Millennials may take the prize as the most analyzed generation, from a marketing standpoint, but the next-younger generation, Gen Z, isn’t far behind. Considering that as of 2020 the youngest members of Gen Z are still five years old, that may seem a little over the top.

It’s not. Gen Z is nearly as big a generation as Millennials, and the older half of it, roughly age 15 to 25 in 2020, is both immediately relevant for bank and credit union marketers and an important indicator of future consumer expectations.

For the third year straight, Manole Capital Management (MCM), a fintech-focused hedge fund, surveyed Gen Z consumers specifically about their banking and payment preferences. The sample group of nearly 300 college students ranged in age from 18 to 25, most of them still in college, but all with established banking relationships. Eight out of ten respondents were banking with a major national bank, the rest had accounts with community banks or credit unions. The survey was taken just as COVID was ramping up in the U.S.

Will Gen Z Bank with Google or Amazon?

Warren Fisher, Founder and CIO of Manole Capital Management, admits to being surprised by one of the answers to a question in his Gen Z banking survey. These younger consumers were asked if they would be willing to let big technology companies handle their banking.

“There is definitely a clear separation of church and state, and most of these kids want to get their banking services from a bank and not from big tech.”

— Warren Fisher, Manole Capital Management

As Fisher tells The Financial Brand, “Each year I expect them to say, ‘Hell, yeah, I’m on my phone all day. I’m on Facebook or Instagram or Apple. Why wouldn’t I trust them to do my banking?’ But there is definitely a clear separation of church and state, and most of these kids want to get their banking services from a bank and not from big tech.”

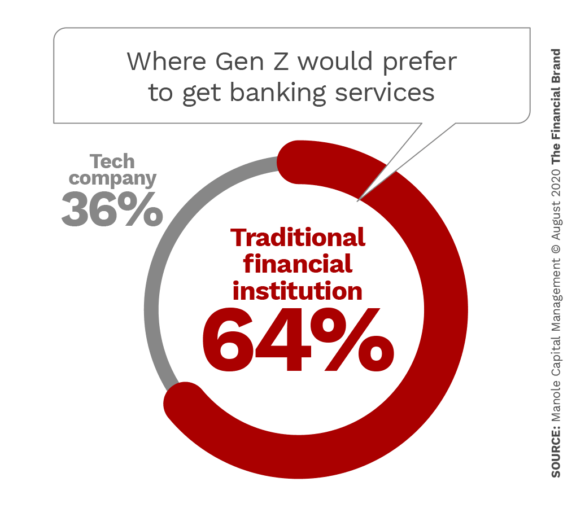

Nearly two-thirds of these college-age respondents say they would rather get their financial services from a traditional financial institution compared with just over a third (36%) that would be willing to use Facebook, Google, Amazon or Apple. This wasn’t a one-year anomaly. The result was substantially similar to the same question asked in 2019, when 34% said they would be willing to use a tech company for banking.

Respondents were asked to rank the banking channel for trust on a score of 0 to 10 with 10 being “very trustworthy.” Just short of 90% of Gen Z consumers give their financial institution a score of 7 to 10, according to the MCM survey report. Clearly Gen Z believes that banks and credit unions are generally trustworthy, the report states. An interesting side note mentioned is that just 50% of the respondents were aware of the 2016 Wells Fargo account opening scandal.

Of the Gen Z consumers who would consider using a tech company for banking, Apple was the company most often selected, at 33%, according to the report, followed by Google at 16% and Amazon at 6%. Only 0.4% would bank with Facebook.

Such data reinforces the idea that the big techs have concluded that partnering with banks is preferable to becoming a bank. Google’s August 2020 announcement that it had added six more financial institutions as partners in its Google digital banking account, is further evidence of this trend.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Even Before COVID, Gen Z Embraced Branchless

Some surveys have found that members of Gen Z actually like to come into a branch. One explanation of this is that these young consumers are just starting out — opening their first banking account — and need help or want to establish a human connection.

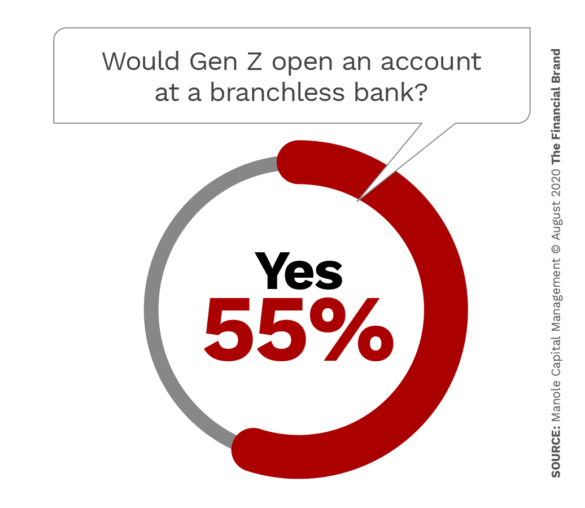

That view isn’t supported by the MCM survey, however, which explores the branch issue from several angles. First it asked members of Gen Z if they would consider opening a banking account if the institution had no physical branches. More than half (55%) of these college age consumers would consider that.

Further, a near-unanimous 90% of the Gen Z respondents said they did not feel “comfortable or safe going to a branch right now,” because of the coronavirus, and 82% said they did not believe that ATMs were a sanitary means of banking.

The “safe” response may or may not be a long-term view, but taken together, these findings could give pause to banks and credit unions that are considering whether to continue to invest in physical locations, the MCM report states.

