The bursting of the dot.com bubble in the late 1990s seemed for a time to write the obituary of the Internet boom. Yet everyone all knows how that story eventually turned out, albeit after considerable sturm und drang.

You’re reading this on a website, right?

Robert Keil, EVP and chief fintech officer at FinWise Bank, sees a parallel in the banking-as-a-service phenomenon. Over the last year or so, a combination of regulatory crackdowns, changing fintech models, and difficulties among companies in the BaaS supply chain (including a recent bankruptcy filing), have produced a dot.com-like shakeup that is still underway.

Nonetheless, Keil thinks the other side of this valley has promise — “and whoever is left will be stronger and better for it.” As bad as the dot.com bust was, “the real use cases for the Internet started to emerge” in its aftermath, he says. “In 2000, nobody envisioned that we’d all be streaming our movies over Netflix and Hulu, and do whatnot else over the internet.”

For BaaS, this is a period where lessons will be learned and adjustments made, among the survivors as well as newcomers who will learn from the experience of those who don’t make it.

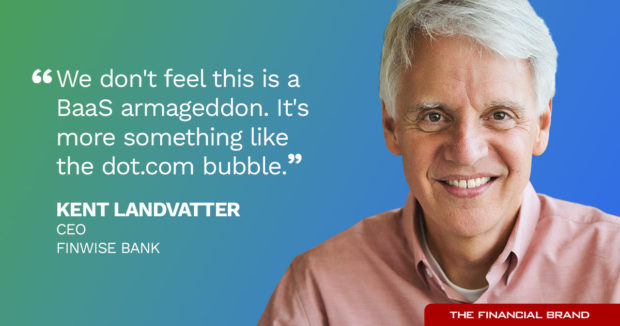

“We don’t feel this is a BaaS armageddon,” Kent Landvatter, CEO at FinWise. “It’s more something like the dot.com bubble or the subprime crisis, where a lot of players fell out because they hadn’t really put the investment in. But those who remained were strong players. And that’s what we hope to be.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

How FinWise Set Out to Tackle BaaS Lending

Salt Lake City-based FinWise, with assets of $582.3 million at yearend 2023, started out with banking as a service in 2016. The focus at the time was on lending as a service, chiefly to consumer-oriented fintech partners. Currently the bank has about a dozen partners, including a couple on the business banking side. One example is Mulligan Funding, which provides working capital credit for small businesses.

Landvatter says in recent years he’d be at banking conferences and invariably there would be a breakout session purporting all the easy money to be made by launching a BaaS program.

Speakers made BaaS sound like a cakewalk. According to the speakers, says Landvatter, “the fintech would do everything and all you, as the banker, would have to do was review some reports and what have you. They made it sound so easy.”

“I’d be saying to myself, ‘It’s not that easy’,” says Landvatter. “I’ve got to sleep at night.”

Both bankers bridle at the term “rent-a-bank,” a label that has been slapped on the BaaS business since early days. But some institutions did just that.

“They basically lent their charter to someone and let them run wild and unsupervised,” says Keil. “And that’s where things really went off the rails.”

As Landvatter recounts, FinWise entered this specialty in 2016 only after a good deal of preparation. The bank beefed up its compliance and anti-money-laundering resources. In addition, he continues, “we built a proprietary IT stack that supports fintechs through API-driven data points into our enterprise data warehouse.” In the holding company’s investor deck, the full-time equivalent for compliance, AML and risk management staff is given as 44 and IT staff at 26.

Landvatter explains that the intent was to not rely on fintech partners for anything when it came to keeping things on track. “We started with the perspective that these are our products,” says Landvatter. Filters are set up to reveal outliers, which are sent back to the fintech for further explanation.

Read more: Before You Boldly Go into Partner Banking, Focus on Data and Compliance

Devising Financial Safeguards Along with Compliance Fences

In addition, as the bank’s 10-K spells out in detail, FinWise incorporates financial backstops into the deals. This includes deposits that serve as reserves against credit advanced through each BaaS lending program. Loans made through the programs are typically held for a short period by the bank. After that, they are generally sold. In some cases, this may be to investors; in other cases, they are sold back to the originating fintech, for securitization. (A relatively small amount is held as an investment by FinWise. The bank has the right to draw on the reserve if loan purchase obligations aren’t carried out.)

