Simple could more aptly be described as a storefront — a front-end banking veneer — than a bank. Simple has very carefully fashioned themselves as a web and mobile front-end interface for basic banking functions that are provided by their back-end partner. Customers’ funds ultimately reside in FDIC-insured accounts held with The Bancorp Bank, a private-label banking and technology operations back office.

Invites And a Waiting List

Financial marketers should not underestimate consumer demand for a simpler banking experience. More than 150,000 people have requested “invites” from Simple, and the company continues to maintain a waiting list with some having waited two years or longer.

Simple is opening thousands of new customers each month, and has processed around $400 million in transactions — not a shabby start at all.

Simple CEO and founder Josh Reich attributes the success they’ve found thus far to the company’s mission: “To help consumers worry less about money by building a new banking brand that is modern, cool, transparent, and trustworthy.”

Inasmuch, Reich built the foundation of Simple’s user experience based on the following principles:

- Simple, engaging and fast account opening process

- Integrated and responsive online and mobile customer interface

- Intuitive account management tools

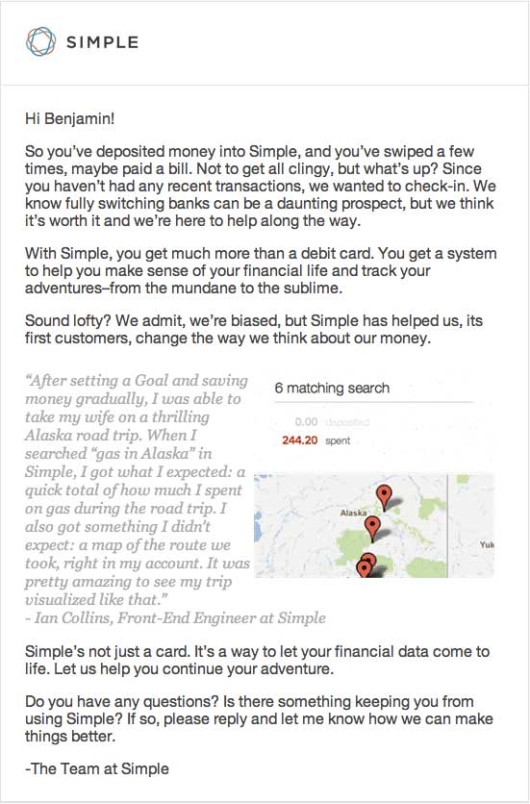

- A highly personal and humanized communication style that is never stuffy or patronizing

Simple’s revolutionary approach to the customer experience has helped the not-a-bank achieve what 99% of financial institutions can only dream of: raving fans. (To get a sense of how rabid some Simple fanatics can get, check out this Twitter user who takes Wells Fargo to town after making the switch.)

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

A No-Fee Strategy

One of the biggest differentiators is that, unlike most traditional banks, Simple says it doesn’t profit from any fees. According to their website, Simple believes that fee-based business models create an adversarial relationship between a bank and its customers, because the bank usually profits when customers make mistakes.

This means no account maintenance fees, no low balance fees, no monthly debit card fees, no overdraft fees, and no fees that may surprise customers. This also means they have no fees for domestic fund transfers or fees when using a domestic out-of-network ATM. However, if the owner of the out-of-network ATM charges a fee, Simple will pass that along to its customers.

So how does Simple plan to make money? Purely off the spread and interchange, both of which are split with Bancorp.

No Lingo With a Breezy Brand Tone

Simple avoids the use of jargon while having a high level of transparency with everything they do. For instance, customers phoning the call center will receive a casual salutation like this: “Hey, my name is Ryan, how can I help you today?”

It’s subtleties like this — changing “hi” or “hello” to “hey” — that define Simple’s straightforward and humanized approach to customer communications. It’s informal, familiar and easy-going… the opposite of most banks with their stiff, corporate tone.

