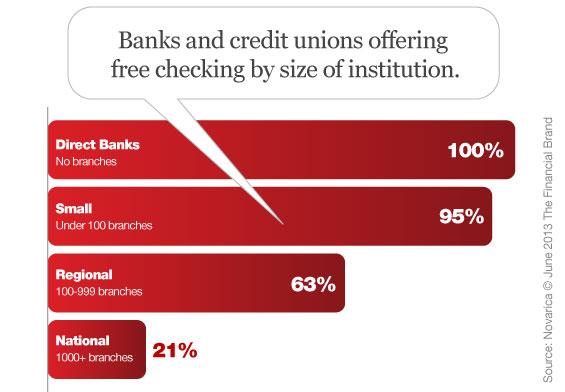

Over the last few years, most national banks have eliminated free checking. Today, there are 14 banks with 1,000 or more branches and only 3 of these institutions offer free checking. In May 2013, FindABetterBank had 66 community banks and credit unions listed on the site and nearly all offer free checking products.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Read More: The Tightrope Between Checking Fees and Consumer Defections

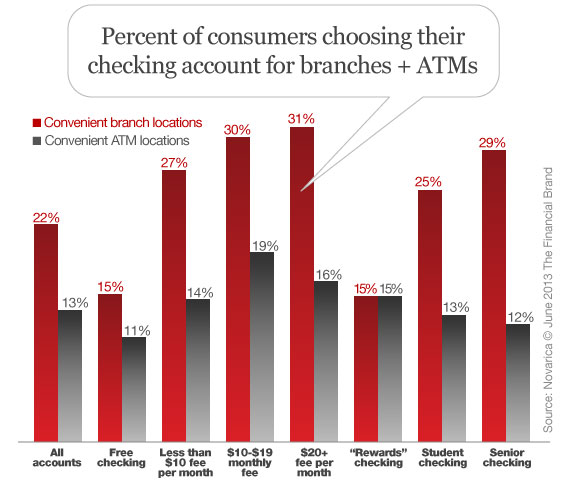

Many national banks have been able to eliminate free checking because some consumers have been willing to trade fees for branch and ATM convenience. In fact, among consumers choose checking accounts with monthly service fees of $20 or more, they are twice as likely to cite “convenient branch locations” as a decision factor vs. other shoppers that chose free checking accounts.

Read More: Credit Union Study Says Switchers Looking for Truly Free Checking

So does that mean the larger banks are trend setters — the leading edge of the curve? Will community banks and credit unions begin eliminating their free checking accounts too? Probably not.

Smaller institutions will continue to rely on free checking products for customer acquisition because they can’t charge fees for the convenience of the branches and ATM networks they don’t have. However, looking out five to 10 years — as fewer and fewer consumers care about branch locations — big banks will dust off their free checking accounts because their expansive networks won’t be the valuable commodity they once were with consumers.

Please visit Novarica read more about the role of bank branches in consumers’ purchase decisions.