The bank’s status as an out-of-state lender in many programs permits higher interest rates. Its fintech clients’ programs span the full range of credit qualifications, including borrowers whose status drives extremely high rates. In 2023, nearly a third of the bank’s revenue came from loans resulting from partnerships where the loans carried rates above 36%, according to the annual report.

Landvatter says the bank’s preparation and specialized staff has helped, as has extensive and ongoing communication with its regulators.

“We may have a hiccup here and there, but the regulators know we’ve got a compliance management system in place that identifies those and elevates them quickly to be addressed,” says Landvatter.

Read more: Maybe BaaS Is Absolutely the Last Strategy Your Bank Should Be Looking At

Remembering that Fintechs Partners are Partners, Not Customers

Keil recalls a recent meeting with a fintech that is leaving its current BaaS provider — some are being forced by the current state of affairs to find a new bank partner. Reviewing the old partner’s setup, much didn’t make sense to Keil, and the new client agreed.

“There’s a good number of fintechs that want to do things the right way and they are willing to follow the bank’s direction,” says Keil. “When you get those fintechs paired up with banks that have a solid process, that’s where the magic happens.”

As an example of “the right way,” Landvatter tells of a recent call the bank received from both FDIC and Utah regulators. The issue was Social Security numbers. Did the bank’s programs gather the whole number? Or was it just getting the last four digits and synthetically filling in the rest, as some fintechs have been doing? asked the agencies.

Landvatter assured the regulators. “We get the full social,” he explains. “Otherwise, it’s like going into a branch and only getting half a driver’s license to open an account. We’re not going to do that.”

Indeed, while fintech partners can also turn into banking clients as companies, Keil says FinWise is cognizant that BaaS partners can be seen as servicers to the bank. This exposes them to potential examination or visitation as much as a processing company.

Read more:

- What Banks Can’t Afford to Miss in the Next Phase of the BaaS Revolution

- Bankers Say BaaS Turmoil Primes Future Growth

- Will Federal Guidance Have ‘Chilling Effect’ on Banking-as-a-Service?

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Moving from Early Days Design to an Evolving Customer Focus

At present, given the turmoil in the BaaS fraternity, the bankers say there are many companies looking for a new bank partner. This has opened up more opportunity and also permitted FinWise to be more selective than ever.

“As a rule of thumb, for anyone we take on as a fintech partner, there’s a dozen to a dozen and a half that we throw back in the pond,” says Keil.

This advantage comes at a time that FinWise is pursuing a strategic shift. Right now, the majority of its fintech partners serve consumer needs. The plan is to move into more card programs as well as partner with fintechs that serve business needs.

Keil says the mix will likely flip, in time, to “90% commercial, 10% consumer.”

Many fintechs have ignored the lending piece until recently, hewing up until now to the belief that interchange fees provided enough to sustain them and their partners.

“If it was that easy,” asks Keil, “why in the world would any bank even do loans? You can’t make a living just on checking accounts.”

“That’s why I see way more opportunity on the business side of things,” Keil adds. “And, incidentally, that’s much easier to supervise from a compliance perspective.”

Accompanying this shift will be an increasing focus on being a payments hub for fintechs. The bank’s goal is to enable fintech clients to call up APIs that FinWise provides that feel right into everything from FedNow and The Clearing House’s Real-Time Payment network to Visa Direct. The idea is that the fintechs will present their customers with a good user interface, backed up by the bank’s muscle.

Some of the fintech fish that get tossed back (to pick up Keil’s usage), aren’t ready or suitable to work with the bank. Some may simply not be big enough, he adds.

“In some cases, I try to introduce them to other BaaS banks that I am comfortable with,” says Keil. “But there’s definitely a shortage right now of banks that I can send someone to where I feel reasonably confident there’s not a consent order waiting to be announced.”