Every now and then, someone in the financial industry suggests transforming branches into hangouts. Most recently, the author of a Bank Innovation article wondered why banks and credit unions don’t follow in Starbucks’ footsteps, becoming a “third place” by turning their branches into “destination experiences.”

It’s tempting to look at what Starbucks has done and think, “Why can’t we try that?” And when financial institutions see what Umpqua Bank and ING DIRECT are doing with their facilities, they can easily be mislead. “We should do that too.” They fall in love with the concept without understanding the underlying strategies driving each bank’s decision to create a café-style experience. ING DIRECT was an internet-based bank looking to reassure consumers by establishing some sort of physical presence. And Umpqua’s success has much more to do with its promotional, branch-centered events – like movie nights — than the bank’s innovative store design or the CDs it sells.

Reality Checks: Branches aren’t hangouts, and they never will be. Consumers generally have no interest in hanging out in banks. Almost every financial institution that has explored this strategy has found that it doesn’t work.

“Institutions trying to replicate Starbucks ‘third place’ have been generally unsuccessful with few exceptions,” says Paul Seibert, Principle at EHS Design, an firm specializing in branch architecture.

“The real question is why do you want people to hang out in your branch?” asks Seibert. “What is the purpose? How does it help create business?”

THE ‘LETS-GO-HANG-OUT-AT-THE-BANK’ BANK

These guys abandoned this concept shortly after introducing it. One of the main reasons? Consumers were confused. Was it a bank or a coffee shop? Consumers weren’t comfortable with the cross-over concept.

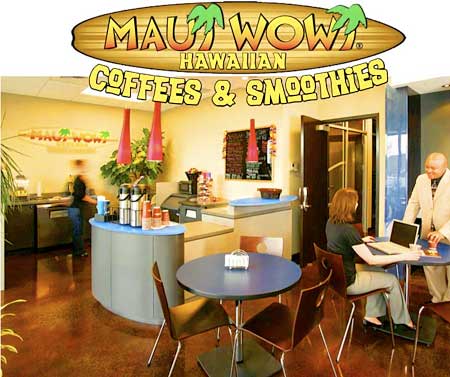

MAUI WOWI SMOOTHIES & 3-MONTH CDS

Reliant Bank subleased some space to a smoothie shop but discontinued the relationship after only nine months due to staffing issues with the franchisee. Apparently, they had a problem keeping the location staffed. Reliant plans to replace the smoothie concession, and is currently in negotiations with another food service partner.

This branch isn’t a prototype that will be rolled out across the Deutsche Bank network. It isn’t the future direction Deutsche is taking its branches. It doesn’t signal an emerging trend. Deutsche had a single branch located inside an upscale, high-end shopping area and needed to match its retail experience with consumer expectations and the architectural cues appropriate to such a situation. Banks should always adapt the design of their branches to fit the local context.

Jim Haack, a principal at Momentum, a design/build firm specializing in the financial industry, reminds us that there is always value in making your branches more comfortable and inviting, but draws the line a developing full-blown cafés. He says you can use these ideas — comfy sofas and gourmet coffee — to create what’s called “touchdown spaces,” an architectural term that is essentially a closing area for sales.

“Sales reps can use lounges areas as neutral turf to close deals,” Haack says. “Customers feel more at ease in a space that feels more like their living room than some guys’ sales office.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Start Offering Free WiFi…Today!

Sarah Meyerrose, a banking consultant, thinks free WiFi is a way to dull the pain consumers associate with banking. “We all know banks are not a destination, but a periodic necessary evil to be avoided whenever possible,” she wrote on Bank Innovation’s website. “So why not offer free, fast WiFi?”

You can — indeed you should — offer free WiFi in your branches. Free WiFi for customers improves the experience by giving those with mobile devices the chance to utilize down time. If they are waiting for a service rep or a loan to be approved, they can use their mobile devices to pass their time waiting productively.

Reality Check: Someday soon, free WiFI won’t be a differentiator, it will be an expectation. Customers will get grumpy if you don’t have it.

“WiFi is an understandable customer expectation,” Brett King, author of the breakthrough book Bank 2.0, told The Financial Brand. “It gives customers more control over their experience.”

“HSBC Premier introduced Free WiFi in Hong Kong,” King explains. “Customer satisfaction almost doubled as a result of this in respect to their perceptions of the branch.”

If a few people occasionally drop in to use your free WiFi, that’s great. But just because you offer free WiFi does not mean you are trying to make your bank a hangout or turn it into a café. You can even call them “lounges.” Just don’t fool yourself into thinking that people will flock to your locations to loaf around and sip cappuccinos. It ain’t gonna happen.

There is nothing wrong with trying to make your waiting areas more warm, personal, inviting and comfortable. You probably already offer coffee, so why not offer good coffee? You already give people reading materials (albeit offline, old media magazines and newspapers), so why not give them internet access and let them read what they want to read?

Reality Check: Building cafés is way too far a departure from banking’s core business model.

“I just don’t think turning a branch into a coffee shop will save your branch if you don’t have a value proposition,” King cautions.

And don’t forget about all the issues with inventory, permitting and other sorts of nastiness associated with food service businesses.

“The more complex in terms of beverages and food, the less likely it is to succeed,” warns Seibert.

King offers this final word of advice: “Banks can use coffee and WiFi to make your stay more pleasant, but don’t think that it will make up for poor customer service.”