In the telecommunications/media world millions have “cut the cable,” canceling or not renewing their cable television contract. Instead, they get their news and entertainment over the internet, increasingly using streaming technology, often live. It’s an apt analogy for financial institutions.

In banking, millions of consumers have given up the weekly or even monthly trip to their nearby branch, preferring to use a combination of website or mobile applications — not to mention ATMs — to handle the majority of routine banking needs, and increasingly some less-than-routine needs such as taking out a loan.

For the vast majority of retail banking institutions, this trend is, if not existential, at least extremely important both from the point of view of continued relevance and for its impact on profits and the allocation of capital and other resources.

This is also a trend a long time in the making. But like watching a train approaching from a great distance, it’s suddenly upon you deceptively fast. Just a few statistics bear out that a time of decision over branch strategy is at hand:

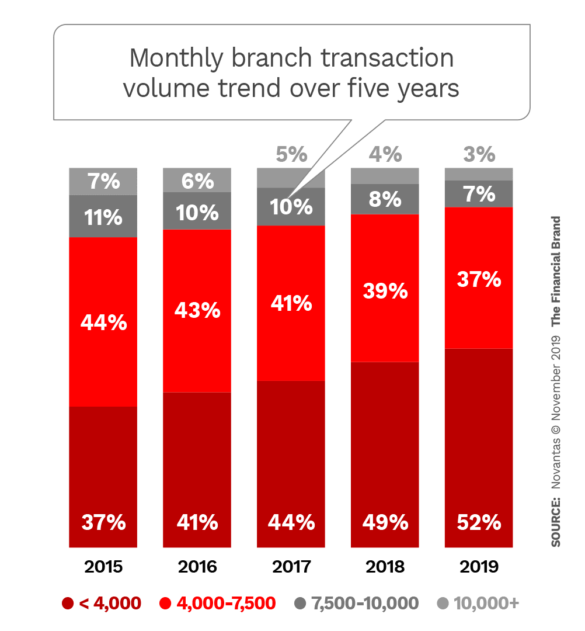

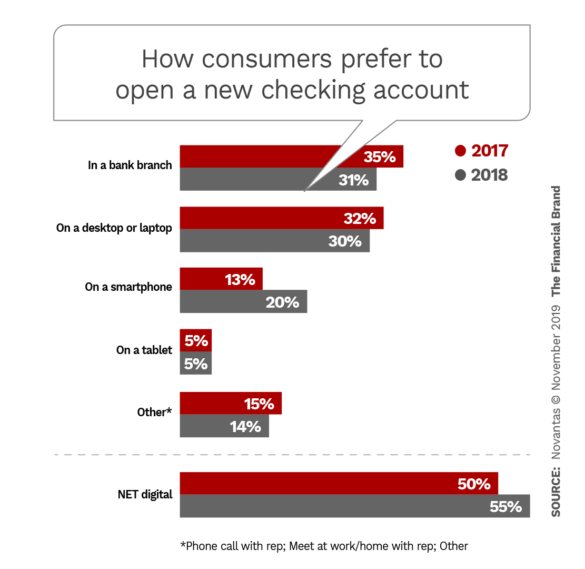

In 2019 53% of retail banking customers use mobile banking (J.D. Power). In four years the number of financial institution branches processing fewer than 4,000 transactions a month has risen from 37% to just over half (52%) (Novantas). And more than half (55%) of consumers would prefer to open a new checking account digitally (Novantas).

At the same time, other statistics suggest that in-person branches still drive the most sales and many people still use them.

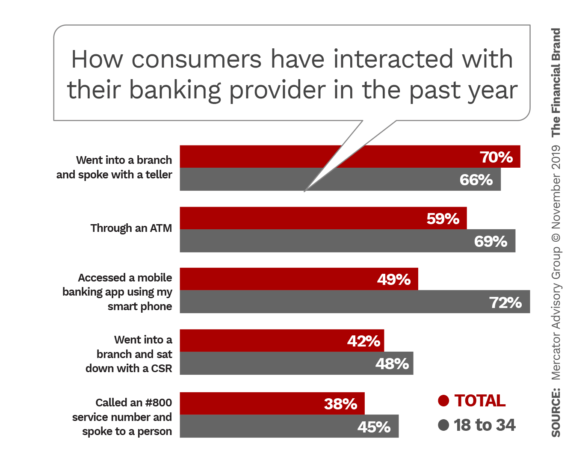

Just over seven out of ten (71%) of “banked” consumers still use branches, though they now make half as many branch visits (J.D. Power).

