The most important objective for any successful financial marketer is to focus on improving the customer experience across channels and with every communication. Touchpoints such as mobile, video and social media continue to grow in importance, with the underlying need for improved data analytics being paramount.

No longer will poorly targeted marketing communications be tolerated by the ever-demanding consumer. The consumer knows the value of their personal information, and they expect their financial institution to know them, look out for them and reward them at all steps of their shopping and purchase journey.

The marketing communications bar is being set by other industries and by tech kings such as Google, Amazon and Apple. If consumers’ experience expectations are not met, they will ignore or block your communications, or abandon the relationship with your bank or credit union altogether.

Improving the marketing communications process — from the consumer’s perspective — will drive growth, loyalty and profitability. Managing the marketing process without taking advantage of the technology tools available is becoming more and more difficult.

Below are the most important marketing industry trends that can’t be ignored by financial marketers. Unfortunately, according to the research from the Digital Banking Report, many financial services marketers are not embracing or effectively prioritizing these trends.

Financial marketers must embrace these trends within all objectives, strategies and tactics. Doing so will become a key differentiator in the future.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

1. Embracing Insight-Driven Marketing

The importance of consumer insight and data for financial marketers will be more important than ever. In the past, the vast majority of financial marketers were more talk than action around “big data” because they lacked the skills and budget to make an impact. New tools and technologies make advanced analytics available for all sized organizations, while digital channels and the desire for personalized offers make the investment in data analytics mandatory for success.

Most industries are far ahead of financial services with insight-driven marketing. This is surprising, since banks and credit unions have access to more transactional, behavioral and demographic data on consumers than any other industry.

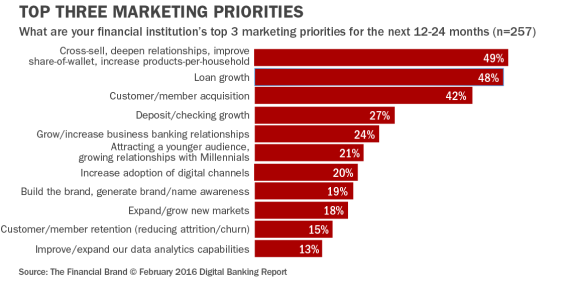

Unfortunately, while the need to leverage advanced analytics for insight-driven marketing is arguably the most important trend, it ranks very low on priorities according to the research.

2. Integration of Mobile

Including mobile as part of a bank’s or credit union’s marketing plan is no longer optional as consumers do a significant proportion of their researching, shopping and buying on their smartphones. “At a minimum, this means a mobile optimized and responsive website, and may include custom apps and mobile targeted campaigns,” states Daniel Newman from Forbes. Leading organizations in the retail and other industries are already leveraging the mobile device for location-based offers and sales messaging. As consumers migrate even further onto online and mobile banking channels, marketing budgets must do the same.

3. Increasing Focus on ROI

It should go without saying that marketing campaigns should be measured to gauge success. The ability to measure results has never been greater, as advanced tools can now look at the customer purchase journey to determine what blend of channels were used in the decision process.

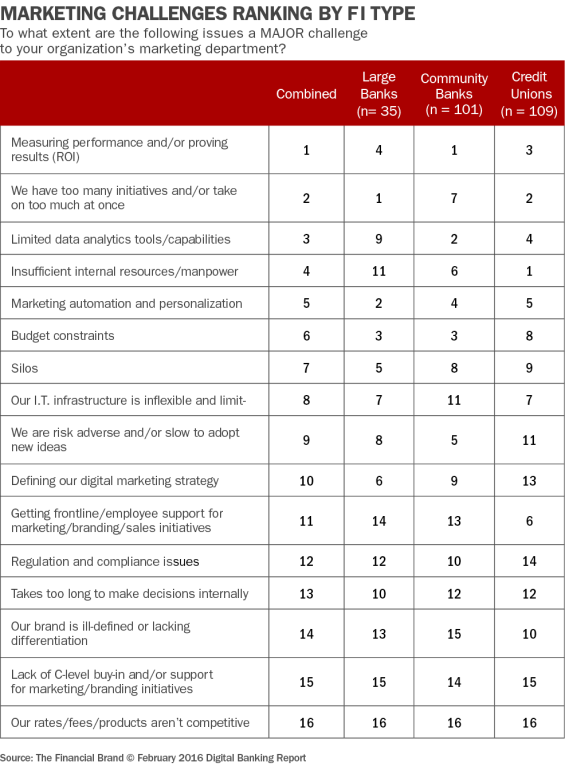

Unfortunately, most financial institutions rank “Measuring performance and/or proving results (ROI)” as a top 5 challenge. With costs being cut across most organizations, the importance of validating the return on marketing investment has never been more important. Being able to tie specific revenue outcomes to marketing initiatives can “close the loop” for financial marketers. These same marketers must now shift where they spend their budgets to reflect this potential.

