Many of those in the financial industry were surprised when both JP Morgan Chase and Bank of America announced that they would be increasing their efforts to build new branches. Chase said it planned to build 400 new branches, mainly in new markets over the next five years. Bank of America revealed that they would open 500 new branches, largely in new markets over a similar timeframe. Both banks admit they will continue to prune their networks elsewhere, so branch totals won’t see a huge increase.

“The heart of our company is our retail branches,” says Gordon Smith, CEO of Consumer & Community Banking at Chase. Smith’s expansion strategy will target between 15 and 20 new markets in several states, representing a relative increase of nearly 8%. “We are a leader in 23 states, but aren’t yet in major markets like Washington DC, Boston, Philadelphia, and others.”

In a press release, Bank of America said their new financial centers will roll out across its nationwide footprint, including Ohio where they plan to offer retail banking services in Cincinnati, Cleveland and Columbus. BofA already has a long history of serving clients in these markets, where it provides commercial and business banking, as well as wealth management services through Merrill Lynch, to more than 775,000 customers across Ohio. BofA’s strategy in Ohio echoes similar expansions in Denver, Minneapolis and Indianapolis, and the bank has future plans to expand in Pittsburgh, as well.

The number of new branches isn’t the most surprising aspect of this story, but rather the timing and the markets that are particularly interesting. In my 11 years at Bank of America leading their retail distribution strategy, we studied the potential entry into new markets every year as part of our overall plan. After reducing the size of the branch network — mainly by exiting small town America — we determined the opportunity for growth was in expanding into large markets where the bank already had a good-sized customer base through Merrill Lynch but no retail branches. Denver and Minneapolis were the first new markets under the bank’s expansion strategy.

Neither bank covers all the largest U.S. markets, so it makes sense that they are focusing expansion plans where there is the most potential. However, not all large markets are the same, and each presents its own perils.

Key Questions: Is this the beginning of a new arms race? Will BofA and Chase be successful?

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Let’s look at Chase first. Chase covers only 33 of the top 50 retail deposit markets, so there are real, significant opportunities to expand the network’s reach and coverage. Take a look at the top 17 markets where Chase does not operate retail branches. Those markets that have a smaller-than-average branch deposit size and smaller-than-average deposit annual growth have been highlighted. This indicates that new market entry can be a difficult slog.

| Top 17 Markets Where Chase Does Not Currently Operate Branches |

Rank | Branches | Average of 2017 Deposits Capped (Millions) |

Average One-Year Deposit Growth (Millions) |

|---|---|---|---|---|

| Boston, MA | 6 | 1,484 | $102,997 | $7,163 |

| Washington, DC | 7 | 1,542 | $94,607 | $8,184 |

| Philadelphia, PA | 8 | 1,632 | $87,461 | $4,801 |

| Minneapolis, MN | 17 | 716 | $89,983 | $6,476 |

| St. Louis, MO | 18 | 856 | $69,861 | $4,728 |

| Pittsburgh, PA | 19 | 780 | $73,722 | $2,405 |

| Baltimore, MD | 22 | 686 | $77,267 | $4,237 |

| Kansas City, MO | 25 | 677 | $61,964 | $2,426 |

| Nashville, TN | 26 | 578 | $70,704 | $6,967 |

| Charlotte, SC | 32 | 520 | $68,320 | $5,333 |

| Providence, RI | 36 | 400 | $80,632 | $4,490 |

| Hartford, CT | 38 | 357 | $82,967 | $2,321 |

| Virginia Beach, VA | 45 | 312 | $72,019 | $5,178 |

| Richmond, VA | 46 | 321 | $68,470 | $7,281 |

| Memphis, TN | 47 | 356 | $60,698 | $4,461 |

| Birmingham, AL | 48 | 315 | $68,293 | $2,204 |

| Raleigh, NC | 49 | 293 | $72,080 | $4,634 |

[Note: Data comes from the FDIC report released June 30, 2017. Deposits for all branches were capped at $500MM to eliminate large commercial deposits, generally held at headquarters locations. Deposit data is in thousands.]

How much growth might Chase and BofA be able to achieve? Let’s look at where deposit growth comes from. Deposit growth is driven by a combination of stealing market share and capturing normal market growth. You might be familiar with the concept of “fair share,” that in a market where a bank has 10% of the branches it should capture about 10% of the local deposits — a 1:1 ratio.

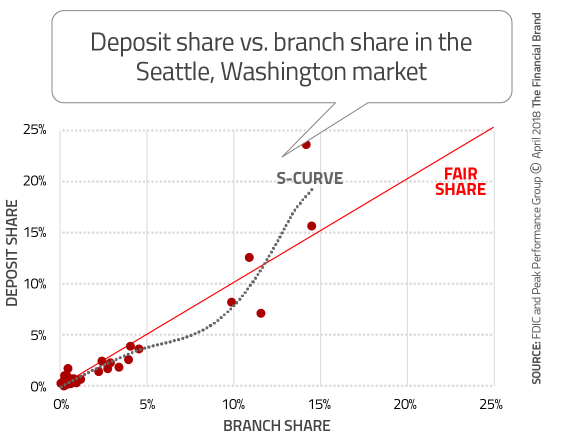

But it’s actually not a straight-line relationship. Banks with fewer branches in a market, or small branch share, don’t get their fair share of deposits. In general, it’s only the top 3-5 branch networks that achieve “fair share” or better. The explanation? Consumers continue to express a preference for convenience, and unless you are operating in a very small market you need more than a minimal presence to be perceived as “convenient.”