Three out of five (60%) retail banking executives say the branch is the leading sales channel — counting account opening, credit cards, insurance, investments, loans (World Branch Report).

One out of five (20%) consumers say the branch is their preferred channel (Mintel).

66% of consumers in the 18 to 34 age range list going into a branch to see a teller as how they interact with their financial institution compared with 72% of the segment who use a mobile banking app (Mercator).

In short, branch transactions and visits are down sharply and will likely continue to decline, but people do still come in and the visits continue to produce the largest proportion of loan and other new business. That, too, is changing, but for now it is significant.

The Financial Brand interviewed several retail banking experts and combed through numerous reports to help banks and credit unions determine their branch strategies for 2020 and beyond.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Managing the Transition from Physical to Digital Is Not an Option

A variety of sources view branches — particularly as traditionally set up and used — as a diminishing asset. Digital is the future and the industry needs to wean itself from the expense of physical locations that fewer and fewer people use. Not overnight, of course, and not entirely, but as a strategic direction.

“ Customer volumes are so low that Novantas believes … the traditional teller/sales platform staffing model is nearing the end of its useful life.”

Novantas sums up the branch status quo succinctly: “Customer volumes are so low that Novantas believes there is stranded capacity in most branches. In short, the traditional teller/sales platform staffing model is nearing the end of its useful life.”

The firm points out that about a third (30%) of the staff in the typical financial institution branch is made of generalists, also known as universal bankers. Another 30% are tellers. Of the remainder, 20% are salespeople and 20% are managers. Not a recipe for a quick and dramatic shift to the largely advisory and sales role many see for branches going forward.

One overarching point in this context is that the scope, cost and complexity of upgrading a network of 30 to 100 branches is a huge roadblock.

“Digital moves so fast,” Bob Meara, Senior Analyst, Banking Group, for Celent tells The Financial Brand. “Almost every institution’s got an agile-software dev-ops framework now, so it’s not a big deal to put a new feature or two in their mobile app and launch it in the span of six to eight weeks. But try doing that with a few hundred or thousand branches.”

Digital bankers for the most part don’t have to worry about getting thousands of bankers trained and armed with all the information and equipped with the right tools, the analyst points out. The whole process is just massively more difficult and complicated in the branch channel.

The question becomes: How many institutions have the budget, the capability — and the will — to overcome these hurdles to keep their branch networks viable? The status quo does not seem to be an option. Even though parts of the customer base still value and use branches, observes a Boston Consulting Group report, “their role is going to change fundamentally, with a new focus on brand presence and high-value interactions rather than service.”

Read More: Don’t Abandon Branches to Favor Digital Banking Channels

Modernizing Branch Networks: It Must Be Done

A rapid upgrade of all of an institution’s branches in terms of staff capabilities, technology, data and design is not practical for likely all traditional institutions with more than a handful of branches. But seven out of ten bank and credit union executives polled by Thynk Digital for The World Branch Report 2019 said their institution’s survival depends on a physical presence.

They’re either in denial about the accelerating trends to digital banking or actively seeking to better align in-person banking with digital banking.

“Every bank and credit union we talk with understands that retail banking is evolving, and that branches are affected,” states Joe Wheeler, Senior Director and Mid-Size Bank Practice Lead for J.D. Power. “There is no denial of the influence or growth of digital banking channels,” he adds.

“For institutions where branches look and do the same thing as they have done for 30 years, consumers have no need to visit them and traffic will continue to decline.”

