The most common question I hear from bank and credit union leaders is “How many branches do I need?”

Generally my answer is, “It depends. But if you want to gather more than your fair share of deposits, you’ll want to have at least 6% branch share locally.”

For shorthand, I call it the “6% solution.”

Is bigger better? It depends. If you are talking about your waistline, probably not, but if you’re talking about your local branch network, then the answer is most definitely yes.

Behind my answer is the S Curve concept. In business this idea has been used for many years to describe innovation adoption. In banking, it has been used to describe the concept that bigger branch networks outperform smaller ones in local markets, earning more than their fair share. I have found it a useful tool to explain certain market conditions, as well as to explain aspects of bank and credit union performance. And it keeps showing up in one geographic market after another.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Exploring the S Curve’s Impact on Financial Institution Market Share

Using the latest FDIC Summary of Deposits database released in Fall 2020, I studied all branches of all banks located in MSAs across the U.S.

I used MSAs because I wanted to calculate every bank’s local branch share and deposit share in every MSA they operated in. Non-MSA areas have little concentration of branches anywhere. The facts support my long-held view that having a larger branch network increases your odds of gaining more than your fair share in a market.

But I’m getting ahead of things. Let’s start by defining S Curve more precisely.

This tool works on the basic assumption that on a neutral playing field you should expect that if your institution holds 3% of the branches in a market that you should capture 3% of the deposits — virtually common sense.

However, the S Curve concept says that larger, denser networks are more likely to capture more than their fair share, making it difficult for smaller networks to capture their fair share levels.

In other words, larger branch networks often gain a “network effect” boost over their smaller rivals.

Comparing the S-Curve Impact in Two MSAs

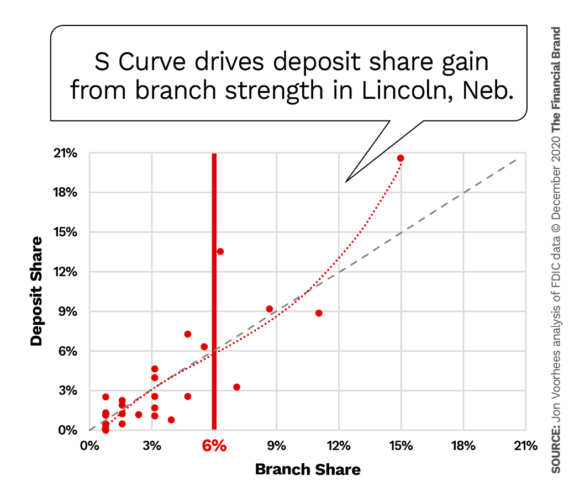

Let’s look at two MSAs: Lincoln, Neb., and Modesto, Calif.

The following chart shows data for Lincoln, a near $10 billion deposits market with 127 bank branches. The diagonal gray dashed-line is the “fair share line,” and the dotted red-line is the S Curve trend line.

This red line bends under the fair share line below 6% branch share and bends above the fair share line after 6% branch share. I call them a lazy “S.” (Some lazier than others, as in this case).

In this example, banks with more that 6% branch share have a 60% (3 of 5) probability of gaining more than their fair share, and those banks below 6% have only 36% (9 of 25) probability of exceeding their fair share.

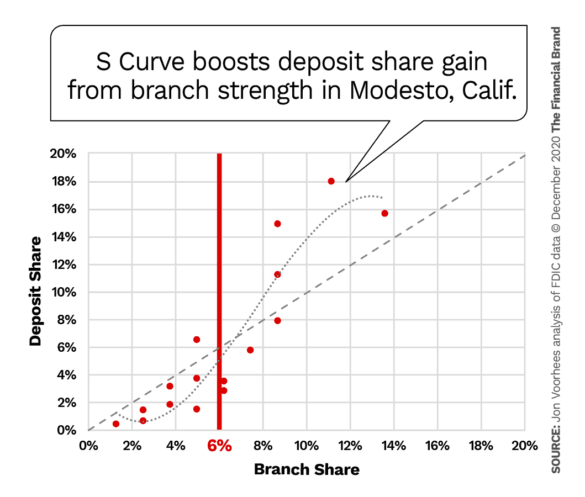

The following chart shows the same data for the Modesto, Calif., MSA in California’s central valley, another $10 billion market but with only 81 branches, so you know the average branch deposit base is larger.

Again, the diagonal gray dashed-line is the fair share line, and the gray dotted-line is the S Curve trendline. This S Curve line is closer to the classic lazy-S shape. In Modesto, banks with more that 6% branch share have a 50% (4 of 8) probability of gaining more than their fair share, and those banks below 6% have only 11% (1 of 9) probability of exceeding their fair share.

About 65,000 bank branches — about 80% of all bank branches — are situated within an MSA, according to the latest FDIC report. They formed the study database for my analysis. (Credit unions don’t report branch-level deposits so they could not be included in this analysis.)

Read More: Why Universal Bankers are Now the Only Logical Option for Branches

Four Key Findings that Bolster the 6% Argument

1. If you have at least 6% of the local branches in an MSA, you have a 63% chance of meeting or exceeding your fair share of deposits. If you have less than 6% branch share, you only have a 29% chance of obtaining fair share. Lesson: You more than double the probability.

