks, for instance) see an all-digital future, it’s still a healthy percentage — nearly two-thirds.

One’s interest in specific features also correlates with age. Younger shoppers are more likely to be interested in features like mobile banking and older shoppers are more likely to be looking for traditional checking account features like free check printing.

When you tie all this together, there’s a strong connection between the way banks and credit unions market their brand, their products and their branch network strategy. If your financial institution’s products attract the growing segment of mobile-centric consumers, then you’ll be able to accelerate the branch wind-down process. But if your strength still see your greatest success among baby boomers (a shrinking segment), you may need to keep those branches open a little longer.