Fifty years ago, there was only one way to open an account: head downtown to your local bank, find a clerk, and ask him or her to help you. Today, you can open an account in the branch, over the phone through a call center, through online account opening on your desktop, or through mobile account opening on your smartphone or tablet. In every channel, account opening has gotten faster and easier as institutions have started using data, technology, and design to remove pain points and improve the processes of application, qualification, identity verification, funding, and account creation.

We’ve come a long way, but we still have a ways to go. What will account opening look like in 10 years? In Andera’s latest report, the Future of Account Opening, we explored a few possibilities.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

1. Account Opening Will Take Less Time

Fundamentally, almost all technology is about saving time; trains, planes, and automobiles reduce the time it takes to get from place to place; machines and computers reduce the time it takes to make things; phones, video, and the internet reduce the time it takes to communicate. (Of course the great paradox of the modern age is that the more advanced our technology gets, the less time it feels like we have.) Most essentially therefore, the future of account opening will be about reducing the time it takes to open an account.

Mobile device capabilities, including cameras and touch screens, can quickly reduce the time required to capture applicant data. Andera’s own oFlows platform has been enhanced to allow applicants to take a photo of their driver’s license, instead of keying their personal data manually. Photo data capture will allow us to cut the data entry required by applicants in half.

Other time-saving improvements, like workflow optimization to reduce abandonment and make applications as intuitive as possible for online and mobile applicants, will occur gradually. In an increasingly data-driven world, new data integration services may also soon emerge to make processes like identity verification and qualification easier and faster.

2. Account Opening Will Become More Like a Conversation

Despite the convenience of online and mobile account opening, many consumers still prefer the branch or call center because of what a digital workflow cannot provide: a human touch. The more that the application can do to replicate human interaction, by breaking up the application into digestible steps, posing questions in a friendly way, and explaining things that may seem strange or confusing to the applicant, the better the overall experience becomes.

If an application can successfully imitate a conversation, the technical and often tedious processes of data capture, qualification, identity verification, account funding, and account creation take a backseat to the relationship between the application and the institution. Conversation also facilitates trust, helping overcome the barrier of remoteness in digital channels and creating a better first impression in person.

3. Account Opening Will Still Be Multichannel

The impressive number ways to open an account today make it clear that no one technology or channel will define the future of account opening. In ten years, multiple channels, including the branch, the call center, online, and mobile, will continue to exist, and consumers will move be able to move seamlessly between them, starting an application online and completing it in the branch, or starting an application with a bank or credit union representative at a community event and finishing it later on a mobile device.

A seamless multichannel experience does not mean that account opening will be the same in all channels. Account opening will be optimized for each channel and experiences will be continuous, but not identical. Multichannel save and resume functionality will be critical, so that work in completed in one channel will not be lost in another.

4. Account Opening Will Incorporate Emerging Technology

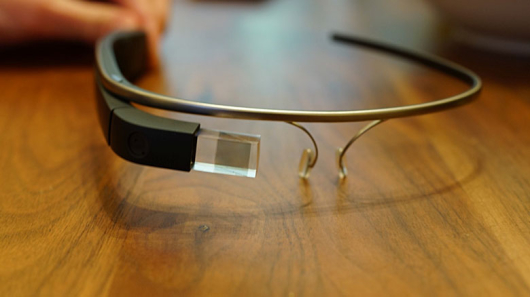

Ten years ago, no one knew for sure how mobile technology would evolve, and no one could have imagined what impact it would have on our lives. Thirty years ago, the same was true of the internet. In the next ten years, account opening will doubtless be transformed by innovations we cannot predict, and choosing which new technologies to integrate, and how, where, and when, will be an important part of the future of account opening.

Some technology advancements are close enough for us to anticipate their impact. Our ability to analyze the data we collect through digital channels is rapidly catching up to our ability to collect it, and new types of big data insights will soon play a role in qualification for financial products. New advances in biometrics, combined with mobile touch screen technology, could revolutionize the way we verify identities online.

Eventually, we will be able to use big data and mobile location tracking to automatically generate and present consumers with auto loan offers during when they are at the car dealership, or with frequent flier credit card offers when they are at the airport. The processes of switching over direct deposit, changing online bill payments, and making other changes to your new bank account could become completely automatic. And, of course, one day we might be able to apply for financial products with a few words and well-timed winks.

5. Account Opening Become Part of Other Processes

Today account opening integrates with many other processes, including online banking enrollment, check and ATM card ordering, and also cross-sell. Soon, account opening platforms will also integrate with other processes, including mobile banking and personal finance management platform enrollment.

In the distant future, account opening may become so easy that consumers will cease to recognize it as a distinct process. Data capture, qualification, identity verification, account funding, and account creation will become so automated that the act of account opening might fade into the background entirely, and merge with the experience of, for example, enrolling in online banking, or speaking with a branch representative about different types of savings accounts.

Conclusion

If one overarching theme for the future of account opening can be identified, it’s that account opening will become easier. Photo data capture and better design will dramatically cut down the time required to open account through digital channels over the next couple of years. Workflows designed to emulate human conversations will make the process friendlier and shift focus from the nitty-gritty of an application to the relationship between the institution and the applicant in all channels. The incorporation of emerging technology will continue to simplify and abbreviate applications, and could surprise us by once again transforming the experience altogether.