Today, about 70% of consumers shopping for deposit products do some or all of their research online. Despite their affinity towards online research, most of these online shoppers will end up opening their accounts at branches. Why? Most believe it’ll be more convenient. Not surprisingly, these shoppers usually choose a bank or credit union with a branch near where they work or live.

Even though consumers transact less in branches than in the past, most still perceive institutions to be “convenient” based on where their branches are located. Mobile banking is driving wholesale change in the financial industry because mobile bankers are different. Case in point: shoppers on FindABetterBank that “must have” mobile banking are less likely than other shoppers to select an account because the institution has convenient locations.

The perception of convenience correlates strongly with purchase intent. So a strategy to reduce the number of branches must include a strategy to establish the brand as convenient for features and attributes that aren’t associated with physical locations.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

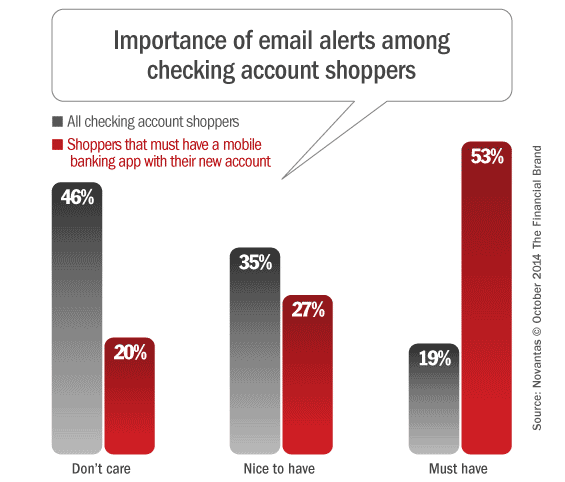

Focusing on the non-physical features today’s mobile bankers want is a good place to start. For example, mobile bankers demand email and text alerts more than other shoppers do. Fifty-one percent of shoppers that must have mobile banking apps also must have alerts – only 16% of non mobile-centric shoppers have the same requirement. Women tend to show more interest in alerts than men, as do people who are more tightly managing their finances (lower income households, older consumers).