Simple Timeline & Milestones

- July 2009 – Founder Josh Reich sends an email to some friends: “Let’s start a bank”

- May 2010 – Alex Payne leaves Twitter to become CTO at BankSimple

- Oct 2010 – BankSimple hires 1st employee

- May 2011 – Employees get debit cards

- Oct 2011 – Name changed to just “Simple”

- Nov 2011 – Beta/pilot with customers

- May 2012 – iPhone App introduced

- July 2012 – Full public launch

- Aug 2012 – New PFM tools rolled out,

including Reports and Savings Goals - Nov 2012 – Simple partners with CFPB

- Nov 2012 – Mobile deposits launched

Ask Ryan, a call center reps at Simple, about his breezy style and he’ll tell you he tries “to talk to anyone who calls in a way I would communicate to a friend.”

“I don’t want to be formal and ‘stiff’ unless it seems like that is preferred by the customer who calls,” Ryan adds.

The challenge for Simple is that they don’t have branches – which many banking consumers still want very much from their bank. Since Simple is a fully digital bank, they need to work harder to give customers a human, connective experience over the phone and via text support (typically rather detached channels).

“Our customer relations team does not work from scripts, which leads to a more authentic — sometimes informal — conversation,” Krista Berlincourt, communications manager of Simple.

It goes beyond the predicable social, digital and phone channels, however.

According to Berlincourt, “Another way we’re humanizing Simple is by introducing plain-English explanations of our Account Agreement and other customer documentation.”

One example is the rather straightforward FAQ section of the Simple website, devoid of the traditional legalese and banking acronyms and cliché terms. Prospects and customers can get the majority of their questions answered in plain English.

Simple has several desk styles to suit employee preferences, including standing, sitting, and straight-kickin’-back. The atmosphere is decidedly relaxed. This is definitely not what your typical bank looks like — inside or out. Interestingly, they say their company meetings resemble a campfire circle more than a traditional boardroom.

Opening an Account: Smooth and Intuitive

Online account opening experiences are getting better in the financial industry, but are far from perfect. According to reports, roughly half of the customers who started opening a new bank account online abandoned the process before the opening was complete. But from the very outset, the account opening process at Simple is extraordinarily easy. Each step is straightforward, with a series of progressive screen shots leading consumers along the way. There is no legal jargon within the account opening screens at Simple.

Simple’s debit card — and the 5″ square cardboard mailer they send it in — are unlike anything you’ve ever seen in the financial industry. Instead of the typical dull “official” envelope loaded with legalese, the stark white Simple debit card is delivered in a carrier that celebrates the experience. It’s almost like receiving a gift in the mail. For customers who really want to read Simple’s terms and conditions, the company gives new customers a link where they can find them online.

If an account goes inactive for an extended period, Simple continues with the onboarding process using follow-up communications that include a certain amount of encouragement, product education and lightheartedness to cultivate engagement.

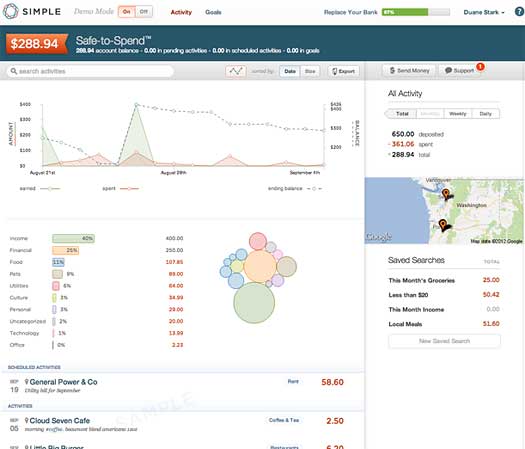

PFM Tools

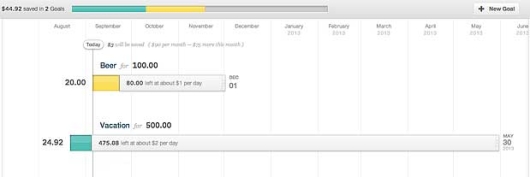

One of Simple’s goals is to provide everything required to plan and track spending so a customer can save more. They try to make budgeting relatively effortless by automatically categorizing transactions and visualizing spending behavior in reports. Unlike most PFM applications, Simple enables users to search their entire history in natural language to better understand spending (e.g., “dinners in Cleveland last month over $50”). Recently, Simple has reintroduced, updated and polished many of the tools that have made Simple somewhat revolutionary. In the past few months, they introduced Goals, Reports and Photo Check Deposit.