— David Horton, Thynk Digital

“The arguments for and against branches always assume the old-style branch model, but never the new ones that are showing success,” observes David Horton, Global Head of Innovation for Thynk Digital. Yes, branch traffic is down overall, but Horton maintains that is not an irreversible trend. For institutions where branches look and do the same thing as they have done for 30 years, consumers have no need to visit them and traffic will continue to decline, he states. But in branches where there are new digital tools and advisory capabilities that customers will value, traffic will rise.

“In branches we have modernized,” Horton states, “and in some cases co-branded with a non-bank business, we have seen footfall increase by a minimum 30%.”

Traditional workforce tools worked well when there were more tellers and transactions, but not now, according to Novantas. Banks and credit unions now need ways to analyze things like when are people coming in and why, what are the customers’ demographics, their relationship with the institution. That way, the firms states, the institution can have the right employee in the branch on Thursday mornings when day-spa owner Ms. Jones comes in to make a deposit. Maybe she would benefit from a line of credit or a new service to better predict cash flow.

“Customers demand quality conversations when they make the effort to come into a branch,” Novantas states.

Joe Wheeler agrees but points out that front-line staff needs to engage in conversations not selling. “Conversations aren’t data dumps on products. They are targeted and relevant to the life stage of the person meeting with them is in.”

Read More: Busting The Three Biggest Myths About Retail Branches in Banking

Branch Staff Need Better Tools to Avoid ‘Flying Blind’

The quicker digital banking capabilities are integrated into branch systems, the more likely will this happen. KeyBank, for example, integrates learnings from its financial wallet app HelloWallet, according to a Comperemedia report, so that when branch reps sit down with a customer they can use that data to run through basics about the person’s financial situation, goals and progress.

Meara is a big proponent of banks and credit unions offering online appointment booking. It allows branch staff time to prepare for a visit. “No good salesperson walks into a sales call cold,” he says. This is particularly important with more institutions using fewer people in their branches, many of them universal bankers who too often are flying blind with walk-in customers. To help increase use of appointment scheduling apps, Novantas suggests promoting the idea to consumers that they’ll get better service with the right professional by scheduling.

Horton takes this a step further saying that with right digital tools, a branch professional cannot simply speak about the best home financing options, but show a consumer what homes they might want to consider, the current trends in the property market, insurance options, and more. “Where better to put this combination of expertise and tools than in a branch where long-term relationships are forged?” Horton states.

There is still a great deal of work to do for many banks and credit unions to get to the point that Horton describes. The chart below, adapted from the Comperemedia report “Bank Branch Innovations 2019,” shows the results of a group of mystery shopper visits arranged by the firm to branches of nine large and regional banks and one large credit union.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

How Will Platform Banking Impact Branches?

With the news of Google partnering with Citibank and Stanford Federal Credit Union to offer checking, along with earlier announcements involving Chase and Amazon and Facebook’s Libra digital currency, does it even make sense to talk about modernizing branches when the basic banking model itself may be in question?

In addition to the Big Tech forays into banking, Celent’s Bob Meara points out that it is “crazy-easier than ever” for a fintech to get into the banking business. BBVA’s open API platform can get them up and running in six weeks, he says.

“If you’re a smaller financial institution, why not outsource everything except customer-facing sales and support. And why not share branches?”

— Bob Meara, Celent

“All this makes me think that if you’re one of the 12,000 smaller financial institutions in the U.S., why would you want to have a vertically integrated business model? asks Meara. “If so much of running a bank is much more efficient at scale, why would you try and compete as a small organization? Why wouldn’t you just say, ‘Why don’t we just outsource everything except customer-facing sales and support?'”

Meara relates this specifically to the issue of the future of branches. Part of the branch challenge, he says, is you can only make it so efficient. You still have buildings and lighting heat and cooling and all that, which won’t scale like digital.

He floats the thought that other community banking institutions could take a page from credit unions’ playbook. Many credit unions not only share networks of ATMs, they share branches. The Co-op Shared Branch network, for example, has 1,850 participating credit unions. It’s also a practice that’s been used by banks in other countries, as well.