In the banking industry, four out of ten consumers say they have — at some point — become frustrated enough with an online application to just give up. That’s according to a study by Signicat, the first and largest identity assurance provider in the world, who commissioned an independent survey of 2,000 consumers examining the experiences people have when applying for financial products at a traditional institution. How long does a typical application take? Is it a positive or negative experience?

The results revealed some startling trends, suggesting that the online account opening process banking providers offer doesn’t align with most consumers’ expectations.

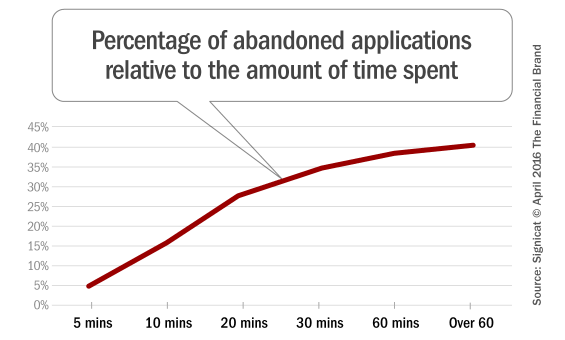

On average, participants in the survey said they had submitted 1.7 financial applications in the last 12 months. 84% of these applications were for checking accounts, savings accounts, credit cards or insurance. Unfortunately, 40% of all online applications that consumers start never get finished.

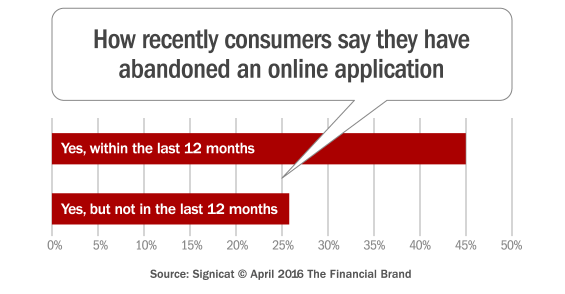

Those who have applied for a product in the last 12 months have abandoned the process significantly more than those who last applied more than a year ago (45% vs. 26%). Why?

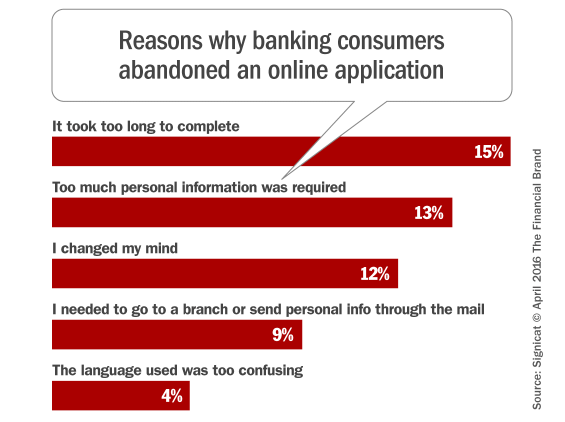

A third (34%) of respondents said too much personal information was needed. Depending on the institution and what they are asking for in the online form, that may or may not be avoidable. But the number one reason consumers abandon online applications is the amount of time it can take. More than one in three (39%) abandonments in the Signicat study were due to the length of time taken.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

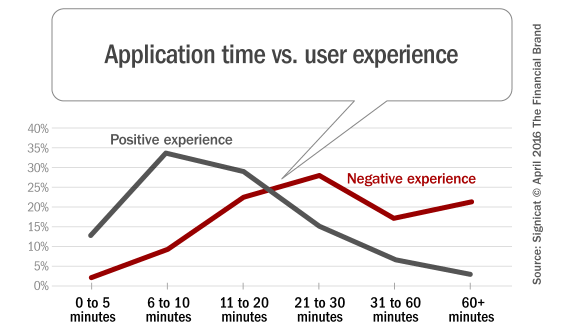

In the Signicat study, the average time taken to complete an online application was 18.45 minutes. But this differs dramatically when comparing the results between those who had a positive experience vs. those who had a negative one. (Note: the “amount of time” referenced here means the time taken to complete the online portion of an application and does not include time needed to submit physical documents which could extend to several days). The average time for the negative proportion was almost twice the overall average at 34.71 minutes. The extra time taken, as well as the amount of personal information required, is a clear factor in leaving these consumers with this negative perception.

The Entire Account Opening Process Must Be Digital

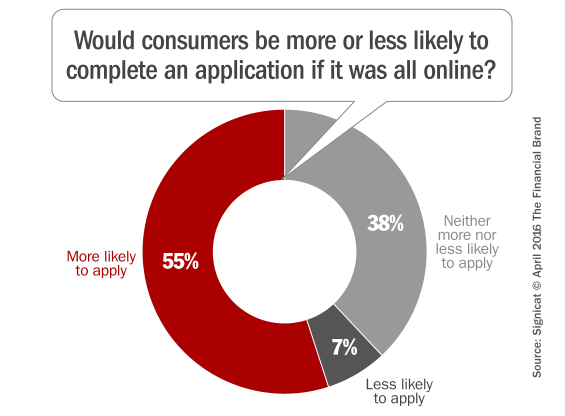

The Signicat study suggests consumers are ready to move to entirely digital process. Over half (52%) said they would buy additional services if a paper-based identity was not needed, and a similar number said they would be more likely to apply if the applications could be completed without having to visit a branch. That number rises to 64% in those who had a negative experience when applying online.

Indeed it seems consumers willing to apply for accounts online have a particular distaste for branches. 68% of respondents in their survey said they were unhappy with how branches operate; 56% expressed outright frustration.

Among consumers who would either prefer to complete their online applications entirely online or have abandoned an online application, the prospect of going to a branch — where further aggravations likely await — severely dampens their appetite for digital account opening. If consumers encounter a digital process that is either time-consuming and/or irritating, then they might reasonably assume that a visit to a branch will only take more time and compound their exasperation.

Bottom Line: Consumers don’t want to visit a branch or send stuff through the mail to complete an online application. The process needs to be smooth, entirely digital and take less than 15 minutes total to complete.

Banking providers spend massive amounts of money attracting new customers and encouraging their existing customers to apply for additional services. But poor online account opening processes are undermining their acquisition efforts in the homestretch — the worst possible time in the customer journey — which negatively impacts sales and revenues. Put simply, if banks and credit unions must make it easier for consumers to apply for services, or consumers won’t bother.