When it comes to the number of net-new checking accounts banks and credit unions need to acquire in the next 12 months, financial marketers are looking up a steep hill. You need to know what triggers consumers to switch checking providers, and how those triggers are evolving over time.

A periodic survey fielded on FindABetterBank reveals the reasons why people are currently shopping for new checking accounts, enabling us to identify some trends in shoppers’ composition.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

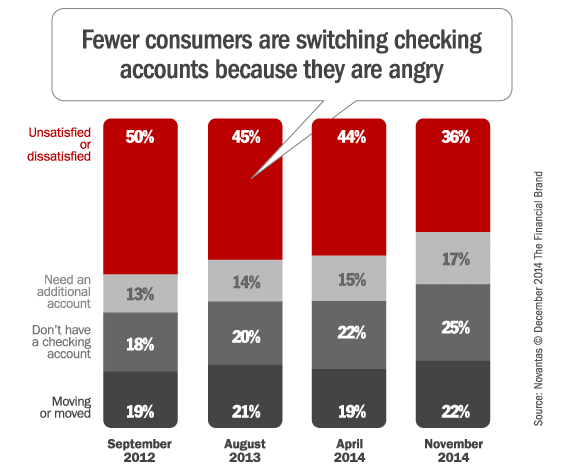

Fewer people today switch banks because they’re unsatisfied or dissatisfied with their current bank or credit union. The result? We’re in a low-churn environment. This is making it more difficult for banks and credit unions to achieve their new customer (or member) growth objectives. In many markets, banks and credit unions are offering large cash incentives to encourage people to switch.

A larger proportion of checking shoppers do not currently have checking accounts. What if you don’t have the budget to buy switchers at a cost of $200 or $300 each? One strategy would be to focus on people who are shopping for their first checking accounts (think: Millennials). These shoppers want great mobile apps, low fees, lots of convenient ATMs and hassle-free customer service.

Branch and ATM locations matter to movers. Back-in-the-day, when you moved you automatically changed banks. Now, if you bank with one of the largest banks, there’s a chance there are branches where you’re moving. Also, virtual channels have reduced the need for branch banking. Therefore, the people who are shopping because they moved really care about locations. On FindABetterBank during November 2014, 33% of shoppers that selected a checking indicated that locations were an important reason why. Over 60% of “movers” said locations were important when selecting their top choice.