With the proposed acquisition of online specialist Radius Bank by marketplace lender LendingClub the momentum of deal making by fintech and traditional banking businesses may be about to surge, riding a wave of enthusiasm and prosperity. Whether that happens will largely depend on how the combination plays out with federal regulators.

On the heels of the approval of Varo Bank for federal deposit insurance, LendingClub, the nation’s largest online consumer lender, based in San Francisco, announced a deal to acquire Radius Bank, a branchless bank based in Boston. Radius has thrived by combining aggressive online deposit promotion with an ongoing string of “banking-as-a-service” arrangements.

The deal bears significance simply as a canny merger, with the two companies having different customer bases that represent potentially massive cross-sell opportunities for each other. However, the deal may also be the vanguard of a ongoing stream, as firms start to pick out dance partners.

“Increasingly, if the U.S. doesn’t come up with a viable fintech charter, you are going to see fintechs come up with capital to do these kinds of deals,” says Brett King, financial futurist and Founder/Executive Chairman of Moven, the financial app. Besides being mired in multiple court challenges, the federal fintech charter carries duties under the Community Reinvestment Act that King says has been a stumbling block for fintechs.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Two Industries, Now in Play, May Become One

King suggests that a clock is ticking. Economic uncertainty is growing and investor enthusiasm for fintech unicorns will wane, impacted in part by the fiasco of WeWork.

“There is a lot of thinking that this is the year to get together,” says King. “There is a lot of thinking that these two worlds — banking and fintech — have to get together.” King and backers had attempted to obtain a charter for Moven during the Obama years, but ultimately found federal regulators inflexible on some points, including CRA. King is among those who think that the Varo Bank drive for a full-service banking charter may turn out to be a one-off. Varo Money, the parent, has obtained the coverage and seems poised to move ahead, “but it was a very long and expensive process,” says King.

It can be argued that the LendingClub/Radius deal represents the first of more to come. “There will be many moves by fintech firms to create momentum in a favorable market,” says banking futurist Jim Marous, Co-Publisher of The Financial Brand and Owner/CEO of the Digital Banking Report. “We have already seen Goldman Sachs position Marcus for growth with a new mobile app, the announcement of a new checking account, and a partnership for small business loans with Amazon.”

In addition, says Marous, Level and other fintech firms have offered very aggressive savings rates and Ally Financial has announced the acquisition of CardWorks.

King sees the LendingClub/Radius proposal as a good deal for the bank, and as helping to advance the U.S. financial services industry’s future, which he sees as behind the global curve.

“Ultimately,” King says, “this deal means that the arguments are over. Fintechs are here to stay.”

Marous expects more activity soon. “Some fintech organizations will be expanding services,” he says, “while traditional banks will most likely acquire other fintech organizations. This is definitely encouraging in the U.S., where the expansion of innovative solutions has lagged other regions globally.”

Marous suggests that a bank’s acquisition of any of the larger robo-advisor firms, like Acorns, Betterment or Wealthfront would make sense. He also anticipates that more traditional banks will launch digital banking units.

Read More: This Virtual Bank Wants to Be The Engine Behind Fintech Brands

LendingClub Deal Could be Model for Fintech/Bank Combos

The LendingClub deal in many ways is a new creature in financial M&A. LendingClub, a fintech consumer lender that began as a peer-to-peer lender, chiefly funds its loans through investors,some of whom are traditional financial institutions. Radius Bank grew out of a troubled labor-union-owned Boston community bank and has mastered online deposit gathering, in turn putting those funds into an eclectic mix of loans, including commercial real estate, commercial leasing and equipment finance, yacht loans and some mortgage loans.