4. Awareness of the Customer Journey

Mapping your customer’s financial product purchase journey is key to knowing where, when, and how to market to them. The traditional marketing funnel is dead. Great experiences with other brands – not just other brands in financial services – but from completely different industry verticals are informing the opinion of your customers on what to expect from you.

It is therefore important to understand how your customers are thinking and feeling, as well as what they are doing when something triggers the need or desire for financial services. Unfortunately, there are many barriers to revealing the truth around the purchase journey. One of the most significant is the structure of incentives that reward branch-based personnel for “restarting” online or mobile purchases to ensure rewards are provided to the branch channel as opposed to a digital alternative.

5. Customization and Personalization

Given the focus on an improved consumer experience and the potential of advanced data analytics in banking, personalized communication must get a higher priority in the year to come. The benefits of personalization include higher response and conversion rates, brand loyalty and repeat customers, amplified reach and increased relevance.

Consumers indicate a desire for custom solutions based on their personal situation … in real time. The tolerance for personalization has limits however, when banks and credit unions are dealing with hoards of potentially powerful, yet private, insights.

“In 2016, consumers expect emails to have more relevant content and will also expect brands to know more about them in the course of social interactions,” says John Arnold, vice president of marketing at FullContact. “Consumers will have less tolerance for online and mobile advertising that is too highly personalized — which may be seen by them as creepy.”

6. Optichannel Marketing

Beyond multichannel or omnichannel, the concept of optichannel in marketing refers to being able to communicate and support a consumer’s shopping and buying process using the channel that is best for them given the consumer’s overall objective. The goal is to support a smooth transition between digital and physical delivery channels as well as between digital and mass media communication channels for the best possible experience.

Financial marketers need to move beyond single channel silos of marketing, where there is a disconnect between the ways a consumer absorbs marketing and how banks and credit unions deliver messages.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

7. Expanding Use of Content Marketing

There is a continuing decrease in the effectiveness of interruptive tactics in marketing overall, and especially in financial services marketing, as consumers are increasingly bombarded by poorly targeted and ill conceived campaigns. As a result, there is a greater need for relevant and interactive content marketing that can be delivered using the right channels at the right time (contextual).

Content marketing plans should include interactive assessments, calculators, training and games to keep people clicking, pressing, swiping and sharing information that can be used in sales processes. Some banks and credit unions are testing these interactive tools, yet many are buried within a website or online design.

8. Moving Social Media Mainstream

While not reflected in this year’s bank and credit union marketing survey, social media marketing is becoming mainstream in most industries since 65% of adults used social media in 2015. Of all the social networks, Facebook is the most popular for marketers, since the network is the largest and because the network has built a top-notch ad system. Facebook’s data and targeting tools allow marketers to personalize their social campaigns at scale.

Instagram, Twitter and Snapchat are also becoming more popular with certain segments of the population. An ongoing challenge for financial marketers is in linking social media campaigns to sales. This challenge is what is holding most marketers back from increasing investments in social marketing.

9. Continuing Battle with Ad Blocking

Consumers are using ad blocking tools to push back on any organization using digital marketing carelessly. When product sales strategies take precedence over delivering an improved user experience, all marketers can end up losing.

Ironically, the more press that ad blocking technology receives, the more users it amasses. Ad blocking also made its way into mobile devices thanks largely to Apple’s iOS 9 update that included ad blocking capabilities. The solution to ad blocking will come from those organizations that provide relevant content that provides value in exchange for accessibility to the consumer. The customer ad experience must become a priority.

10. Introduction of New Channels

While augmented reality (AR) and virtual reality (VR) may not be mainstream marketing channels yet, financial marketers should become familiar with these advanced digital options as developers work on monetizing these channels. Initial uses may revolve around advertising within apps such as a branch or ATM finder or even be a standalone app like the home finder/buyer app from Commonwealth Bank of Australia.

In the not so distant future, some financial organizations may even provide a complete 360-degree buying experience that doesn’t require a special VR headset or device. These immersive experiences can give consumers reasons to interact with their bank or credit unions without visiting physical facilities.