2. The average branch deposit base for banks with less than 6% deposit share is $93.8 million versus $118.8 million for those banks with at least 6% local branch share. That is a $25 million difference in average deposit bases. (Note: In my analysis individual branches were capped at $500 million to mitigate the impact of corporate deposits — a standard practice when analyzing the FDIC data. If the deposit bases seem high, remember that I’m only looking at branches in MSAs, where the average branch has a $107 million deposit base. Branches in non-MSA areas only average $59 million.)

3. FDIC reports that the current net interest margin for banks is 2.68% in 3rd Quarter 2020. That $25 million advantages for banks with 6% or greater branch share translates into $670,000 in additional net interest income per branch. Given that branch model expenses are heavily fixed costs, that’s about two-thirds of a million dollars net profit per branch left on the table.

Let’s revisit the Lincoln MSA again. The branches of banks with at least 6% share hold $90 million in deposits, while those banks under 6% average only $67 million, a $23 million difference. Using the FDIC NIM that’s $630,000 in annual income difference per branch. It takes eight branches to reach 6% in Lincoln, so that’s eight times $630,000 or roughly $5 million in annual income in that one MSA alone.

Here’s the same type of data for Modesto. The banks holding more than 6% branch share average $140 million in deposits per branch, versus those under 6% branch sharing average $83 million in market. That $57 million difference is worth $1.5 million in revenue annually per branch. Reaching 6% only requires five branches there so five times $1.5 million is $7.5 million in incremental revenue on one market.

4. Now, here’s the kicker. Those banks that maintained at least 6% branch share grew by an average of $17.1 million per branch during the last reporting year versus $12.4 million for the smaller networks. Not only do the more-concentrated networks have larger and more profitable branches, but those banks also get more than their fair share of deposit growth, further accelerating away from the smaller players.

Something I’ve learned about retail banking in a 40-year career is that mathematics, specifically statistics, can be particularly useful in explaining market conditions, and bank branch performance. Understanding the detailed stats behind why one bank performs better than another or one branch performs better than another can be helpful in plotting your own course to profitability.

Three Things You Can Do If You Have Less Than 6%

Now you may be saying to yourself: “I only have three branches today and I cannot invest enough capital or time to get to 6% branch share.”

That just means that you need to compensate for the lack of branch share in some other manner. Here are three suggestions:

1. Invest in a branded network of deposit-taking ATM sites located in heavily trafficked retail shopping centers. (ITMs can also work if you are into those.)

You will want to have either a walk-up or drive-up kiosk for the machines. They should fill in the gaps between branches, especially where you have larger clusters of current customers or dense opportunity.

These sites will act as satellite mini branches for your network at a much lower cost than building branches. If these remote ATM sites are well-branded, it will make your network appear larger.

2. Invest incremental marketing dollars in the market to compensate for the lack of branches.

You need increased awareness of the brand and local marketing investments can do just that for your brand.

3. Invest in community-building activities.

I have found that many credit unions have been great in this area. It does not necessarily take a ton of dollars to do the right thing for your communities to make a difference … and get your brand noticed.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Big Banks Already Know About the 6% Solution

You may have noticed that the largest banks always seem to get more than their fair share. That’s partly due to their strong brand and product/channel offerings. But it can also be attributed to their strategies of dominating wherever they play.

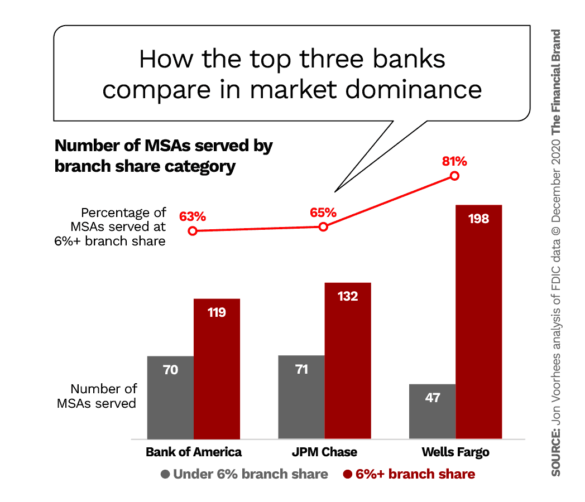

Take Bank of America. Today it operates in 189 MSAs, and in 63% of them they have at least 6% branch share. (Keep in mind that the bank closed about one-quarter of all branches over the last ten years. I know because I closed most of them.)

In JPMorgan Chase’s case, they operate in 203 MSAs and maintain 6% or greater in 65% of them.

Wells Fargo, which has the broadest-reaching network operates branches in 245 MSAs and maintains at least a 6% branch share in an amazing 81% of them.

All three banks know that if you are going to invest in a market make sure you do enough to make it matter on the bottom line.

All this data points to the fact that having a large enough concentrated network has significant financial benefit. Keep in mind that it still assumes you pick good locations and visible sites to deploy your branches.

One last note, a warning: If you think you can hit 6% branch share and get more than your fair share of deposits through the deployment of supermarket branches, don’t try it. Supermarket branches average only 30% the deposits of traditional branches ($101 million versus $30 million).

The bottom line: If you rely on a branch network to reach new customers and serve your existing base, you may want to consider a concentrated strategy focusing on building share in fewer markets rather than small networks in many markets. Of course, if you can’t afford to take that approach at least try to mitigate the impact by alternative smaller investments.