What is the impact of word-of-mouth on banking purchases? That’s the question tackled in “The Word on Banking,” a report published by a pair of marketing consultancies. The report suggests that banking product and service purchases are made largely based on past experience and face-to-face communications.

“Does this mean social media initiatives of banking institutions such as Chase, American Express, and Wells Fargo among others are futile marketing efforts?” Idil Cakim, the reports author says. “Hardly. Looking at the past five years’ banking-related purchases, Social media is a budding influence on these purchasing decisions.”

“Its impact has risen sharply in the past couple of years,” she adds. “In particular, young adult and minority segments weigh social media nearly as much as offline word of mouth when making choices about banking products and services.

The report says that as the US population technologically gentrifies, banks will be investing more in online programs surrounding customer review sites and social media conversations.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Drivers behind people’s financial decisions

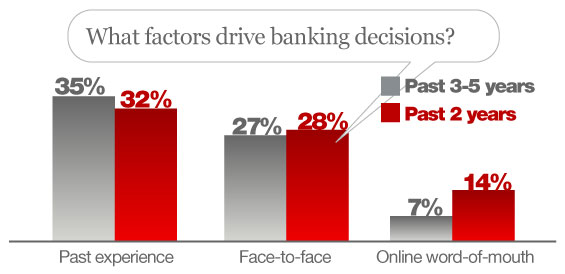

According to the study, past experience and word-of-mouth have been strong drivers of banking product purchases in the past five years. Overall, face-to-face conversations have had more impact than online buzz on banking decisions. Yet in the past two years, there has been a significant increase (from 7% to 14%) in consumers’ reliance on online word of mouth for banking product and service purchases.

“Banks need to keep a close eye on their online reputation,” the report recommends. “Those institutions who identify their outspoken customers and win them over will protect and grow their brand.”

How people choose financial products

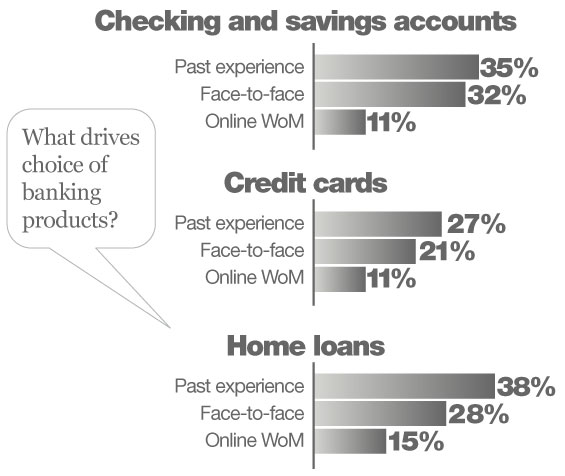

The study found that past experience and word-of-mouth drive more than a third of consumers’ checking, savings and mortgage account choices. Similarly, about one-quarter of credit card brand choices are made based on past experience and word-of-mouth.

Among word-of-mouth sources, consumers are more likely to rely on offline word-of-mouth than online sources when making banking product- and brand choices.

Men vs. women

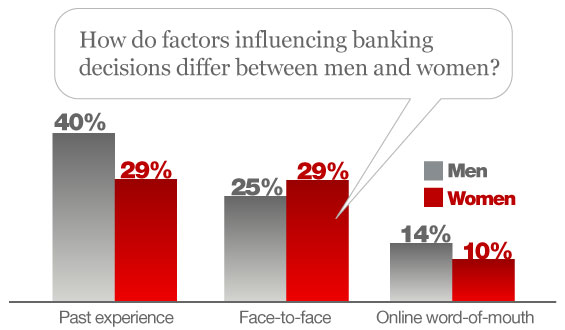

While men primarily rely on past experience when making banking-related decisions, women are driven by word-of-mouth. When making banking decisions, women are more likely to rely on face-to-face conversations than online buzz. These conversations are as influential as their past experience with banks and related products.

Young customers turn online more often

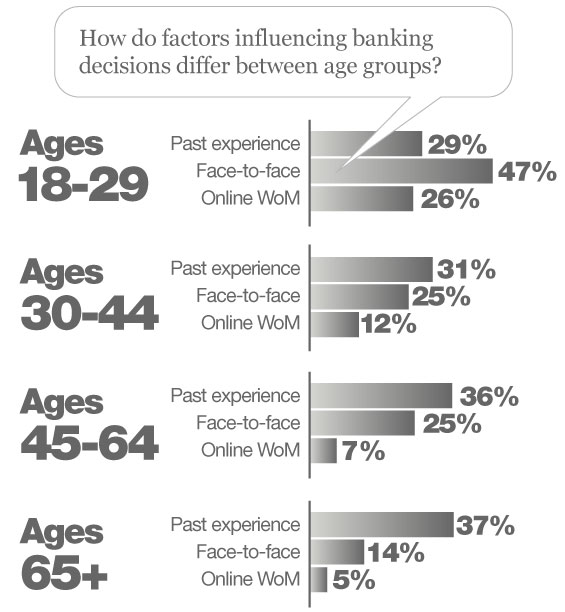

The older the banking customers are, the more they are likely to rely on their past experience to make purchasing decisions and brand choices. Meanwhile, young adults (18-29) are more likely to rely on online and/or offline word of mouth than any other information source when choosing their banking products.

The findings in the report are from the Large Purchase Study conducted by S. Radoff Associates in summer 2010. The online study delved into information sources that influenced brand choices for recent large-ticket item purchases. The study is based on a nationally representative sample of 1,000 U.S. adults ages 18 and up.