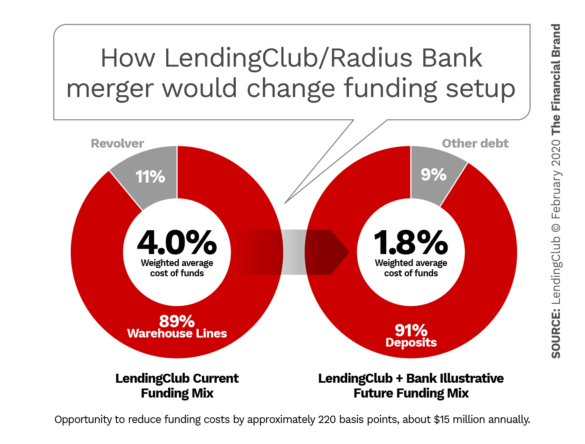

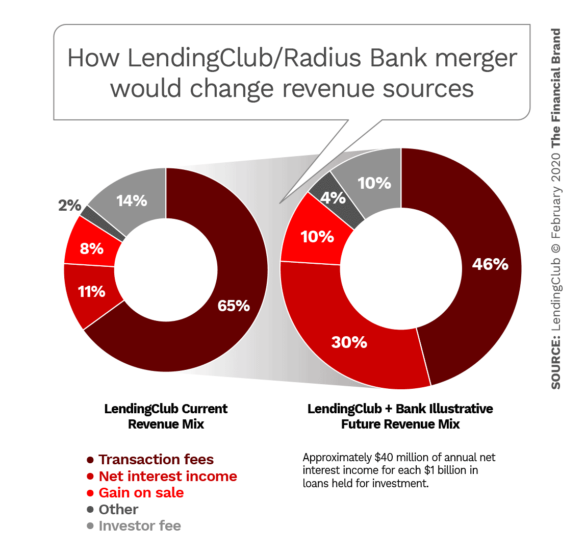

As envisioned, the finalized deal will revamp the LendingClub funding mix, substantially substituting deposits raised by the Radius operation for the warehouse credit lines that currently support LendingClub operations. Post merger, while sales to investors will continue, LendingClub also anticipates taking about 10% of its annual volume of loans into portfolio — possibly more in time —a new step for fintechs.

Beyond this, however, this deal is different because it requires LendingClub to go through a process of regulatory conversion to essentially become a banking company while it acquires Radius. LendingClub management estimates that this unusual process will take 12-15 months to navigate. In announcing the deal LendingClub CEO Scott Sanborn said that the company has been discussing the best ways to proceed with federal regulators all through the evolution of the proposed merger.

Also setting the proposed deal apart is that some of the burdens that accompany banking mergers aren’t presented. There are no duplicative branch networks to resolve and the economics of the deal don’t involve cost savings by reducing redundant staffs.

“This is not a traditional bank merger,” says Mike Butler, President and CEO of Radius. “We have no cost synergies. We have no buildings to shut. We have no legacy technology to get rid of. It’s all about the future and working together. In a consolidating financial services industry, we’re happy to say that there are no job cuts coming from this.”

Steve Allocca, President of LendingClub, says the company had been exploring both acquisition and de novo options for over a year before the announcement.

“We scoured the earth on the acquisition front, ” he says. Management realized that “Radius is not really a regular bank. It’s a fintech company with a bank charter,” and one of only a baker’s dozen of digital banks with a national footprint, plus a record of innovation.

“We saw the potential of bringing together America’s leading online lender with its leading online bank,” says Allocca, who was formerly a senior PayPal official. “The opportunity stood out head and shoulders above any alternative.”

Surprises could still await. While regulators have obviously shown positive enough signs for the two companies to move forward, breaking new regulatory ground is always a gamble. Even if the regulators greenlight things all the way through, a lawsuit could trip up the timing, Brett King suggests.

In a stock report following the February 2020 deal announcement, Steven Kwok of Keefe, Bruyette & Woods, called the deal “fairly transformative.”

However, “while the transaction does have a lot of upside potential given the synergies…,” wrote Kwok, “there is also a fair amount of execution risk given the lengthy approval process along with the higher regulatory scrutiny going forward.”

Read More:

- The Challenger Banks That Threaten to Disrupt Financial Institutions

- Does Your Institution Have a Disruptive Mindset?

- Why Fintech Challengers May Not Conquer Banking After All

Plotting a Course for Fintech-Banking Synergy

Ironically, putting together LendingClub and Radius could be seen as reinventing a classic full-service bank. But in reality, the result will be a very different creature from a traditional bank.