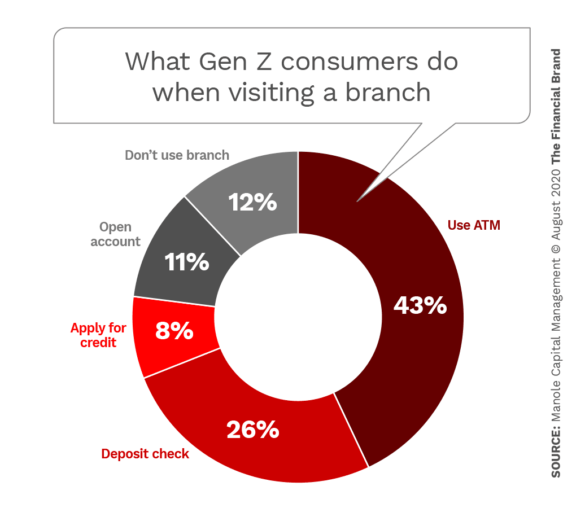

While the following chart suggests that at least prior to the pandemic, many Gen Z consumers did visit a bank or credit union branch, the reasons they did so are a little surprising on the surface — primarily to use the branch ATM or to deposit a check.

Read More: Connecting with Gen Z: Six Tips for Banks & Credit Unions

The ATM usage may be explained by the desire to avoid the fees of out-of-network ATMs. But check depositing is a puzzler, Fisher concedes. Even though 42% of Gen Zers use remote capture to deposit checks, as noted below, still about a quarter go to a branch to make a deposit. The firm didn’t ask for an explanation in the survey.

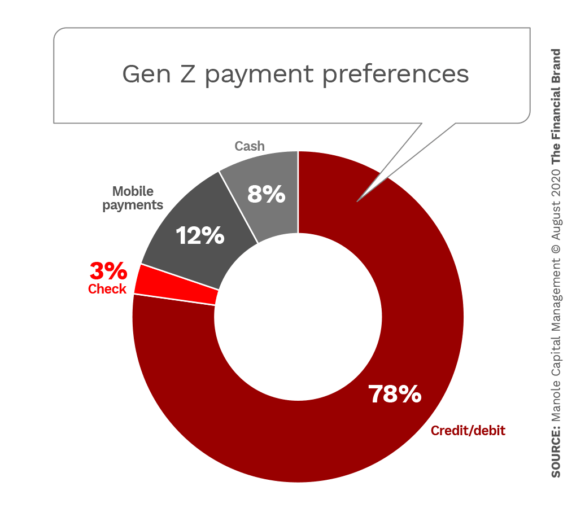

ATM usage at least should decline with the trend away from cash and towards mobile-based payments and contactless payments, the report predicts. As shown below, cash is the preferred payment for only 8% of the respondents. “We believe that Gen-Z does not have the same need for cash because they can easily make mobile peer-to-peer payments with Venmo or Square’s Cash App,” says the report.

MCM also makes this observation: “If the two most popular reasons to visit a bank branch are getting cash and depositing checks, we believe that banks will begin to phase out expanding their costly physical presence.”

How Gen Z Uses Online Banking

If the above findings suggest some ambivalence among Gen Z towards branches, the survey found no such uncertainty regarding use of online banking. 96% of Gen Z respondents said they use online banking services.

“Venmo is not a banking function in their minds. It’s seen much more as a mobile function.”

— Warren Fisher, Manole Capital Management

To bankers accustomed to thinking about advanced online and mobile banking features, however, what Gen Z actually uses may be surprising. As the survey uncovered, the favorite digital banking feature was simply checking their balance, which exactly half cited. This was closely followed by scanning and depositing checks at 42%. Paying bills was a distant third at 8%.

As the report (which was written in part by Gen Z interns) states: “With limited funds in our bank accounts, we are always looking to ensure we aren’t exceeding our spending allowance. This is why we are constantly checking our available balance. For most of us, many of our monthly bills are still paid for by our parents.”

Some retail bankers may wonder why person-to-person payments, a favorite feature of Gen Z, is not listed among the most popular features. Warren Fisher says that’s because for these consumers “Venmo is not a banking function in their minds. It’s seen much more as a mobile function.”

Read More: Why Millennials and Gen Z Love Megabanks

Cards Strongest But Mobile Payments Growing

Because members of Gen Z were practically born with a smartphone in their hands, it is sometimes assumed that mobile payments predominate with them. They do love Venmo, but for more than three quarters of Gen Zers their preferred method of payment is a credit or debit card, a separate MCM payments survey revealed. However, that percentage declined from 89% in 2019. Mobile payments, on the other hand, increased from 3% last year to 12% in 2020. In addition, 75% of Gen Z say they would use mobile payments more, if given the option.

College age consumers’ preference for mobile P2P payment apps is decidedly one-sided based on the MCM survey results. Nine out of ten of them said they use Venmo, the P2P app. The remaining 10% was split between Apple Pay Cash 4%, Zelle 3% and PayPal 3% (PayPal owns Venmo, but has other applications).

Venmo’s lead has increased significantly since 2019 when 75% of Gen Z respondents said they used the app. Zelle, a P2P product created by a consortium of banks, actually has greater dollar volume than Venmo because its per transaction amounts are much higher, Fisher notes. But Venmo is the clear choice of the younger set.

“Can I Venmo you?” is a widely used phrase, especially among Gen-Zers. “Once a product gets known as a verb,” the report points out, “it usually is the defacto winner.”