Americans are increasingly turning to their bank’s mobile app to conduct financial tasks, but many still rely on in-person interactions when seeking financial advice or learning about services, according to a new study by Market Force Information.

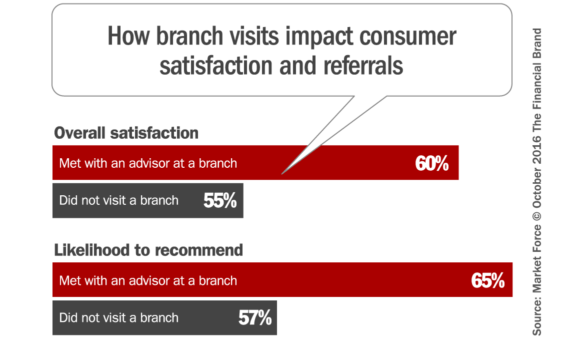

In a survey encompassing more than 9,500 participants, they found that the in-person experience at branches is still important for banking consumers. In the past 90 days, one-fifth of respondents said they went into a branch to speak with an advisor about new products and additional services. Those who did reported 5% higher satisfaction levels than those who didn’t, and they were 8% more likely to recommend their bank to others. In other words, you may be able to move people to digital channels, but other aspects of your brand may suffer if you don’t also provide consumers with the option to meet in person when they need financial advice or want to learn about other products and services.

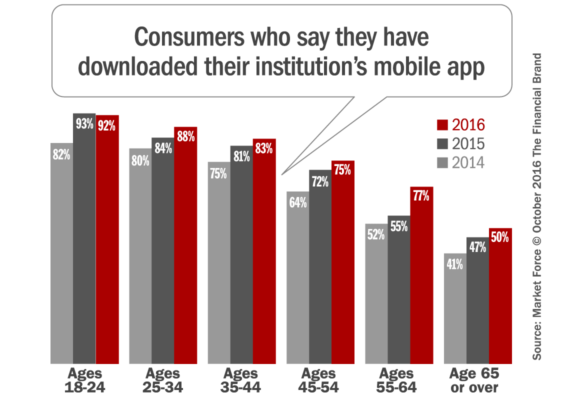

Market Force Information found that 77% of consumers whose bank offers a mobile app have downloaded it, an increase of 5% over 2015, and 12% over 2014. Those in the 18-24-year-old range have the highest adoption rate at 92%, but there are increases across all age groups. In fact, half of those over age 65 use their bank’s app.

“Mobile banking is gaining ground every year as people of all ages are more comfortable making transactions on their smartphones,” said Cheryl Flink, Chief Strategy Officer for Market Force Information. “Does that mean physical banking will eventually be eradicated? Unlikely. A more likely scenario is that, similar to what we’re seeing in other retail industries, physical banks will be reinvented and have more specific, dedicated functions to service consumers in person.”

While mobile app use is on a fast track, digital wallet usage is growing at a much slower pace. 57% of consumers surveyed don’t even know what a digital wallet is or how it is used. Only 14% say they are using digital wallets today, a slight increase of only 2% from 2015, with the highest adoption rate among 25-34 year-olds. PayPal Mobile and Apple Pay are the most widely used digital wallets.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Traditional Banking Providers Hold Their Ground in The Battle for Consumers Hearts, Minds and Wallets

Neobanks may get a ton of coverage in the financial press, but they aren’t making much of a dent when it comes to market share. In the Market Force study, only 3% of participants say they use a digital-only bank with no physical branch locations. More than half of consumers said they still bank with traditional retail banks; 59% report doing so today, representing a 4% drop from 2015. Credit unions and community banks are steadily rising in popularity, with 30% giving their business to these financial institutions.

With 85% of consumers reporting that they’ve stayed with the same banking provider for three years or more, it’s clear that inertia remains a powerful force in the banking industry, and that consumers see very little difference between one institution and another. Still, 12% say they are considering switching their primary banking provider within the next six months. Most said they’d switch for one of two reasons: either to find lower fees, or because they don’t believe their bank is looking out for them.

“By and large, consumers rated their primary banks poorly when it comes to looking after their financial wellbeing,” said Flink. “Most retail banks are missing an opportunity to differentiate through trust — a message that consumers are anxious to hear.”

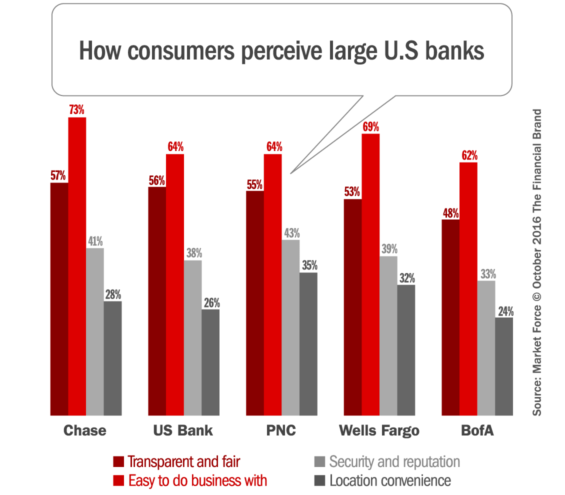

To learn which banks are delivering exceptional experiences, Market Force Information asked participants to rate their satisfaction with their most recent banking experience and their likelihood to refer that national bank to others.

PNC Bank ranked first in two of the four areas that impact customer satisfaction, including “Security and Reputation” and “Location Convenience.” Chase nabbed the top spots for “Ease of Doing Business” and “Transparency and Fairness.” Wells Fargo scored well in some categories, but the fallout from their cross-selling scandal will surely hurt their standing with consumers.

Out of the five banks studied, Bank of America was last in each attribute, a position unchanged from the 2015 study. They are clearly the most vulnerable megabank out there today, and smart financial marketers will take advantage of this by targeting BofA’s customers directly.