During a joint interview The Financial Brand conducted with LendingClub and Radius officials, Allocca noted that the acquisition is part of an overall financial health play LendingClub has in place. Much of the marketplace lending movement has served to refinance credit card and other debt at lower rates.

“Millions of customers come to LendingClub to use a lending product to find savings,” Allocca explains. “It’s been our primary use case. They come to find a path out of what is, in many cases, paralyzing, debilitating high interest credit card debt or auto debt. But ultimately what they’re really coming to us for is to find, accumulate and grow savings, the fundamental building block of financial stability.”

Adding the Radius online deposit operation allows LendingClub to expand that appeal to financial health and reach out further to consumers who have already established that digital is their method of choice. In talking to Allocca and Butler, there’s clearly no “Amazon Store” strategy in the offing — the combined entity won’t go “phygital.”

In fact, Butler says the digital nature of both operations should make the two operations synch better. “Our platform is incredibly scalable without any kind of additional infrastructure costs.”

To date, Radius has been handling approximately 10,000 deposit applications a month. “The numbers pale a bit in comparison to what LendingClub’s been doing,” Butler says, given that the retail-focused company handles $12 billion in loans annually. But all those borrowers represent potential new depositors and vice-versa, the officials say. Since its founding in 2006, LendingClub says, it has worked with three million customers. In announcing the deal, Scott Sanborn envisioned a reimagination of checking and savings products in conjunction with timely usage of credit. Butler says he could see the combined companies onboarding 120,000 new deposit customers each month — a 12X increase over current levels but the operation can handle it.

Joined Firms Could Lead to New Product Concepts

Combining expertise to devise new products is something contemplated by both companies.

For example, Allocca was asked if the two firms could come up with new forms of savings based on returns not driven directly by interest rates. For example, could a CD be backed by a basket of loans by LendingClub, offering a blend of peer-to-peer investment with deposit insurance?

“The short answer is that we absolutely hope and expect that innovation along those lines would be the case,” says Allocca. When LendingClub started 100% of funding came from retail investors; today only 5% comes from that source, with wholesale carrying the bulk.

“We still have a few hundred thousand active ‘retail investors,’ as we call them, who are funding loans on the LendingClub platform today,” says Allocca. “That product, the original fractional notes program, hasn’t evolved in ten years. So re-imagining that product to be complementary with a new cash account makes all the sense in the world.”

Radius Bank’s work with other fintechs, providing deposit services for them, is expected to continue after the acquisition. “We expect this to be a big part of our business on a combined basis,” says Butler. He says most fintechs that approached Radius were not competitors to LendingClub. During 2020, a time of transition as the deal goes through the regulatory process, Butler anticipates Radius will do another dozen or so banking-as-a-service deals.

In a similar way, the various lending streams that Radius currently has that are not personal credit may complement the LendingClub mix.

“We’ve talked with the Lending Club team about the opportunity to become a more diversified financial services company,” says Butler. “We bring the opportunity to do that to the table.” In addition, there are credit needs that weren’t a good fit for LendingClub that would, for example, be new business for the Radius Small Business Administration loan business.

The mirror of that is the interest Radius fintech partners have expressed in consumer credit, which the firm either referred to other companies or simply couldn’t satisfy. Joining with LendingClub now gives Radius a personal credit capability to bring to fintechs, according to Chris Tremont, EVP for Virtual Banking.

“One of the things that we’re excited about as we move into this integration process and further build out the banking as a service platforms into 2021 is to be able to offer both sides of the balance sheet to those partners looking for that,” says Tremont.

Overall Branding Not Yet Determined

Not yet determined are many aspects of the marketing and branding the merged company will have. It’s anticipated that both operations will stay where they are, geographically, but the look and feel to the online public remains to be determined.

“The next 12 to 15 months are going to be primarily focused on getting the regulatory approvals,” says Allocca, “and then we’ll go through a period of integration where we’re going to look to how can we optimize these two companies coming together.

While that is happening, Radius plans to sign up LendingClub as a banking-as-a-service customer.