The S-curve you see in the chart below gets its name from the lazy “S” pattern that emerges when you chart the data. Here is an example using the Seattle MSA. You can see most banks fall below the “fair share” line until the branch share exceeds 10%.

As any bank enters a new retail market, they will acquire deposits from the annual churn in deposits within the market, and from overall growth in the market itself. Branch deposit churn rates will vary by bank from about 10-15%, but in my experience, churning accounts hold less than average balances, so the market may see balances “in play” of only 6-7% of the total, plus market growth.

That said, let’s do some basic math:

- The average branch in the US holds $77MM in deposits and grew by $4.8MM last year.

- Adding one well-located branch to a large market has the potential to capture about 6% of the $77MM, or about $4.6MM, plus $4.8MM from growth, or about $9.4MM annually.

- That’s not a bad growth level as it would generate a $42MM branch deposit base by the end of year 5, assuming the new branch gets its fair share and has normal attrition levels.

- However, as the S-curve shows it is hard to get to fair share level until the bank has built up a convenient network.

- Up until banks reach about 5% branch share in the Seattle example, they average only 60-80% of their fair share of deposits, so the overall growth would be less. Under that scenario the 5th year tops out at about $29MM in deposits. That deposit base would barely be profitable for most banks.

So, if a market has lower than average branch deposit levels to begin with (as is the case in 10 of the 17 new market opportunities for Chase) then it’s harder still to reach even that $29MM level.

One final point about Chase’s challenge. Boston is one of the first target markets. Boston and New York are natural rivals. How will Boston consumers warm up to a New York bank? Anyone remember Citibank’s efforts to enter the Boston market several years ago?

Read More: Will Branches Survive the Shift to Digital?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Bank of America is facing a tough challenge too. Out of the top 50 deposit markets, Bank of America does not operate in ten of them. 70% have smaller than average branch deposit bases, and 80% have slower than average deposit growth.

| Top 10 Markets Where BofA Does Not Currently Operate Branches |

Rank | Average One-Year Deposit Growth (Millions) |

Average of 2017 Deposits Capped (Millions) |

|---|---|---|---|

| Pittsburgh, PA | 19 | $2,405 | $73,722 |

| Cleveland, OH | 24 | $4,065 | $73,159 |

| Cincinnati, OH | 27 | $4,279 | $53,619 |

| Columbus, OH | 33 | $6,017 | $64,756 |

| Indianapolis, IN | 37 | $4,072 | $58,607 |

| New Orleans, LA | 40 | $3,095 | $84,282 |

| Salt Lake City, UT | 41 | $4,288 | $113,128 |

| Honolulu, HI | 43 | $6,618 | $126,732 |

| Louisville, KY | 44 | $3,805 | $57,423 |

| Birmingham, AL | 48 | $2,204 | $68,293 |

Denver is a good deposit market with above average branch deposit bases ($88MM per branch) and above average deposit growth ($5.2MM per branch). Early results suggest the bank is doing a great job — beating the odds and capturing deposits at a better than “fair share” level. The reasons for this could be the large pre-existing Merrill Lynch customer base, the extensive marketing effort in launching the brand in the Denver market, and/or the addition of many deposit-taking remote ATM sites spread around the market to extend the reach of these branches. Hats off to the bank, because it appears they are making a very thin branch network work.

In Minneapolis, the results are not quite as strong. Minneapolis has an above average deposit base per branch ($88MM per branch) and above average deposit growth ($6.3MM per branch) like Denver. The first two branches opened are doing fine, but the next three appear to be getting less than their fair share level of deposit gathering. Why is the performance of Minneapolis less than in Denver? Again, there could be many causes.

Read More: 14 Breakthrough Branch Designs From Banks & Credit Unions

What Does It All Mean? Six Key Takeaways

1. Branches are still relevant. Even large organizations like Bank of America and Chase, which have aggressively expanded their non-branch channels, still know that they won’t effectively grow without reasonably convenient physical branch locations.

2. It’s hard to beat the big boys. Chase and Bank of America’s entry into new markets will make these competitive markets even more competitive. This will make it harder for other players to achieve their growth objectives, and will impact banks with smaller share — those further down the S-curve — the greatest.

3. Scale yields disproportionate benefits. In order to compete, financial institutions need to build the right size network to get their fair share. This means concentrating resources, so they can show dominance in at least a reasonably contiguous portion of the market.

4. Use ATMs to consolidate your “fair share” position. Consider adding remote deposit-taking ATMs to your network to extend the reach of your branches and increase brand identity and convenience. This can be an effective, lower cost, way of creating the perception of convenience without the cost of full branch build-out.

5. Plan for your “future state” network. Take the long view and set realistic expectations. Be patient and keep your eye on your goal. It takes time to find great branch sites.

6. Choose wisely (due diligence). Pick your new markets carefully as potential deposit growth will vary.