Simple PFM Reports – The visualization of the spending and transaction activity rivals some of the better PFM applications available today.

Simple Savings Goals – Give Simple an amount, a date and an initial contribution (optional). Users will be able to see how much money they move from your Safe-to-Spend to your Goal each day.

Attaching Memos, Notes and Even Photos to Transactions

An example of a Simple transaction

that’s been annotated with a photo

attachment and personalized note.

Users can add a memo to a transaction within the Simple online banking app. This helps them create a diary of what they spent money on and why. A very neat touch is the ability to add photos or documents to a specific transaction. In the web app, users can drag-and-drop an image or PDF and attach it to a transaction. This allows users to, for instance, upload a receipt so they don’t have to carry it around in their wallet.

But Simple envisions more creative uses for transactional annotations. A user could attach a picture of a meal they just had, a photo of whomever they shared the meal with. While the photo memo feature is not yet available within the mobile app, Simple says it is coming soon.

iPhone App

While many are still waiting for the Simple Android application, the iPhone application from Simple is pretty slick.

Customers can access the Simple application with just a 4 digit code, similar to what they are accustomed to on ATMs. Once you’re into your Simple mobile account, the look of every screen is consistent and very easy to navigate.

Because Simple is truly a virtual bank with no bricks nor mortar, they knew it would be essential to include an ATM finder in their mobile app. They also recently rolled out a mobile remote capture platform allowing users to simply snap photos of the checks they want to deposit.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Twitter, Facebook and a Blog

Unlike most banks that use Twitter as a self-serving broadcast tool, Simple leverages Twitter for real time customer service and new product idea generation. Their @Simplify account tweets provide insight into current challenges customers may be having (which are always responded to quickly and publicly. Simple has 23,448 followers on Twitter, and has sent 7,702 tweets.

The majority of conversations between Simple and the customers are relatively informal in tone and include the real initials of the customer service representative. On a regular basis, people visit the Simple Facebook page

The majority of conversations between Simple and the customers are relatively informal in tone and include the real initials of the customer service representative. On a regular basis, people visit the Simple Facebook page to request invites and posts from those still waiting in the virtual waiting line outside. To date, over 6,500 people have indicated that they ‘Like’ Simple on Facebook.

to request invites and posts from those still waiting in the virtual waiting line outside. To date, over 6,500 people have indicated that they ‘Like’ Simple on Facebook.

Simple has a very active blog that combines financial education with updates on their product offerings. Over the past few months, the blog has covered topics from estate planning to auto leasing.

Insights, Analysis & Takeaways

Bank and credit union marketing executives need to keep their eye on Simple. For starters, Simple is directly competing for your customers. Their business model is built purely around banking’s major pain point: it sucks.

Most of today’s financial institutions seem to think that checking accounts are fixed, concrete, immutable — that there is no need to innovate around the basic, fundamental service they provide because consumers “understand it” or “are comfortable with it.” However, Simple proves that consumers are interested in- and indeed very receptive to new ideas in banking, specifically checking products and transactional services that make their life easier.

But be warned: Making banking easy isn’t easy. Perhaps the only reason nascent financial institutions like Simple and Ally have found success with an “easy banking” brand position is that they started from scratch. It’s probably a lot easier to build an “Easy Bank” from the ground up than to try to retool and tweak an existing institution.

As is almost always the case (in any industry), real disruption in financial services usually comes from startups and outsiders — not the big, dominant established players. While consultants consistently nag financial marketers to “be more innovative,” real innovation is hard and expensive. It’s much safer and easier to learn from the experiences of others.

What’s interesting about Simple’s storefront reseller arrangement with a backend provider is that it proves you can still run an “easy bank” on the same backend systems pretty much everyone else is using today. You don’t necessarily need to build a brand new backend core DP system — just a new user experience with a front-end interface.

However, as tempting as it may be for financial marketers to want to mirror Simple’s approach, there aren’t many who can pull it off. The strategy takes more work that most banks and credit unions have the appetite or capacity for.